'Educational Redlining': New report alleges discrimination against certain student loan borrowers

A new report asserts that lenders are discriminating against student loan borrowers based on the college they attend.

The report by D.C.-based nonprofit Student Borrower Protection Center (SBPC), which is headed by a former top student loan official at the Consumer Financial Protection Bureau (CFPB), created hypothetical applicants who attended community colleges and four-year colleges.

The aim was to evaluate how consumer finance lenders use an individual’s education history to screen borrowers for creditworthiness and whether that is fair. SBPC argues that in this situation, it’s not, and that the implications are troubling.

“The use of education data in underwriting raises significant fair lending concerns, and its widespread adoption could reinforce systemic barriers to financial inclusion for Black and Latinx consumers,” the report states, adding: “Where the effects of these practices have negative economic consequences for borrowers from historically marginalized communities, these practices are known as ‘Educational Redlining.’”

‘Charged nearly $3,499 more over the life of a five-year loan’

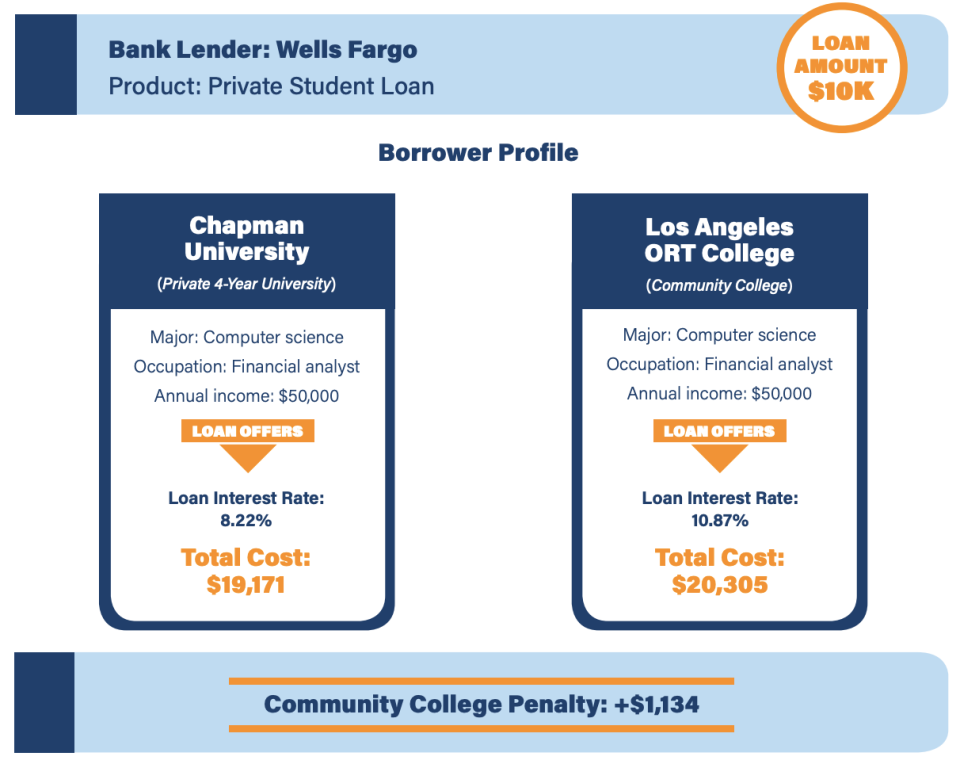

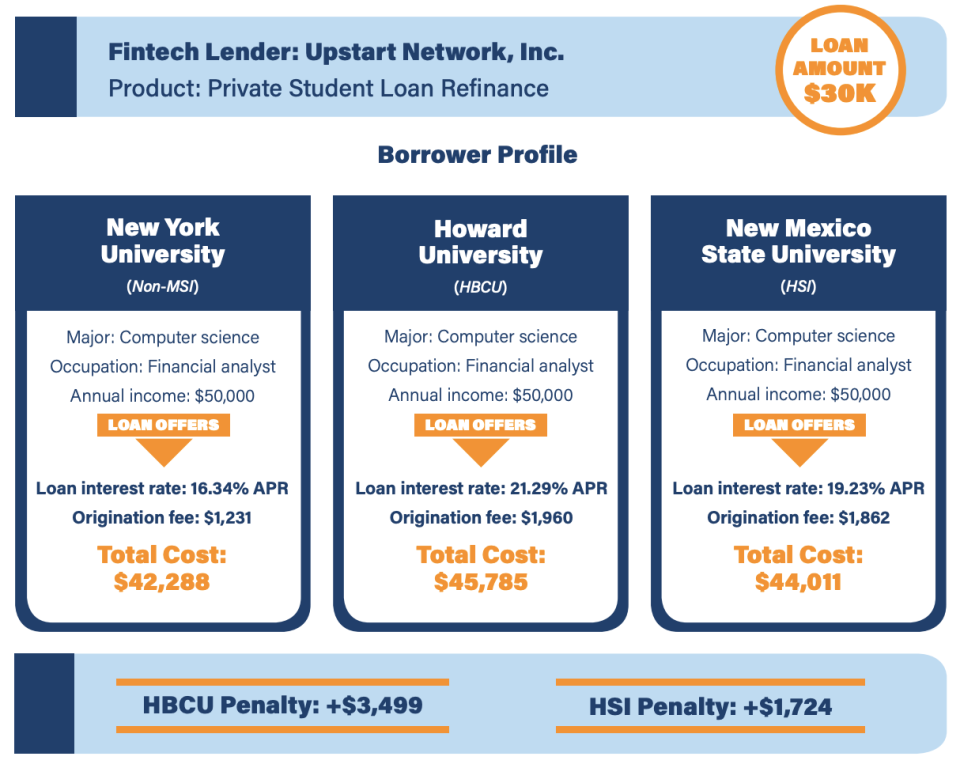

Researchers submitted online inquiries for private student loan offers to Wells Fargo and estimated the overall cost of a $10,000 loan, as well as inquiries to lending platform Upstart for a $30,000 student loan refinancing product.

They found that borrowers attending community colleges, Historically Black Colleges and Universities (HBCUs), and Hispanic-Serving Institutions (HSIs), are more likely to pay significantly more for loans.

“Wells Fargo charges a hypothetical community college borrower an additional $1,134 on a $10,000 loan when compared to a similarly situated borrower enrolled at a four-year college,” the report stated. “When refinancing with Upstart, a hypothetical Howard University graduate is charged nearly $3,499 more over the life of a five-year loan than a similarly situated NYU graduate.”

If that borrower was from New Mexico State University-Las Cruces, which is an HSI, they were charged “at least $1,724” more over five years compared to an NYU grad.

