Private student loan startup LeverEdge expands to save undergrads money

One novel way to mitigate the student debt crisis: helping groups of borrowers negotiate better terms on their private student loans.

LeverEdge pools together thousands of students and uses collective bargaining to get them beneficial terms for private loans from lenders, such as lower interest rates or waived fees.

The two-year-old company has thus far focused solely on helping graduate students, particularly those pursuing their MBAs. But on Monday, the startup told Yahoo Money, the company began working with undergrads as well.

“We already had a lot of people asking us why we weren’t doing undergrad loans [and] when we were going to start,” LeverEdge co-founder Chris Abkarians told Yahoo Money in an interview. “Now that we’ve grown and have more bandwidth… we can expand our coverage.”

One expert who is familiar with how the company works lauded the expansion to the private loan market for undergrads.

“Anything that empowers students during the borrowing process is a positive development, and that's just what collective bargaining can do — by banding together, borrowers could qualify for lower private loan interest rates that they otherwise could have secured on their own,” Student Loan Hero’s Andrew Pentis told Yahoo Money.

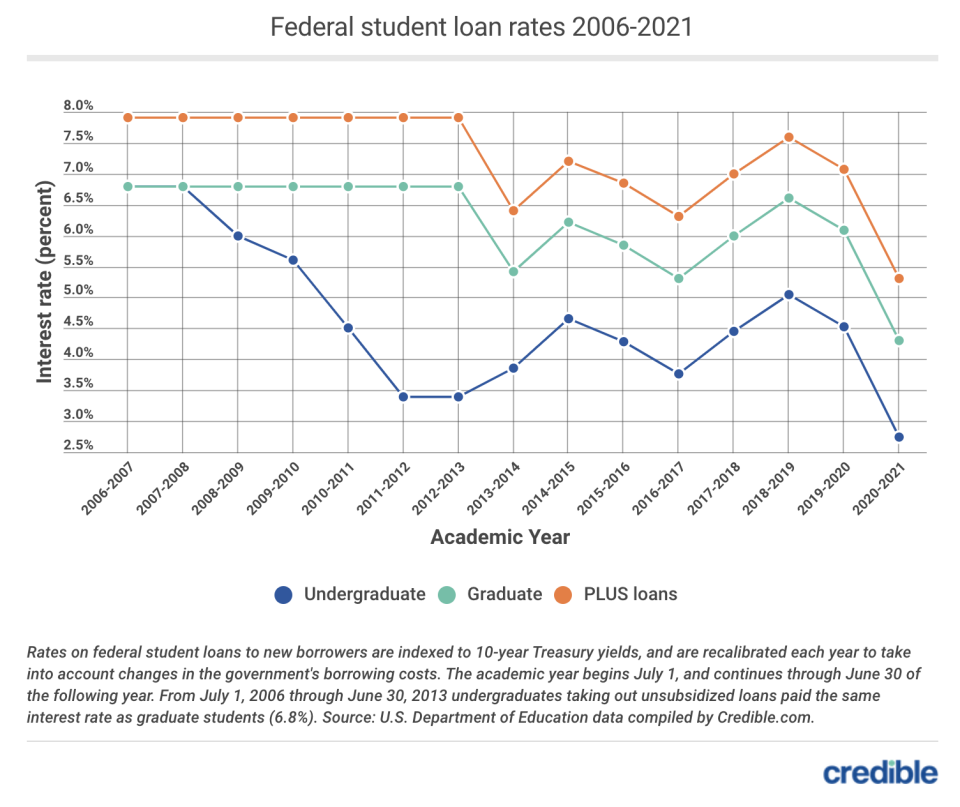

Abkarians noted that the private undergraduate loan space is “where we see interest rates jumping the most and where we think we can have the most impact to create a more fair market… there’s just a very large jump from what that federal rate is.”

Federal student loan rates have fallen to the lowest on record amid the coronavirus pandemic. Interest rates on federal student loans taken out during the 2020-21 academic year will be 1.78 percentage points lower than the previous year — falling from 4.53% to 2.75%. The lowered rates do not apply to private student loans.

The LeverEdge founders stressed that undergraduate students should first exhaust all federal student loan options before turning to private student loans for their higher education needs.

“We fully acknowledge that there are benefits to federal loans that grad students give up by choosing private loans, such as income-based repayment protections and loan forgiveness programs,” Abkarians said. “That being said, our classmates and members ask us to identify the lowest total cost loan options to consider alongside their federal loan options.”

Pentis agreed, noting that federal loans come with “their unique safeguards, such as income-driven repayment and forgiveness programs. If a borrower decides they won't need these federal-only programs upon leaving school, they could always refinance their federal loans at that point and potentially reap the same savings.”

Thousands in estimated savings for certain students

The private student loan market is approaching $130 billion, according to a report by the Student Borrower Protection Center, and borrowers owe 71% more private student loan debt than they did a year ago.

Private lending can be an attractive option for borrowers locked out of the federal system, including international students or Deferred Action for Childhood Arrivals (DACA) recipients.

“Right now, there are about 7,500 people who explicitly told us that they need a loan for August to October 2020 for that academic semester and the next one,” Abkarians said. “ That’s split across underground and grad, that’s a little over $300 million in aggregate.”

Those in the current batch range from MBA students at New York University or Rutgers University to nursing students at DePaul University.

The company estimates that undergrads are estimated to save around $2,800 through a deal LeverEdge reached with an unnamed lender when assuming that the incoming freshman is taking out a $20,000 private student loan under a 10-year fixed term and is deferring payments until six months after graduation.

Graduates, such as a first-year MBA student, are expected to save anywhere between $2,000 to $7,000, the company estimated, assuming they are taking a $65,000 loan over a 10-year term (variable and fixed) and making $25 minimum payments while in school.

How LeverEdge works

LeverEdge vets student loan lenders before it partners with them to offer its members special rates and/or terms. For example, the company previously reached a deal with lender Laurel Road in which it offered a reduced interest rate for its members for a specific period of time.

“Most private lenders typically have stringent requirements on income for the borrower,” Abkarians explained. “Most of them require you to have a co-signer, and the income thresholds are typically quite high… so we spent a lot of time convincing lenders to change their underwriting criteria and to remove those two factors entirely from the consideration.”

Lenders work with the startup, which functions as a middleman, to identify underlying credit factors and offer interest rates that are lower than what borrowers would get if they went directly to the lender.

“The rates that each person differ relative to their underlying credit factor,” Abkarians explained. “Everybody gets a discount… [but] there’s a lot of deviation from person to person.”

The company has also made headway on other factors that help borrowers, such as asking lenders to reconsider some requirements for borrowers and adding some dischargeability options in case of death or disability.

“We’ve learned that as we’ve gone through this process is that a lot of terms and conditions can be kind of flexible as long as you talk to somebody who can make the decision,” LeverEdge Co-Founder Nikhil Agarwal said. “The average person going to customer service is not really going to have their request sent to somebody who makes that decision.”

—

Aarthi is a reporter for Yahoo Finance covering student debt and higher education. If you have a tip or a story idea, reach out to her at aarthi@yahoofinance.com.

READ MORE:

'Inexcusable blunder': Senate Democrats demand action against Great Lakes for credit score mishap

Income share agreements: Assessing the latest big idea for fixing the U.S. student loan crisis

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.

money

money