Coronavirus and job loss: What is a furlough versus a layoff?

As retailers shutter stores nationwide to help combat the spread of the coronavirus, many major chains like Macy’s, JCPenny, and Gap have furloughed their employees. Other companies, like newspaper publisher Gannett and fitness studio SoulCycle, are following suit to cut costs.

Companies use furloughs to try to avoid reducing their workforce altogether during hard times. Furloughed workers remain on an employer’s payroll but aren’t paid for the period they are not actively working.

After the furlough, employees can return to work and avoid any paperwork or processes to become an active employee, said Amber Clayton, the knowledge center director at SHRM, a human resources membership association.

“It makes it easier for them to return without any kind of administrative burden on the employer or the employee,” Clayton said.

Here’s everything you need to know about being furloughed.

Furlough vs. layoff

A furlough is temporary and requires a worker to take some unpaid time off or work reduced hours. It could last from a couple of days to a couple of months.

A layoff is a temporary separation of employment, meaning the worker is removed from the payroll for a limited time. Some Worker Adjustment and Retraining Notification Acts may require employers to give advance notice of a layoff, but no notice is required for a furlough under six months.

The layoff is also different from a termination or reduction in workforce because there is an expectation that the employer will recall individuals back to work.

What does a furlough look like?

A furlough may require reduced hours or taking a period of unpaid time off. It also depends if the employees are exempt or nonexempt.

A company could furlough nonexempt employees one day a year or require they work only 32 hours a week instead of the regular 40 hours per week, according to SHRM.

Read more: What to do before you lose your job

Exempt employees - or salaried workers - can be furloughed, but in a way that doesn’t threaten their exempt status under Fair Labor Standards Act. One way to do this is to require exempt employees to take a full week off unpaid, which is what Gannett is doing. The FLSA says that exempt workers don’t have to be paid for any week they don’t work.

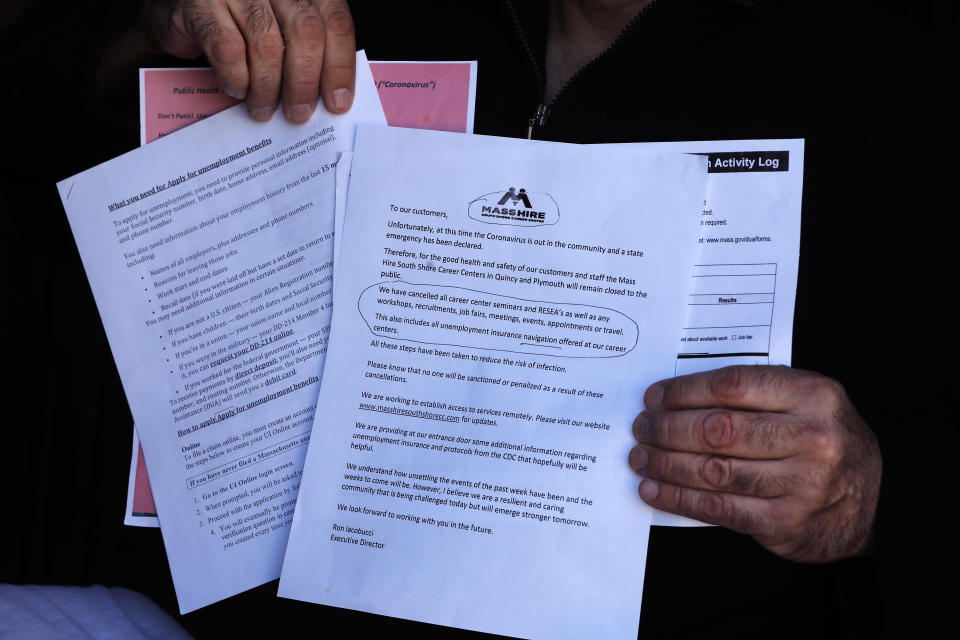

Unemployment benefits while furloughed

Many of those who have been furloughed may be eligible for unemployment benefits, depending on the state where you live. During the federal shutdown many furloughed employees were eligible for unemployment insurance. However, if the furlough is only a week and you don’t meet the state requirements you may be ineligible, according to Clayton.

Read more: How to file for unemployment insurance

The $2 trillion coronavirus relief package called the CARE Act also will help furloughed workers. It provides an additional $600 a week for four months, in addition to the unemployment benefit workers would typically get with their state.

The overall unemployment benefit you get per week also depends on your state. In New York, eligible workers can get between $104 and $504 a week, while in Nebraska, weekly benefits go up to $440. The $600 from the aid package is added to the calculated weekly benefit.

“It is important to note that individuals furloughed, not just those whose jobs have been cut, are among those filing for unemployment assistance,” Mark Hamrick, senior economic analyst at Bankrate said. “We hold onto the hope that many of these individuals will be able to return to their jobs once stay-at-home orders are lifted, consumers venture out, and the peak in infection is behind us.”

Health insurance while furloughed

It depends. Gap’s furloughed employees are able to keep their health insurance, which they wouldn’t have access to if they were laid off.

Continuation of health insurance for furloughed workers depends on whether the benefit plan allows it, according to Clayton. Group medical plans usually have an active-at-work requirement and furloughed employees may continue coverage only for a specific time.

Read more: How to get ACA health insurance if you lose your job

“If an employer has the language within their plan documents that allows for a temporary leave, they may be able to continue the coverage [for their furloughed workers] or maybe help by paying the premiums to the health care provider directly,” Clayton said.

Furloughed employees who lose their health coverage can get COBRA coverage. A reduction in hours is considered a triggering event for COBRA coverage, a law that allows employees to continue their health insurance coverage after leaving employment.

Read more: COBRA insurance: How to file if you lose your job

Workers who lose their health care coverage through their employer may also be eligible for a special enrollment period in the Affordable Care Act marketplace, according to HealthCare.gov.

Retirement plans while furloughed

Retirement benefits are less likely to be kept up during a furlough, Clayton said. Since furloughed employees get no pay, there are no automatic deductions for 401(k) contributions or employer matches.

“What could happen is when an employee comes back to work, they could certainly adjust their contributions if they wanted to,” Clayton said. “Make up the difference for what they lost during the week or two without pay.”

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

Read more:

'I may lose everything': Americans reel from job losses as coronavirus stalls economy

What to do if you lose your health insurance during the coronavirus outbreak

Read more personal finance information, news, and tips on Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.

money

money