Where is my tax refund? This chart shows when you can expect it

Many Americans are waiting for their biggest windfall of the year to hit their bank accounts: their tax refund.

Often, this money is earmarked for savings, debt, or a big purchase like a vacation. So, it’s important to know when the refund will arrive.

Read more: How to file taxes: The full breakdown

Nine in 10 refunds should be issued in less than 21 days, according to the Internal Revenue Service, as long as your return doesn’t require additional review. If you claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), your refund can’t be issued until mid-February, meaning the earliest it will show up is the first week of March, the IRS said.

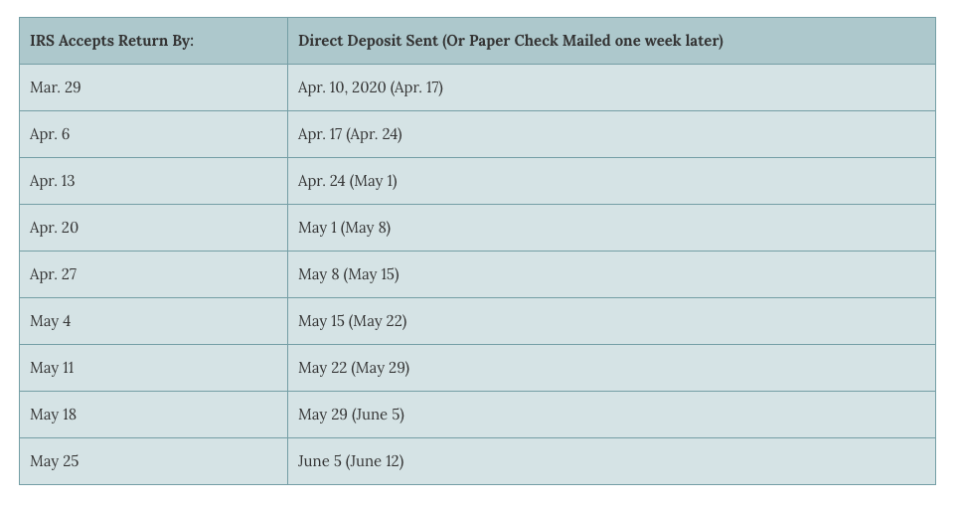

But if you need more exact dates for the arrival of your refund, CPA Practice Advisor, a tech resource for accountants, has put together a chart showing when you should expect it based on when you filed your taxes. Its estimates are based on previous year’s filing statistics from the IRS and Treasury Department.

The fastest way to get your refund is to file electronically and choose direct deposit.

“Paper returns take a week longer,” said Gail Perry, a certified public accountant and editor-in-chief of CPA Practice Advisor Magazine.

“States, as a rule, are generally slower than the IRS issuing refunds,” she added.

Track your tax refund

After you file your taxes, you can track your tax refund using the “Where’s My Refund?” tool online at the IRS website or the free mobile app, IRS2Go form the agency.

Information on the status of your refund will be available 24 hours after the IRS receives your e-filed tax return or four weeks after you mail a paper return. The tracker updates once a day.

The tracker will show when your tax return was received, when your refund was approved, and when the refund was sent. It will also provide a date that you should expect to receive your refund.

To use the tool, you must enter your Social Security number, filing status and the exact dollar amount of your refund. You can also call 800-829-1954 for the automated phone line, which provides the same information on your refund.

For those who claimed the EITC or ACTC, the “Where’s My Refund” tool will be updated with estimated deposit dates for refunds on Feb. 22, the IRS said.

Is my tax refund lost?

You can file an online claim to get a replacement check if more than 28 days have passed since the date the IRS mailed your refund. The “Where’s My Refund?” tool will provide information on how to file a claim.

Janna is an editor for Yahoo Money and Cashay. Follow her on Twitter @JannaHerron.

Read more:

Read more personal finance information, news, and tips on Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money