Americans are treating their retirement savings like piggy banks

Half of working Americans are using their retirement savings like a bank account, according to a new Bankrate study, raiding these funds for unexpected expenses, college tuition and down payments, long before they reach 65.

Workers are potentially giving up significant returns later by withdrawing money early, experts warn, exacerbating a growing retirement crisis in the U.S. One of every 2 workers is already behind on saving, the Bankrate survey found.

The trend could get worse. Recent regulation changes will make it easier next year for workers to take early distributions from 401(k) plans and could incentivize more to dip into their savings before retirement.

“I don’t think people realize that to take out $5,000 now means they’re losing out on compound interest,” said Jeff Rose, founder of the financial blog, Good Financial Cents. “They are potentially losing tens if not hundreds of thousands of dollars by making what seems like a simple transaction.”

Getting through hard times

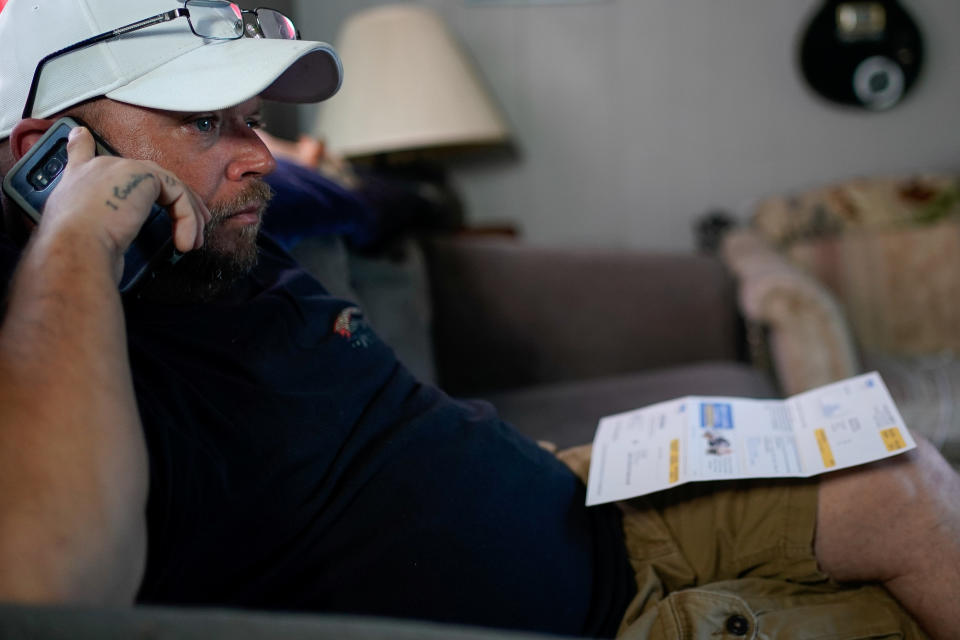

Emergencies are the top reason for grabbing retirement funds early, Bankrate found, especially among households making less than $80,000 a year. A third of Americans cited unemployment for breaking into their 401(k) plan or IRA early, while a quarter said the money was for medical bills and unplanned expenses.

But personal finance experts note that these costs should be covered by other savings earmarked for these types of events.

“If people are taking money from their 401(k), where is [their] emergency fund?” said David Lowell, a certified financial planner and founder of Up Your Money Game. “You need to have that built out and funded three to six months to cover unforeseen costs.”

Keeping up with rising costs

Other Americans turn to their retirement savings to help them meet major life milestones like paying for college or buying a house.

About 1 in 6 took a withdrawal to purchase a house, while just under 1 in 8 reported they needed the funds to pay for higher education costs, according to Bankrate. Households making more than $80,000 were more likely to cite these reasons than lower-earning ones.

This reflects the increasing costs of both housing and education. The median U.S. home price has soared by 42% to $232,000 in the last ten years, while the cost of tuition and fees for a four-year public college have doubled in the last 20 years.

Consequences of early withdrawals

Those who take out funds must factor how taxes and penalties will reduce the amount they withdraw. You’ll incur a 10% penalty if you’re younger than 59 ½ and you must pay taxes on the distribution, Lowell said.

“If you’re taking out $10,000, you might only be getting back $7,000 depending on your tax bracket,” he said. “It isn’t black and white, but you really have to weigh against the true cost of taking the money.”

It’s also difficult to replace the money you took out because you can contribute only so much to certain retirement plans each year. For 2019, the limits are $19,000 for 401(k)s and $5,500 for traditional and Roth IRAs. Those 50 and over can contribute more to catch up on saving.

“The money comes out but doesn’t go back in,” said Greg McBride, Bankrate’s chief financial analyst, in a company release. “You don’t get to make higher contributions in subsequent years to make up for what you’d taken out early.”

You’re also more likely to fall behind if you make early withdrawals.

Three in five who took early distributions also report they aren’t where they need to be on retirement savings, Bankrate found. It’s “a permanent setback to your retirement planning,” McBride said.

Easing the rules

New rules issued by the Internal Revenue Service could encourage more workers to turn to their retirement plans sooner.

Starting next year, workers will be able to take more funds from their plans than previously allowed. It will also be easier to claim a qualified hardship without providing much proof to a 401(k) plan administrator.

“Heavy financial need is so loose to interpretation,” Rose said, “that all they have to basically do is show they’re broke.”

Americans also won’t be required to take a loan first from their 401(k) – if the plan offers one – before taking a withdrawal. This means that those who withdraw money don’t have to redeposit these funds, plus interest, like with a loan.

“I think it’s a horrible thing,” Rose said. “It’s no different than somebody that’s trying to better their health, and instead of watching what they eat, they’re starting to take a pill.”

Dhara is a writer for Yahoo Finance. Follow her on Twitter @dsinghx.

Read more:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money