We're Not Very Worried About NGM Biopharmaceuticals' (NASDAQ:NGM) Cash Burn Rate

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should NGM Biopharmaceuticals (NASDAQ:NGM) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for NGM Biopharmaceuticals

How Long Is NGM Biopharmaceuticals' Cash Runway?

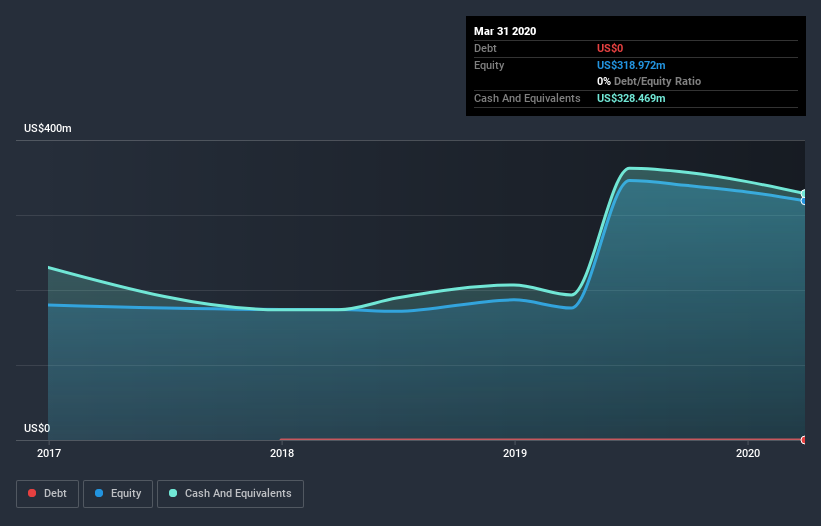

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at March 2020, NGM Biopharmaceuticals had cash of US$328m and no debt. Looking at the last year, the company burnt through US$50m. Therefore, from March 2020 it had 6.5 years of cash runway. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. You can see how its cash balance has changed over time in the image below.

How Well Is NGM Biopharmaceuticals Growing?

Notably, NGM Biopharmaceuticals actually ramped up its cash burn very hard and fast in the last year, by 131%, signifying heavy investment in the business. As if that's not bad enough, the operating revenue also dropped by 11%, making us very wary indeed. Taken together, we think these growth metrics are a little worrying. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For NGM Biopharmaceuticals To Raise More Cash For Growth?

While NGM Biopharmaceuticals seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

NGM Biopharmaceuticals' cash burn of US$50m is about 3.9% of its US$1.3b market capitalisation. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

How Risky Is NGM Biopharmaceuticals' Cash Burn Situation?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought NGM Biopharmaceuticals' cash runway was relatively promising. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. On another note, we conducted an in-depth investigation of the company, and identified 3 warning signs for NGM Biopharmaceuticals (1 is potentially serious!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

money

money