Unemployed Americans see their savings deplete as stimulus hopes fade

Taylor Read lost her job as a bookseller in March. She’s been unemployed since and, while the expanded unemployment benefits helped her pay bills in the summer, they are now gone and she’s burned through what little she saved.

“What little money I managed to save during the $600 boost was then dried up because of how long it's been taking for another stimulus package to go through,” Read, 28, said. “All of those savings are gone. They were gone in August.”

Read is one of the many Americans who saw her savings grow early in the pandemic, only for those funds to dwindle in the fall. The personal saving rate reached a record high of 33.6% in April driven both by a pull back in spending and an influx of cash from government support, according to the Bureau of Economic Analysis. By September, the rate dropped to 14.3%.

“The federal government was pushing out an incredible amount of money in relief to families and the unemployed,” said Claudia Sahm, a former principal economist at the Federal Reserve Board of Governors. “Once that extra income stops, and they still have to pay the rent and they still have to buy food for their kids, they're gonna start drawing down that nest egg.”

But while the national saving rate remains elevated compared with pre-pandemic levels, the rate now may be driven more by high-income Americans who remain employed rather than those at the bottom. While jobless workers more than doubled their liquid savings between March and July, according to a study from the JPMorgan Chase Institute, they spent two-thirds of those accumulated savings in August alone.

Unemployed workers' savings likely are declining even more because “the trajectory of the August data shows that this is a trend in motion, it hasn't yet stabilized,” Fiona Greig, director of consumer research at the JPMorgan Chase Institute, told Yahoo Money earlier this month.

‘It was literally a lifesaver’

Jobless Americans saw a boost in the spring and summer when the extra $600 in weekly unemployment benefits and stimulus checks under the CARES Act were distributed. Some Americans even got more money from unemployment than their old wages for a short period.

“It was literally a lifesaver,” Read said about the extra $600. “I was barely staying above water before the pandemic and the boost allowed me to pay off debt, raise my credit score a little bit, and learn some new skills, so maybe it might be easier to get jobs I actually want.”

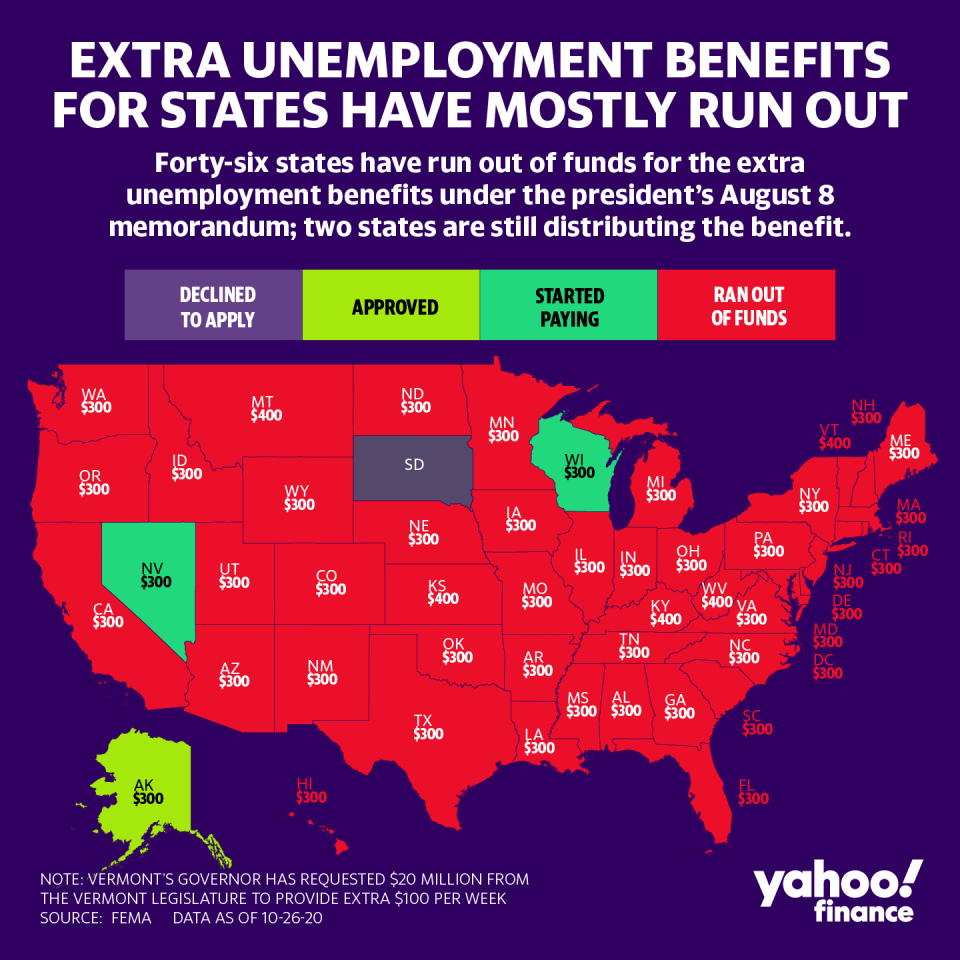

But since then, out-of-work Americans have faced two fiscal cliffs: the first when the extra $600 expired at the end of July and the second when the $300-$400 under the Lost Wages Assistance (LWA) program expired in September. Now they are left with only regular unemployment state benefits.

Over 22 million jobless Americans who are currently receiving unemployment insurance have seen their benefits drop from around 130% of their pre-layoff wages to 50% after the expirations, an analysis from Evercore ISI found.

Since the job market hasn’t fully recovered, the reduction not only means shrinking savings, but also the inability to pay monthly expenses.

“I’m still unemployed, and because all of the protections from the CARES Act are gone, the bills are piling up,” said Read, who can’t pay her rent, car registration, or credit card issuers who are threatening to sue. “It’s becoming a desperate situation.”

‘Playing games with our lives’

Negotiations for the next stimulus deal have been ongoing for more than three months, but no deal has been reached. One won’t happen before the election and the future of a deal depends on what happens after the election. It’s possible a deal may not happen until the end of the year — or even worse — until the next administration takes office in January.

Read more: Here’s what you need to know about unemployment benefits eligibility

While some unemployed Americans survived on accumulated savings over the last few weeks, most of that extra money will be exhausted by mid-December if no more stimulus is passed, according to analysis by Evercore ISI.

“There's almost no way for a lot of these families to have that buffer when they get to December,” Sahm said. “There’s just a scenario for a lot of hardship, and a lot of missing mortgage payments, missing rent, not being able to get food.”

Read, who hasn’t been able to find a job for seven months, gets $220 a week in unemployment benefits or less than $900 a month, which doesn’t cover her rent in Los Angeles. She had hoped the government would pass more stimulus before the election.

“I think Congress is so out of touch with reality, it’s laughable,” Read said. “They have starving, desperate Americans counting on them and they are playing games with our lives.”

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

Read more:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.

money

money