How two uniquely American issues could make the coronavirus worse

Clarification: A previous version of this story included a photo of a worker at Homegirl Café, which offers employees comprehensive benefits such as paid sick leave. We removed the photo so as to not imply that Homegirl Café did not.

The spread of a coronavirus outbreak may be particularly swift in the U.S., thanks to the nation’s cost-sharing health insurance model and legions of workers without paid sick leave.

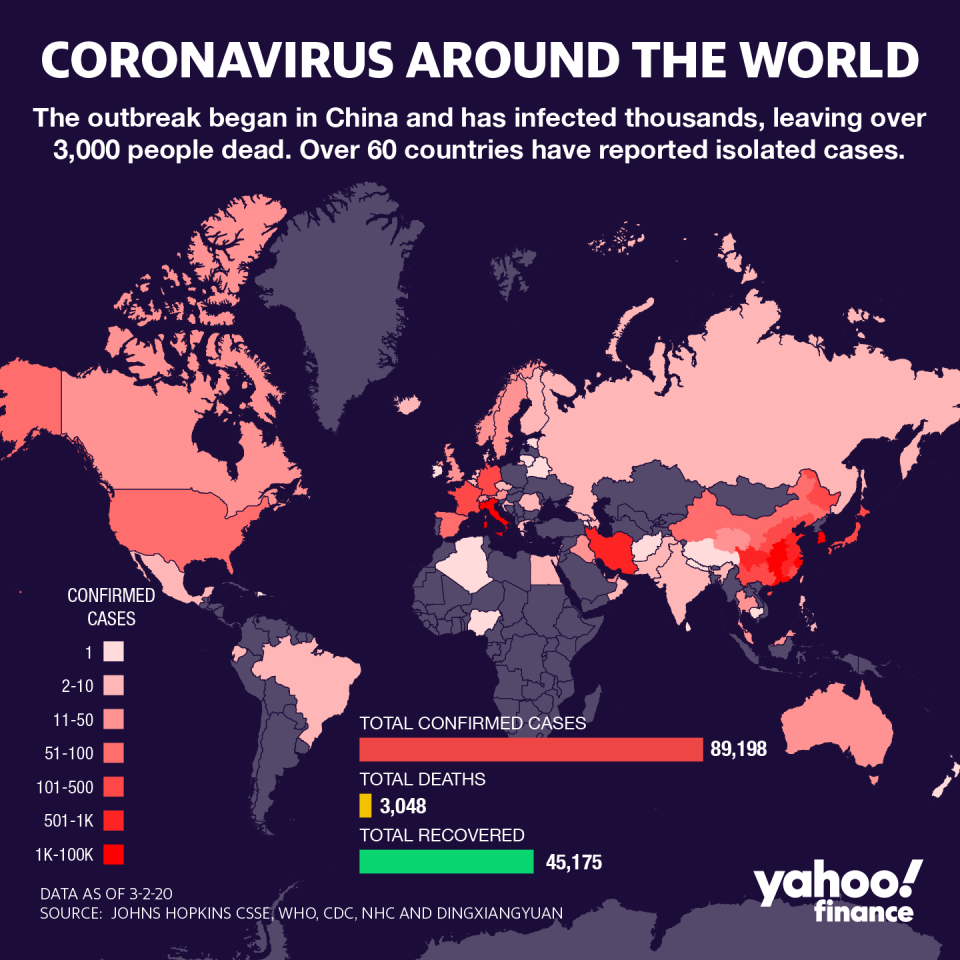

So far, COVID-19, short for coronavirus disease 2019, is responsible for at least 85,000 cases worldwide and almost 3,000 deaths, with 60 countries including the U.S. reporting cases, according to the latest tallies. On Saturday, the U.S. recorded its first death from the virus.

Read more: Paying for healthcare: Everything you need to know

To stem an outbreak in the U.S., the Centers for Disease Control and Prevention is encouraging sick employees to stay home and to seek out medical care if coronavirus-like symptoms worsen.

But some experts worry many Americans may ignore that advice simply because they can’t afford to lose money by missing work or paying to see a doctor.

‘Tremendous economic need to go into work’

The U.S. is one of the two developed nations without guaranteed paid sick leave. More than 1 in 4 private industry workers don’t have this benefit including more than half in the bottom 25% of the wage distribution, according to the U.S. Department of Labor.

“These are the people who are really living paycheck to paycheck,” said Amy Traub, an associate director of policy and research at Demos, a left-leaning think tank. “So, they have a tremendous economic need to go into work, even if they have symptoms of the flu or the coronavirus.”

Making matters worse, many workers who don’t have access to paid sick leave work in child care, restaurants, hotels, and travel where they come into contact with many people everyday and could help spread the virus. In these service occupations, more than 2 in 5 of the workers don’t get paid sick days, according to the Labor Department.

“These are folks who are serving [and] preparing food for all of the rest of us,” Traub said. “It's a recipe for contagion when...the people preparing your food cannot afford to stay home when they have a contagious disease.”

If these workers had paid sick days, the rate of infection could be reduced. A study by economists at the Swiss Economic Institute and Cornell University found that the general flu infection rate decreases by 10% when U.S. workers received paid sick leave.

‘Think twice about going to the doctor’

Another challenge to preventing an outbreak is the structure of the U.S. health insurance system. About 7%, or 27.5 million U.S. adults, lacked medical insurance in 2018, according to the Census Bureau, making it a costly proposition to visit a doctor, urgent care, or ER.

Even those with coverage may hesitate to get medical care if coronavirus symptoms pop up.

Two in 3 U.S adults have privately administered health plans, whether through an employer or the Affordable Care Act marketplaces, that largely rely on the patient splitting costs with the insurer through deductibles, coinsurance, and copayments.

Those cost-sharing mechanisms are “designed to make you think twice about going to the doctor when you have a cough or a sniffle,” said Dr. John Graves, an assistant professor in health policy at Vanderbilt University. But, “these are exactly the symptoms that we are concerned about and would want people to get tested and treated as necessary.”

‘They also cut back on necessary care’

Already, Americans hold out on visiting the doctor when they’re sick or need care.

A quarter of Americans skipped a medical treatment due to costs, according to a 2019 survey by Westhealt and Gallup. Additionally, 15 million Americans have deferred purchasing prescription drugs in the past year because of cost.

Recent reports suggest that the bill to get tested for coronavirus could cost more than $3,000, a huge cash outlay for many. Two in 5 Americans couldn’t cover a $400 emergency without borrowing money or selling items for cash, according to the Federal Reserve.

The timing of the coronavirus is also bad for covered Americans, Dr. Graves said, because most people haven’t yet met their policy’s deductible, the amount they must pay out of pocket for covered services before the insurance kicks in.

“They haven’t spent down to the point where the plan covers their utilization,” he said. “There’s a wide body of evidence [that’s] very conclusive on the fact that when people face things like a deductible, they cut back on unnecessary care, but they also cut back on necessary care.”

Denitsa is a writer for Yahoo Money and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

READ MORE:

Morgan Stanley chief economist: Millennials are savvier than people think

AOC has a point: U.S. parental leave policy is shockingly bad compared to the rest of the world

Read more personal finance information, news, and tips on Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.

money

money