Coronavirus put these Americans 'in purgatory' with unprecedented layoffs and furloughs

The biggest frustration for Austin Rogers, who lives north of Orlando, Fla., is filing for unemployment.

Rogers, a bartender, was furloughed from his job at a family-owned restaurant on March 17 due to the coronavirus pandemic. His unemployment application remains pending.

“It doesn't say that it has been approved or declined,” Rogers, who estimated he’s called almost 1,000 times without success, told Yahoo Money. “They tell you to call the hotline. Well, the hotline has been unreachable for the last month. I'm in purgatory.”

Read more: Unemployment insurance: What it is and how to get it

Rogers and many other Americans have experienced their lives turned upside down by the coronavirus pandemic. Some are construction workers, hotel employees, and bartenders. Some live in the heartland, others in coastal states. Some are married, and others are moms and dads.

And they all share the same hardship: They are among the swelling ranks of Americans left jobless in the wake of the coronavirus pandemic.

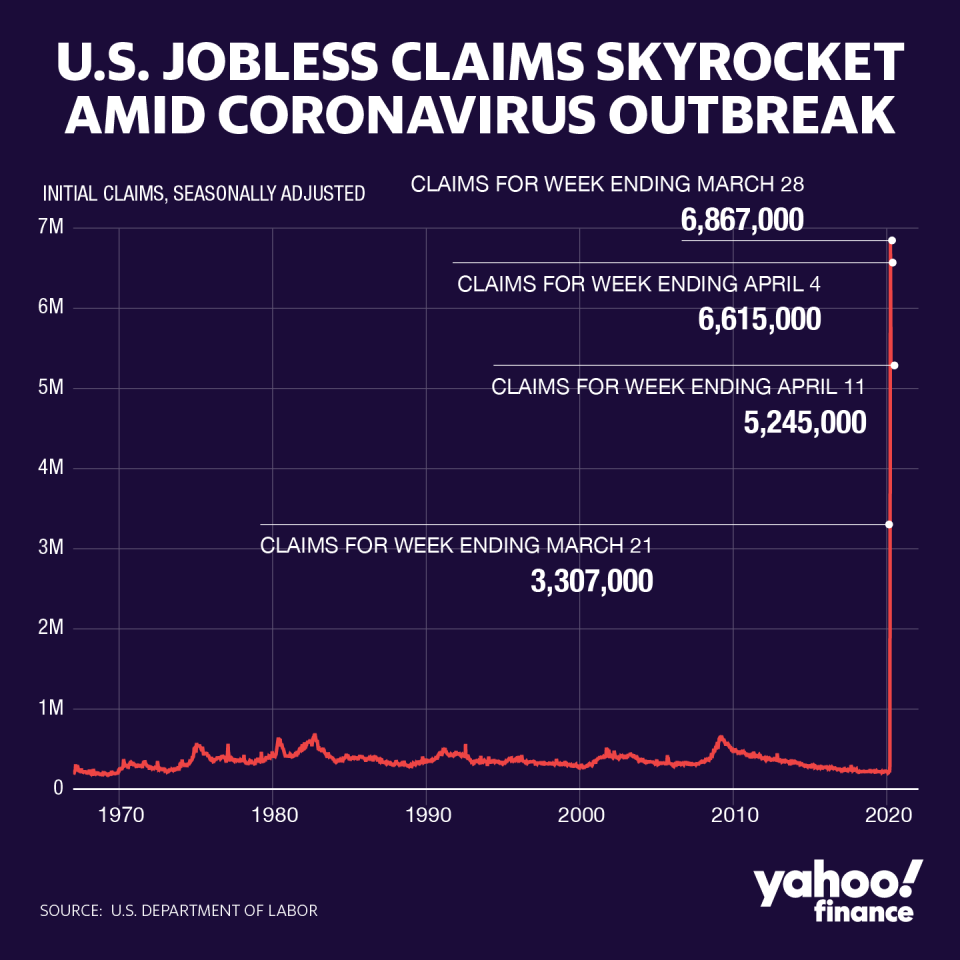

The number of unemployed U.S. workers grew even larger on Thursday with another 5.2 million people filing jobless claims last week. In the last four weeks alone, 22 million workers have asked for government help, erasing all of the job gains since June 2009.

