What to do if you lose your health insurance during the coronavirus outbreak

The accelerating numbers of layoffs across the country are not just hammering people’s finances. Many Americans are losing their healthcare coverage, too — and in the middle of a pandemic.

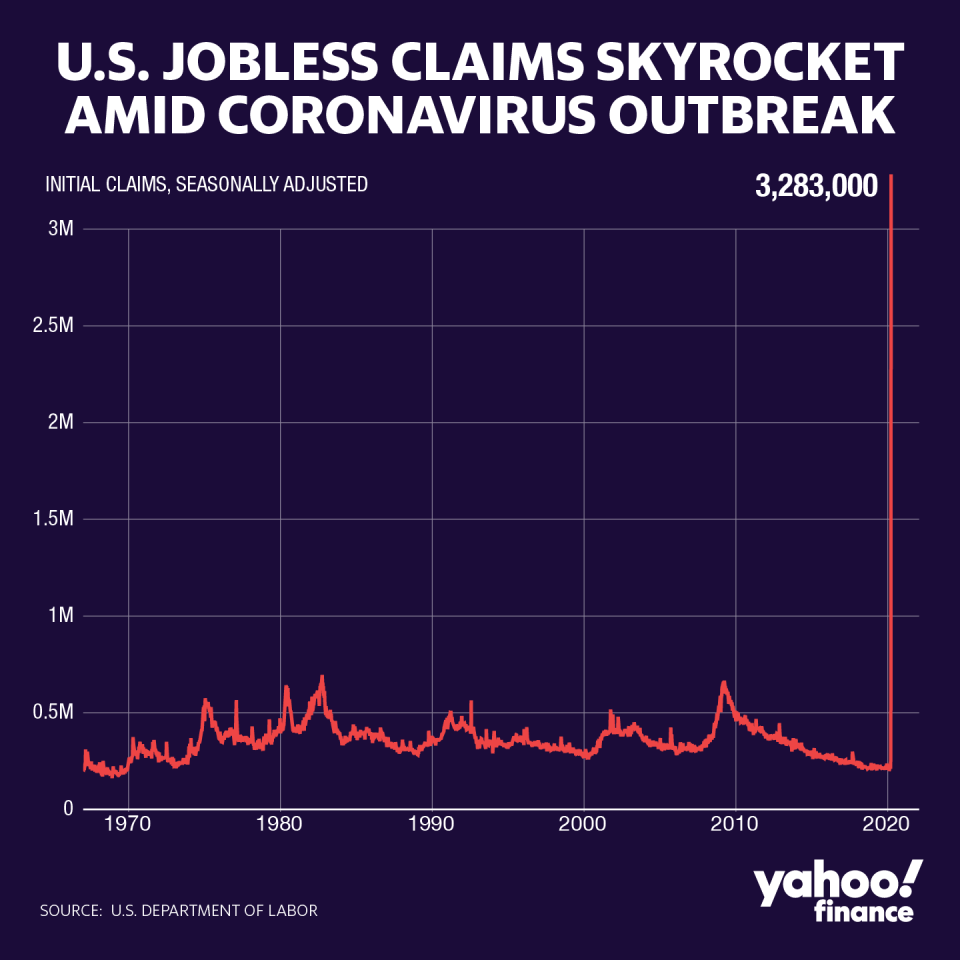

Nearly 3.3 million workers filed for unemployment benefits last week, the largest weekly total ever and nearly quadruple the last record set in 1982. A good chunk of them likely lost their health insurance as well, for themselves and potentially their families.

More than half of U.S. adults have employer-based insurance, making it the most common way to be covered, according to the Census Bureau. It also makes a job loss that much more difficult.

“Our health coverage system is tricky. Your eligibility depends on where you work, who you're married to, your income, the state you live in,” said Karen Pollitz, a senior fellow at the Kaiser Family Foundation, a nonprofit that focuses on national health issues.

“Basic life events like changing or losing jobs, getting divorce, blowing out the candles on your birthday cake, all can change the eligibility for health insurance you had yesterday,” she said.

Here are your options.

COBRA ‘is exceptionally expensive’

When it comes to layoffs, employees who worked for companies with more than 20 employees and were enrolled in health coverage, may be eligible to get COBRA, a law that allows employees to continue their health insurance coverage after leaving employment. This is a good option for those who want to continue their current plan, but it’s also typically the costliest option.

“If you lose your job, you're eligible for COBRA benefits, where you would pay 102% of the premium,” said Dr. John Graves, an assistant professor in health policy at Vanderbilt University. “Often, that is exceptionally expensive.”

Read more: COBRA insurance: How to file if you lose your job

When you have COBRA coverage, you have to cover both what they paid from their paycheck plus what your employer contributed to the premium. This may make it particularly unaffordable for those who lost their jobs and paychecks, Pollitz said.

You have 60 days to decide whether you want the COBRA coverage. During that time, you should also look at the two other options available to you: coverage through the Affordable Care Act and through Medicaid. These other options may provide cheaper coverage.

Medicaid ‘really is for everybody’

Medicaid is the most-affordable option for people who have lost their health care coverage. The expanded Medicaid programs, which cover low-income adults, are available in 37 states at the moment.

“Some people are still worried that Medicaid is for really poor people,” Pollitz said. “But it really is for everybody. It’s for people who fall on hard times and aren’t earning any income for now.”

Read more: How to file for Medicaid if you lose your job

Single people who earn up to 138% of the federal poverty level are eligible for free Medicaid coverage with no premiums or deductibles. You can apply through your state health or Medicaid department and also at HealthCare.gov.

Medicaid eligibility is based on your monthly income. If you can prove that your monthly income for the last month was below the eligibility threshold, you should qualify as long as your state expanded Medicaid.

Medicaid may be a good option for people who didn’t or don’t have access to employer-sponsored insurance — if they meet the eligibility criteria.

“Currently, many of the most directly affected, like people working in the service industry, are probably people that don’t actually receive employer-based health insurance at least at the moment,” Dr. Graves said.

Special enrollment period for the marketplace

The ACA marketplace is another option for people who’ve been laid off. You can qualify outside the annual open enrollment period — that typically occurs Nov. 1 through Dec. 15 — if you lost your health coverage through your employer or a family member’s employer in the last 60 days or you expect this to happen in the next 60 days.

“If you lose your coverage then you’re entitled to a special enrollment period,” Pollitz said. “The loss of health coverage is a qualifying life event.”

You can go to HealthCare.gov and fill out questions to see what kind of coverage you’re eligible for and if you qualify for government assistance.

Read more: How to get ACA health insurance if you lose your job

If your income is between 100% and 200% of the poverty level, you may be eligible for cost-sharing reduction, where the federal government will help pay additional costs such as deductibles, copays, and coinsurance.

If you project to make between 100% and 400% of the poverty level, you could qualify for a premium tax credit, where the federal government will pay some of the premium.

“That's going to be not quite as affordable, you always have to pay something for marketplace coverage,” Pollitz said. “But depending on how low your income is, it may only be like $20 to $30 a month.”

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

READ MORE:

'I may lose everything': Americans reel from job losses as coronavirus stalls economy

How two uniquely American issues could make the coronavirus worse

Read more personal finance information, news, and tips on Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.

money

money