U.S. household debt hits record high of $14.15 trillion

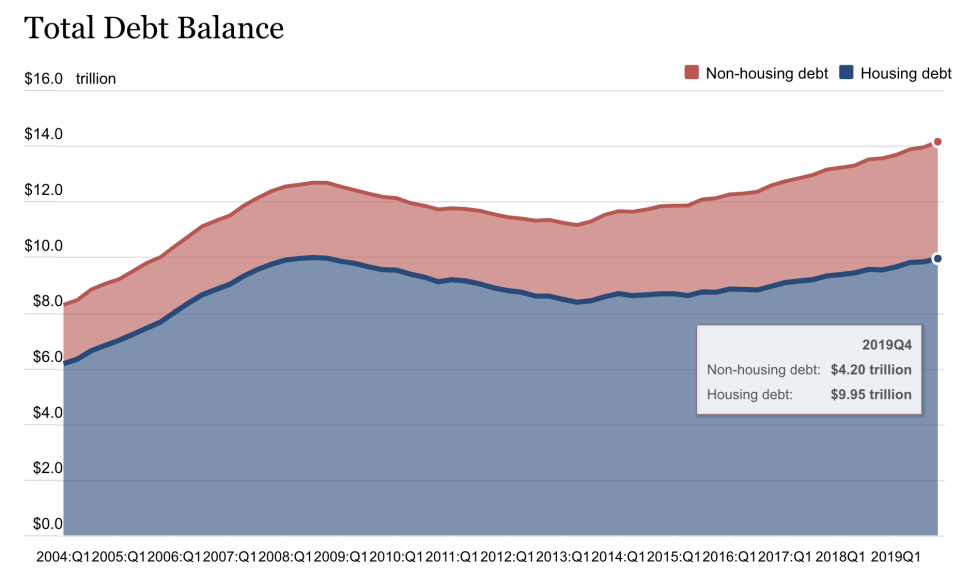

Total U.S. household debt reached a record $14.15 trillion at the end of the year after increasing by $193 billion, or 1.4%, in the fourth quarter of 2019, according to the Fed’s Quarterly Report on Household Debt and Credit.

The report, based on “a nationally representative sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data,” noted that total household debt is now nominally $1.5 trillion higher than the pre-recession peak of $12.68 trillion in the third quarter of 2008.

The rise in household debt, led by mortgage balances, marked the 22nd consecutive quarterly increase. Housing balances rose $120 billion from Q3 to December 31, 2019, ending the year at $9.56 trillion.

Non-housing balances increased by $79 billion in the fourth quarter to hit a record $4.20 trillion. The Q4 increases included $16 billion in auto loans, $46 billion in credit card balances, and $10 billion in student loans.

Wilbert Van Der Klaauw, senior vice president at the New York Fed, noted that the data showed that “transitions into delinquency among credit card borrowers have steadily risen since 2016, notably among younger borrowers.”

And though student loans may have only seen a “muted” increase of $51 billion, borrowers are still struggling with their debt. In terms of the percentage of outstanding balances that are seriously delinquent or severely derogatory, student loans still lead the way.