‘That financial pain will longer long’

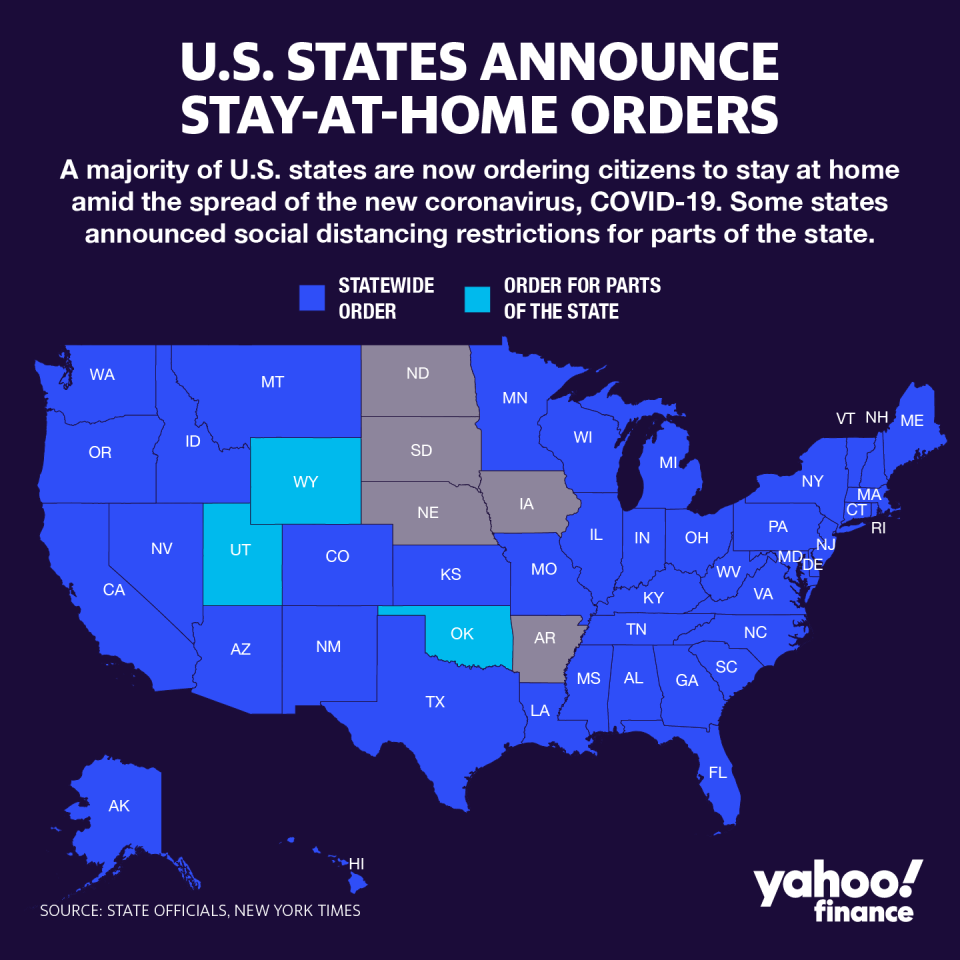

The unprecedented surge in unemployment comes after all 50 states shuttered much of American life to stem the spread of the outbreak, efforts that were made on an indefinite timeline. On Thursday, New York extended its shutdown through May 15.

Even when public life finally reopens, the economy might not be able to bounce back.

