Two sentences in Netflix's earnings should terrify those obsessed with its stock

Before jumping to the conclusion that Netflix’s better than expected third quarter earnings on Wednesday suggest the stock’s 22% three-month slide is overdone, you should consider two important sentences in the press release.

The first area of concern centers on the concept of price elasticity. Earlier this year, Netflix (NFLX) raised the price of its basic plan by $1 and the standard plan that features HD streaming on two devices by $2. The premium Netflix plan also went up $2.

While the price hike helped to nicely lift average revenue per user in the U.S. (+16.5%) and internationally (+10%) in the third quarter, it appears that a large subsection of consumers have balked — possibly canceling their subscriptions.

“Since our U.S. price increase earlier this year, retention has not yet fully returned on a sustained basis to pre-price-change levels, which has led to slower U.S. membership growth,” Netflix called out in its shareholder’s letter Wednesday. Exerting pricing power is critical for Netflix given the outsized investments it’s making to develop original content and to keep the outside content it has on its platform.

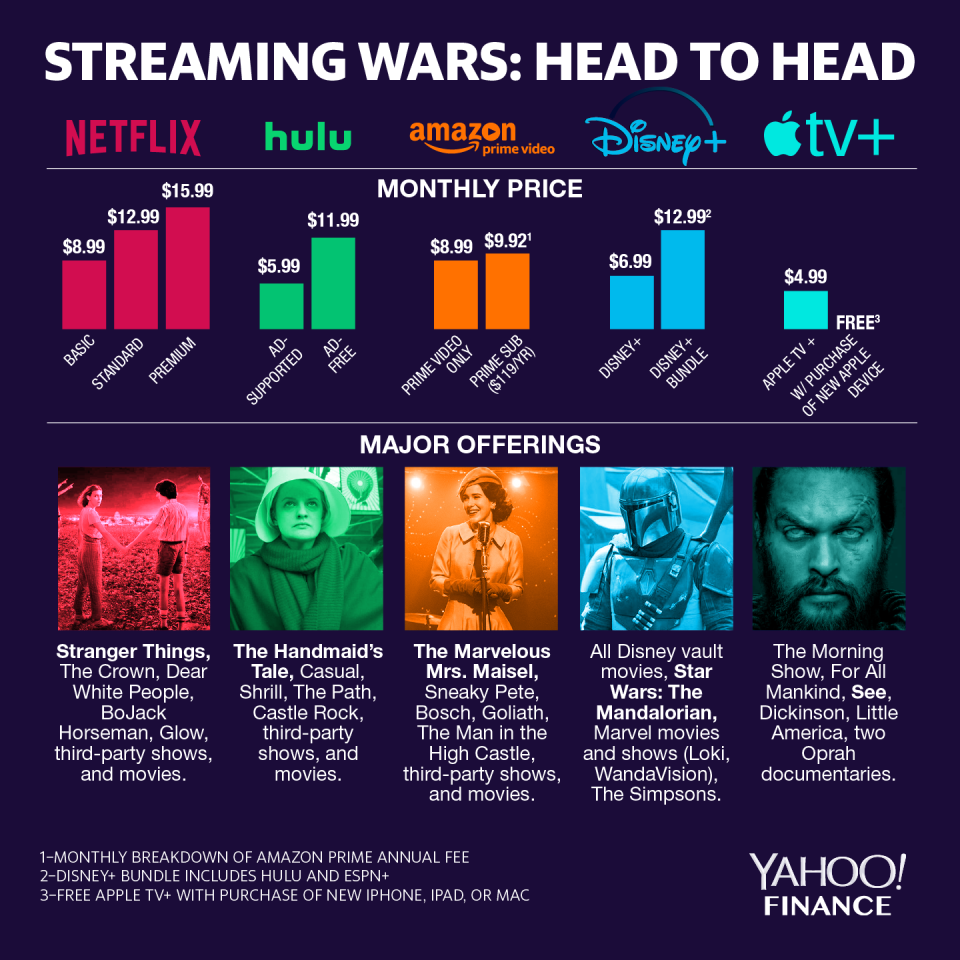

Seeing what may be limited pricing power for Netflix is a red flag ahead of competing offerings from Disney (DIS) and Apple (AAPL) arriving shortly. It suggests consumers are open to lower cost options to Netflix — which is obviously not a good look for Netflix, especially as it continues to burn through its free cash flow. Further, it hints that Netflix may have to find a way to offer greater value to subscribers if it wants to push prices higher.

As for the other worrying sentence, it speaks to the quality of the third quarter — or lack thereof by Netflix’s historical standards — that the streaming giant delivered. Netflix beat on Wall Street earnings estimates by a whopping 43 cents, but that looks to have been fueled by clever maneuvers on the expense line.

“Operating margin of 18.7% (up 670 bps year over year) was above our guidance due to timing of content and marketing spend, which will be more weighted to Q4’19,” Netflix said in the letter. That suggests Netflix is ready to spend aggressively in marketing and promotions in the final quarter of the year to keep subscribers amid the arrival of competing offerings. With subscriber growth continuing to slow, what may be elevated expenses only raises the downside risk to fourth quarter profits.

Cautioned Netflix, "The launch of these new services will be noisy. There may be some modest headwind to our near-term growth, and we have tried to factor that into our guidance. In the long-term, though, we expect we’ll continue to grow nicely given the strength of our service and the large market opportunity."

Nevertheless, in the early going the market is breathing a sigh of relief Netflix’s third quarter wasn’t as bad as feared — even though it was another mixed one at best as outlined above. Netflix shares popped 8% early Thursday in the aftermath of its earnings report, despite the company once again falling short of its U.S. paid net subscriber additions.

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Follow him on Twitter @BrianSozzi

Read the latest financial and business news from Yahoo Finance

SmileDirect co-founder: here’s what life will look like post IPO

Starbucks CEO on what China has in store for the coffee giant

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money