The report’s findings show that “borrowers can be forced to pay a penalty because of who they sit next to in the classroom,” Seth Frotman, SBPC Executive Director, stated in a press release. “Despite assurances by these lenders that their practices lift up consumers from marginalized communities, our analysis shows that educational redlining can further drive disparities and inequality. It is time for law enforcement to act.”

‘We disagree with the study’s characterizations’

Wells Fargo and Upstart both didn’t agree with the findings, however, arguing that they were “exaggerated” and “contrived.”

“We disagree with the study’s characterizations, they do not reflect our lending practices and its conclusions are exaggerated,” Wells Fargo spokesperson Vickee Adams said in a statement to Yahoo Finance.

She added: “Wells Fargo has a long standing commitment to providing access to financing for students attending community colleges. We follow responsible lending practices that take into account expected performance outcomes and are confident that our loan programs conform with fair lending expectations and principles.”

Upstart also pushed back, stating that it used more than 1,000 data points to assess creditworthiness. The company’s co-founder and CEO Dave Girouard told NPR that the SBPC researchers used “hypothetical, contrived applicants for a loan … [that] was both anecdotal and not reflective of the real world.”

In a statement to Yahoo Finance, an Upstart spokesperson asserted that its artificial intelligence model used to determine creditworthiness actually “increases access to credit across all tested race, ethnicity, and gender segments by 23 to 29%, while also decreasing average [Annual Percentage Rates] by 15 to 17%.”

Addressing the pushback from Wells Fargo and Upstart, SBPC argued that the inclusion of education data in the first place in credit decisions was “particularly troublesome” since it perpetuates historical inequalities inherent within this system.

If more and more lenders begin to such data to evaluate creditworthiness for student loans, “lenders could reinforce systemic barriers to financial inclusion for black and Latinx consumers,” the report argued.

—

Aarthi is a writer for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

'I have a chance now to have a life': Navy vet who won watershed student loan ruling tells his story

‘I’m working until I’m 75’: Factory worker describes family’s student debt nightmare

'I can't afford that': Woman in student loan limbo since 1997 decries a muddy system

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money