“Not all are going back to work the day the stay-at-home orders are lifted,” Greg McBride, chief financial officer at Bankrate, said. “That financial pain will linger long after the worst of the virus has faded. Elevated unemployment will be something that stays with us for many months and years, not days or weeks.”

Nathan Barnes was part of the first waves of layoffs to emerge from the crisis. He lost his construction job on March 18. His other gigs as a seasonal landscaper and a nightclub comedian also are nonexistent.

“I feel like I have been punished for doing the right thing and for what the government told us all to do,” Barnes, a 34-year-old veteran, told Yahoo Money. “I am in fear of not being able to provide for my family and have no battle plan on how to get my family back on track.”

Barnes filed for unemployment on March 26 but was rejected for not making enough money per quarter in the 2018-2019 period. He was told to refile after the CARES Act — the $2 trillion relief package from the federal government — went into effect. The family did so on April 6 and is still waiting for a response.

Read more: What to do before you lose your job

In the meantime, the Barnes family — including three kids who live at home — are relying on Nathan’s wife’s income of $800 a month. She remains employed as a health care case worker, but with reduced hours. Barnes has also resorted to online pleas to make ends meet, including setting up a GoFundMe campaign and sharing his Venmo account on Twitter.

He worries about making his $1,500 rent and utilities payment for May. He already owes $900 in rent left over from the beginning of this month. He and his wife are eligible for the full $1,200 stimulus checks and extra $500 per child, but it may be too late before they arrive.

“I don’t have the time or money to wait for a miracle to come down the pipeline from our government,” Barnes said. “The worst case scenario, we might be standing on the street.”

Read more: Coronavirus stimulus check: How to get one if you don’t file your taxes

Austin Rogers and his wife, who was furloughed on the same day as he, had some savings to fall back on, but the couple still needs unemployment benefits to go through. Austin’s wife’s application is also pending, but he was one of the lucky Americans to get a stimulus payment this week.

That money will go to bills that have piled up: back payments on their cable and power bill, he said. Anything left over will go towards groceries for the rest of the month, along with rent.

“And then I'm back down to very low funds,” Rogers said. “You know, once it starts getting later in May...or even going into June, I don't know what's going to happen.”

‘We're still trying to process everything’

At first, Cody Walton, who was in a management position at a nearby hotel, was the one laying off people. He and his wife, Chanel, thought he would be spared the very worst. But a week later on March 25, Cody, 26, was also let go, leaving the sole income source for the family of seven gone.

“I don't think it's really hit us yet,” Chanel, who lives in Fresno, Calif., told Yahoo Money. “We're still trying to process everything that's happening. I'm not really sure what he's going to do yet.”

They can’t lean on savings. After paying their mortgage and car payment, there’s not a lot left over in the Walton family budget, a problem for many U.S. households. Two in 5 Americans can’t cover a $400 emergency without borrowing money or selling items for cash, according to the Federal Reserve.

Read more: How to deal with financial stress

“We don't have any savings, like at all,” Chanel, 27, said. “We don't quite live paycheck-to-paycheck, like it's not that tight, but we are in a spot where we can't really save much.”

Fortunately, Cody will be paid for accrued paid time off on top of an additional two week’s pay his former employer gave him. With five children under the age of 17, the family also will qualify for a $4,900 stimulus check, which is earmarked for the bare necessities like food, water, and heat.

“One thing that scares me is not being able to provide for our kids,” Chanel said. “Those are things that we're going to have to really worry about like these next couple weeks, these next months, depending how long this lasts.”

Stephanie and Dhara are reporters at Yahoo Money and Cashay. Janna is an editor at Yahoo Money and Cashay. Follow them on Twitter at @Dsinghx, @SJAsymkos, and @JannaHerron.

READ MORE:

'Fundraise for the most vulnerable': GoFundMe campaigns fill gaps before government aid kicks in

'Not going to happen': Couples call off weddings during pandemic, losing time and money

Read the latest financial and business news from Yahoo Finance and Yahoo Money

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money