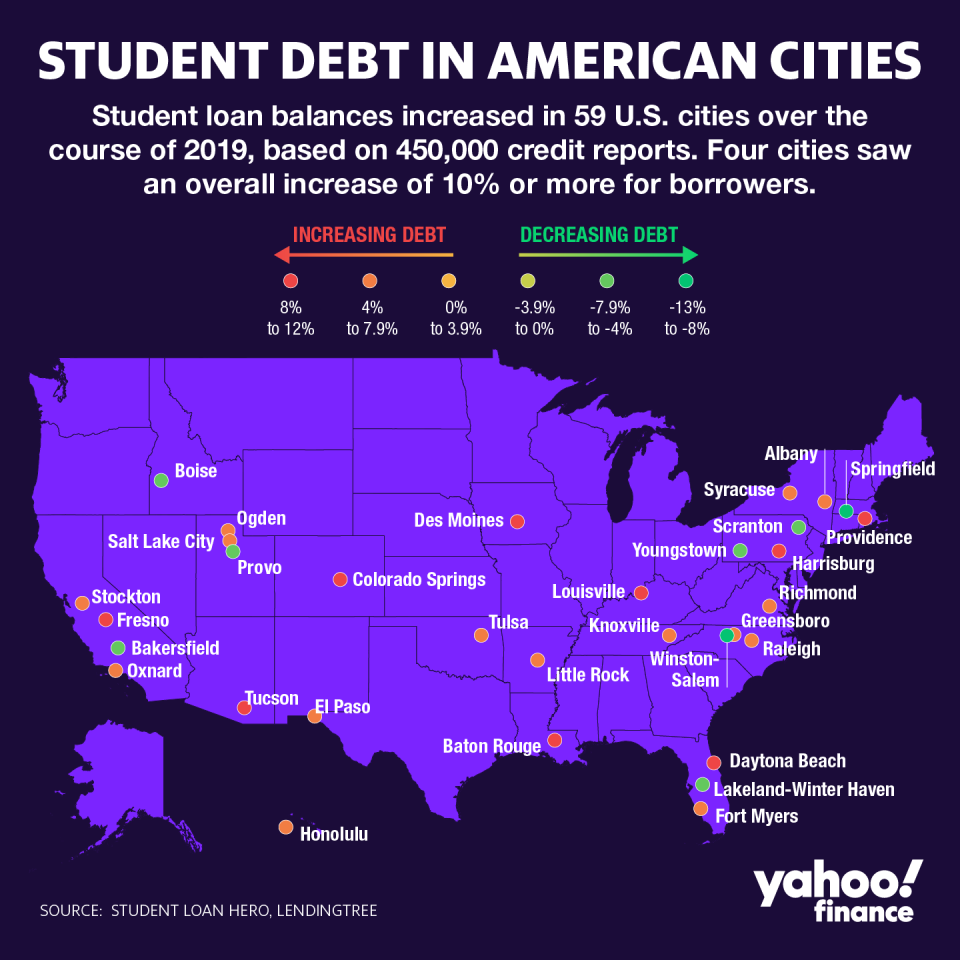

Progress on student debt varied across America in 2019

According to a separate analysis of metros across the U.S., student loan borrowers in Harrisburg, Pennsylvania, saw the biggest increase in their student loan balances over the course of 2019, while those in Winston-Salem, North Carolina, saw the biggest decline.

The analysis by Student Loan Hero — which analyzed over 450,000 credit reports of consumers across the U.S. between Q1 and Q4 of 2019 to understand how student loan borrowers were making progress on student debt — illustrates that student loan borrowers aren’t one monolithic bloc and are making varying levels of progress on their debt.

Overall, student loan borrowers in 59 metros saw their student loan balances increase, with four reporting double-digit increases.

Borrowers in Harrisburg, Penn., saw their student loan balances increase the most by 11.9%, from $22,408 to $25,081, followed by borrowers in Des Moines, Iowa, who experienced a 11.3% increase in their balances from $21,894 to $24,374.

The average borrower’s balance was $22,763 in the first quarter and increased by 2% — to $23,089 — by the end of the year.

“Borrowing across the board has dropped dramatically,” Kali McFadden, a research manager at LendingTree, told Yahoo Finance. But “because of the [income-based] repayment programs or deferments … you could definitely see that your interest outpaces your monthly payments … [and] that is a big reason why some of these numbers went up.”

According to data from the Department of Education from 2018, nearly 30% of borrowers were not in repayment — rather, they were in forbearance or deferment or delinquent or defaulting on their loans.

And so while fewer people were taking out loans, the reality of interest rates outpacing payments led balances to rise.

Two metros saw double-digit decreases, according to the Student Loan Hero analysis.

In contrast, borrowers in Winston-Salem, N.C., saw a 12.6% decline in their student loan balance, from $25,830 to $22,578, followed by borrowers in Springfield, Mass., who experienced a 10.5% decline from $19,419 to $17,382 .

McFadden said that there may be a few reasons for the dramatic declines, ranging from demographic shifts, to people moving away. Winston-Salem, for one, is a college town, and graduates are quite likely to move away (or home) to find better opportunities.

—

Aarthi is a writer for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

'Educational Redlining': New report alleges discrimination against certain student loan borrowers

Student loan servicer appeals landmark $220,000 bankruptcy ruling

‘They destroyed us’: Defrauded student loan borrower decries DeVos policies

Read more personal finance information, news, and tips on Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money