Watch that email carefully: Scammers push stimulus stories to steal bank account numbers, more

Scammers are at it again, flooding us with texts and emails that involve phony pitches about coronavirus relief money, known as Economic Impact Payments.

One email, pretending to be from the Internal Revenue Service, asked taxpayers to "please re-enter the correct banking data previously provided to the IRS."

Another was titled: "Third Round of Economic Impact Payments Status Available."

That email included the greeting "Dear Customers IRS," then went on to tell taxpayers they were eligible for $815.05. To get the money, they had to click on a blue box marked "Claim My Payment."

Scam calls sell student loan forgiveness. Don't fall for it.

Robocalls making you crazy? Here are 5 ways to stop them for good

Clicking on a link or box can open the door to scammers who may attempt to download malware onto your computer to steal important ID information.

The email tried its best to sound official but sounded super strange, ending with a footnote: "For security reasons, we will record your ip-address, the date and time. Deliberate wrong inputs are criminally pursued and indicated."

Indicated? What? Were the scammers, maybe, thinking of indicted? While we're at it, "criminally pursued" isn't exactly a phrase you hear on "Law & Order" either.

The IRS announced Thursday that it received a record number of complaints about Economic Impact Payment scams in June and July, a level not seen in more than a decade. Specific numbers were not disclosed.

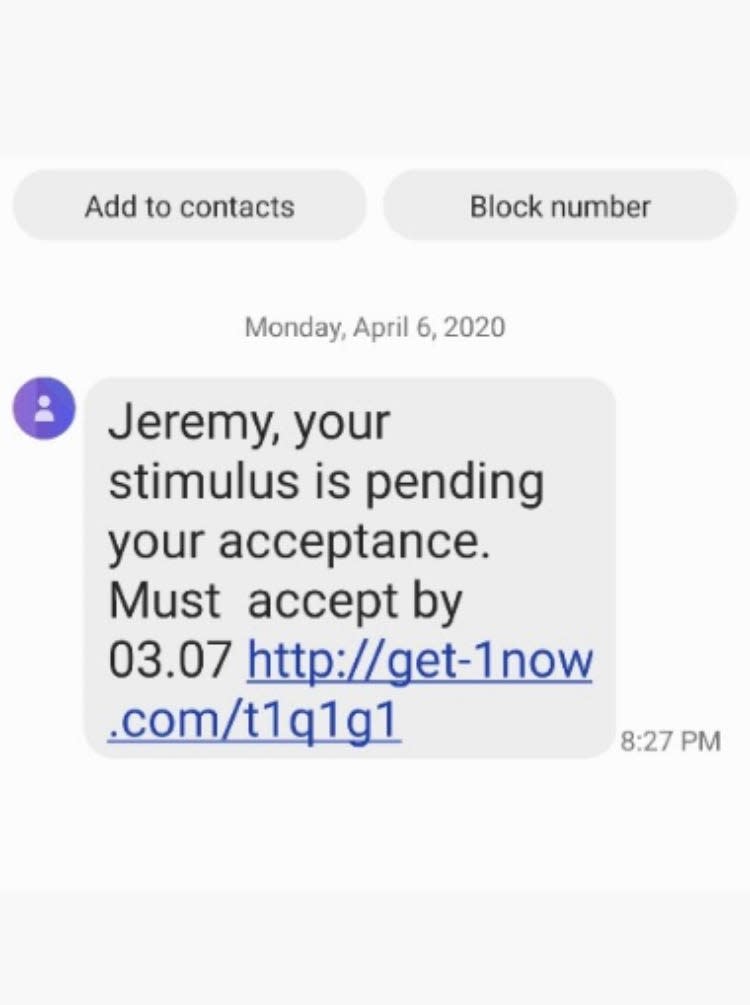

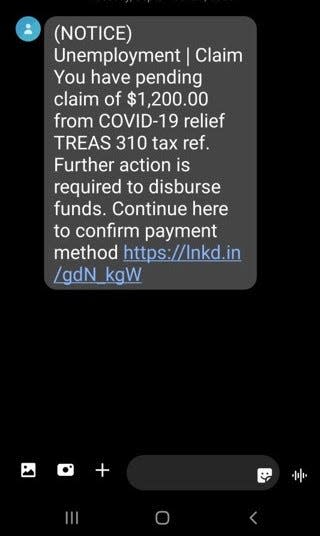

The alert said scammers sent text messages that a taxpayer was eligible for a "stimulus payment" and must click on a link to complete information to claim it.

Phishing emails claim that the IRS calculated taxpayers' "fiscal activity" and they are eligible for an Economic Impact Payment in a specific amount.

The IRS again alerted taxpayers that it does not send unsolicited texts or emails.

And the IRS does not threaten individuals with jail or lawsuits or demand tax payments on gift cards or via cryptocurrency.

The IRS said that if it does call, the taxpayer should not be surprised because the agency generally sends a notice or letter first.

Taxpayers can report fraud or theft of their Economic Impact Payments to the Treasury Inspector General for Tax Administration. They can make a report online at TIPS.TIGTA.GOV.

The alert noted that unsolicited emails or social media attempts to gather information that appear to be from either the IRS or an organization closely linked to the IRS can be sent to phishing@irs.gov.

"Taxpayers are encouraged not to engage potential scammers online or on the phone," the alert said.

Contact Susan Tompor: stompor@freepress.com. Follow her on Twitter @tompor.

This article originally appeared on Detroit Free Press: Stimulus payment scam: Emails, texts aim to steal bank account numbers

money

money