'Inexcusable blunder': Senate Democrats demand action against Great Lakes for credit score mishap

Senate Democrats are demanding action against a student loan servicer for reporting inaccurate payment information for millions of student loan borrowers, hurting their credit scores.

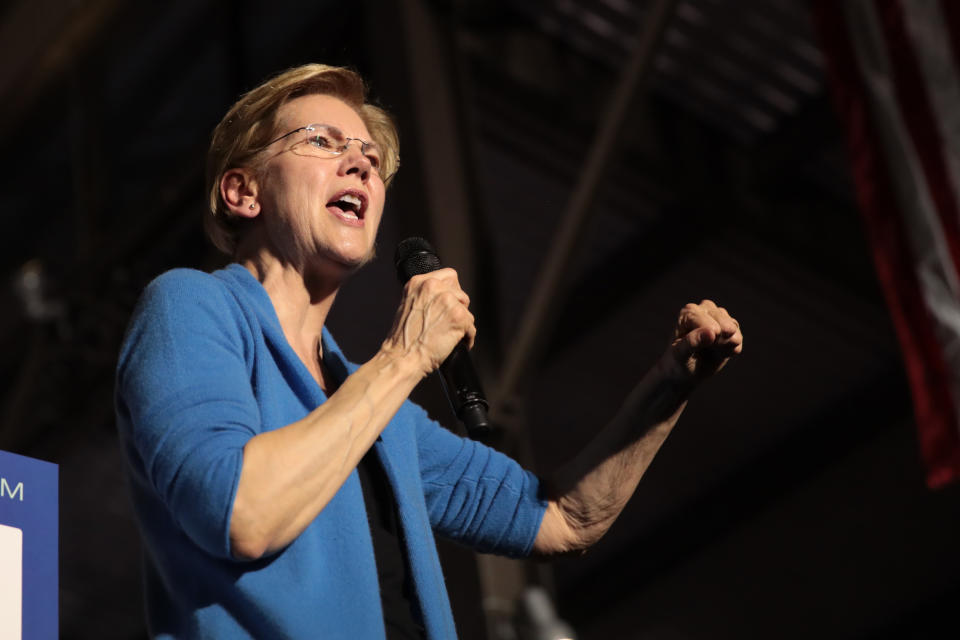

In a letter to Education Secretary Betsy DeVos, Senate Democrats Elizabeth Warren (D-Mass.), Jeff Merkley (D-Ore.), Richard Durbin (D-Ill.), Sherrod Brown (D-Ohio), Richard Blumenthal (D-Conn.), and Tina Smith (D-Minn.) said the Education Department (ED) must immediately fix the issue and hold Great Lakes, the loan servicer, responsible.

“This error likely caused significant financial harm to millions of federal student loan borrowers, including lowered credit scores and resulting harm, such as denial or increased cost of credit and other significant financial harm,” they stated in the letter. “We demand the Department take immediate action to fully remedy this issue, hold Great Lakes accountable for this inexcusable blunder, and provide Congress with a detailed accounting of how this breakdown occurred.”

The senators’ letter comes days after consumer advocates filed a class action suit for the same issue against Great Lakes (NNI), Equifax (EFX), TransUnion (TRU), Experian (EXPN.L), and agencies owned by VantageScore Solutions in the U.S. District Court’s Northern District of California.

Great Lakes borrowers had scores dinged

The CARES Act, which was passed in March, had specifically suspended payments and interest, and stopped debt collection on federally-held student loans from March 13 to Sept. 30.

Student loans were placed on forbearance and borrowers were not required to pay. Additionally, payments were to be reported as current, or on time, under the act.

However, Great Lakes provided incorrect credit information to credit bureaus by reporting that the borrowers had deferred payments instead, dinging their credit score. The error affected around 4.8 million federal student loan borrowers, according to Politico.

Both the Education Department (ED) and Great Lakes have stated that they are fixing the problem.

“Providing incorrect information to credit reporting bureaus is totally unacceptable, but it’s important to understand Great Lakes quickly corrected the coding issue last Friday and sent updated credit reporting files to ensure as little impact as possible from the coding error,” ED spokesperson Angela Morabito told Politico previously.

In a previous email to Yahoo Finance, Nelnet spokesperson Ben Kiser said that the company apologized for the inconvenience caused by the situation and said it was resolving the issue quickly.

Kiser also explained the timeline:

On May 6, Great Lakes reported payments in a manner it thought would not have an adverse impact on borrowers’ credit scores.

On May 11, it realized that there was something wrong with that process after getting questions from borrowers’ about their credit scores, which they found out about through information from third-party credit services. (That explains this exchange between Federal Student Aid and Credit Karma.)

Great Lakes then “began researching these borrower accounts and determined there was an inconsistency between Great Lakes reporting and that of other student loan servicers,” Kiser said.

“Instead of reporting borrowers as current with monthly payments of $0, Great Lakes reported borrowers as current with deferred monthly payments of $0,” he explained. “That same day, Great Lakes acknowledged the inconsistent coding and let our borrowers know we would adjust the inconsistency in reporting with the credit reporting agencies immediately.”

The company said it had also provided an updated credit file on May 15, and three out of four credit reporting agencies have processed the file, the the fourth to do so imminently.

“Our priority is providing an exceptional customer experience,” Kiser said. “When we fall short of our goal, our focus is to communicate openly and resolve the issue as soon as possible.”

Credit reports are ‘critical’ to borrowers’ lives

But the senators argued that this incident wasn’t something to brush off lightly.

“Credit reports are critical documents in borrowers’ financial lives,” they argued. “Lenders, landlords, and employers use them to assess the credit worthiness of borrowers, consumers, tenants, or potential employees, or to otherwise assess how reliable an individual is with regard to their financial obligations.”

Thus, it’s “critically important that reports be accurate — especially in the middle of a pandemic and economic crisis,” they stated.

The errors could be a violation of the Fair Credit Reporting Act, they added, “which prohibits furnishers of credit information like Great Lakes from reporting information if a company “knows or has reasonable cause to believe that the information is inaccurate.”

Aarthi is a reporter for Yahoo Finance covering student debt and higher education.

Read more:

Student borrowers sue over ‘illegally damaged’ credit scores amid coronavirus pandemic

Student loan borrowers sue Betsy DeVos and Steven Mnuchin over seized tax refunds

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.

money

money