Americans reveal 2020 financial resolutions in new survey

After a successful year, most Americans are optimistic about their finances going into the new decade. And they still plan to improve their money habits in 2020.

According to a recent survey by Fidelity Investments of 3,012 American adults, the most popular resolution for 2020 is saving more, followed by paying down debt and spending less.

More than three-quarters of Americans believe they will be better off financially next year, partly because of changes they plan to make in the new year. More than two-thirds of respondents are setting financial resolutions for 2020.

Their commitment comes after a year when 4 in 5 Americans reported their finances were similar or better than in 2018, thanks to increased savings, better budgeting, and working more.

“With the state of the economy, you would think a lot of the credit would go to low unemployment and 10 years of positive market returns,” said John Boroff, director of retirement and college leadership at Fidelity Investments. “One of the surprising things is that people are giving credit to themselves.”

Still, they are “developing better habits,” he said, “and that’s going to sustain [those] who continue to do that stuff through a downturn or correction.”

Money resolutions for 2020

These new money habits will help many Americans reach their other financial goals.

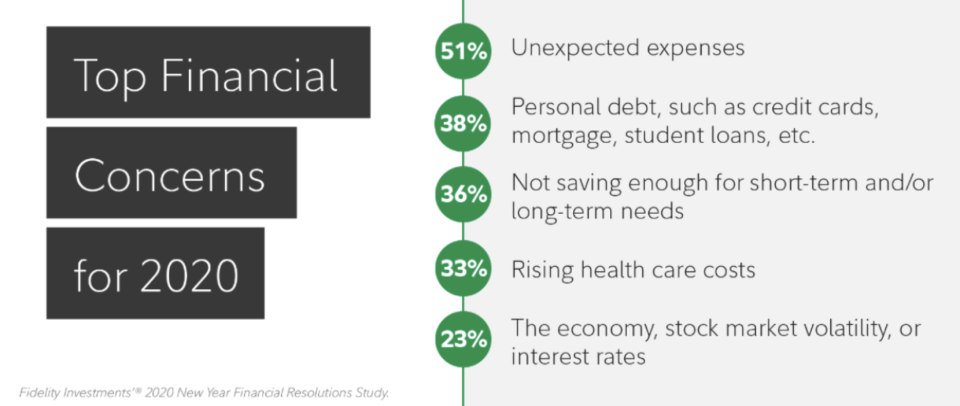

More than 4 in 5 Americans say they plan on building an emergency savings fund, reflecting their biggest worry in 2020: unexpected expenses. This troubles one in two Americans, according to the study.

“[Our] financial advice is usually to have 3 to 6 months of your monthly expenses tucked aside,” said Nick Holeman, head of financial planning at Betterment, a robotic investing firm.

Half of Americans are also committed to increasing annual contribution to retirement accounts. The annual contribution limit next year is $19,500 for 401(k) plans and $6,000 for IRAs.

Motivation

The biggest reason for making a financial resolution? Debt. More than two-thirds of Americans making a money change next year want to live a debt-free life, according to the survey.

The next motivator is retirement. Over half of Americans say a comfortable retirement is the reason behind their resolution. Workers are woefully behind on saving for retirement, with half raiding their nest eggs well before they retire for unexpected expenses, down payments, and college tuition.

Another half of Fidelity participants say their physical and mental well-being is motivating them to make major financial changes. Over a third of American fear they’re not saving enough despite this year’s success, according to the study.

“I think it’s encouraging that the study exposes these concerns,” Boroff said. “It would be unrealistic if they weren’t acknowledging the uncontrollable pitfall of unexpected expenses.”

Dhara is a writer for Yahoo Finance. Follow her on Twitter @dsinghx.

Read more:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money