Coronavirus: Tips for managing personal finances amid the pandemic

Now is not the time to panic about finances, according to one personal finance expert, but rather take control.

“Things are so out of control right now,” Jill Garvey, a strategist at Huntington Private Bank, said on Yahoo Finance’s The Final Round (video above). “I’m trying to get my clients to focus on what we can control.”

The market uncertainty is top of mind for many, along with shifting retirement plans and savings. Garvey is telling her clients that the best thing to do right now is to revisit those long-term planning discussions.

Tip: Sock away money for an emergency fund

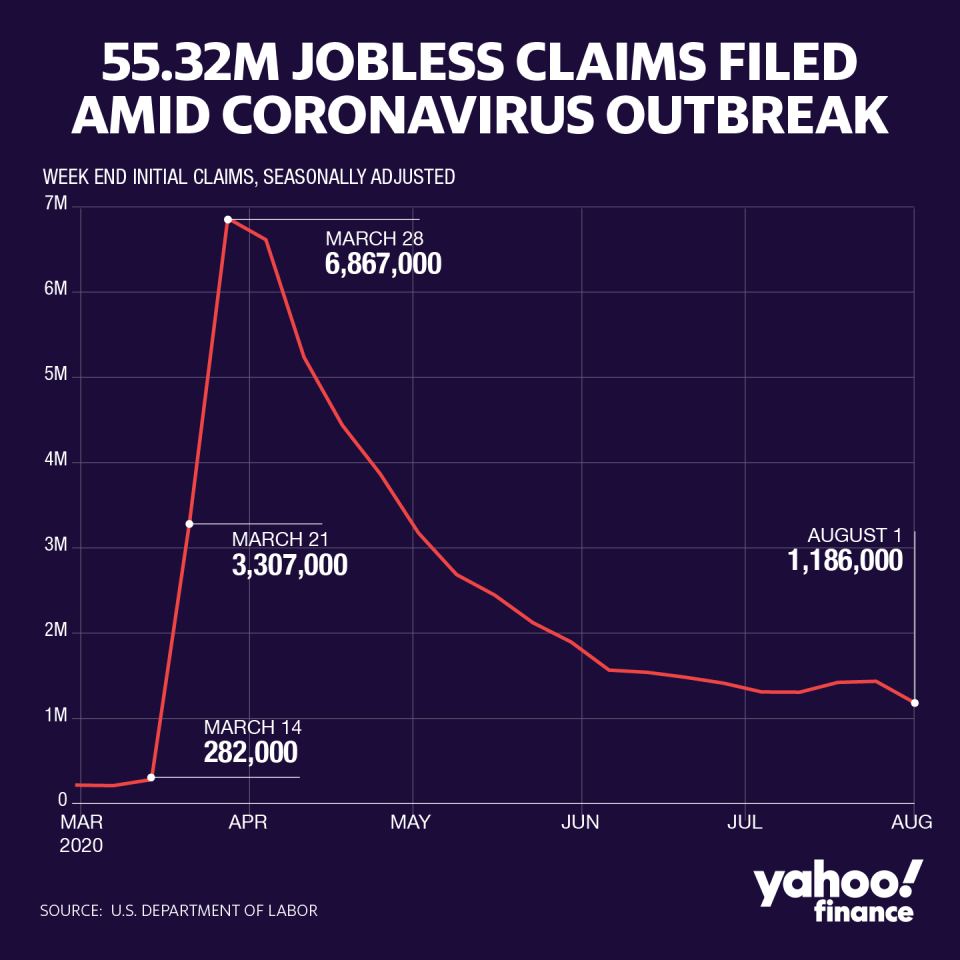

Evidence of the lack of stability in the job market has become clear as over 44 million Americans filed unemployment insurance claims over the last five months, underscoring the need for a personal emergency fund.

Conventional wisdom dictates that a household or individual should have between three to six months’ worth of expenses in liquidity that can be drawn on for an emergency like a job loss, medical expense, or auto repair.

The pandemic has challenged the prescribed benchmark, and Garvey said she errs on the side of saving six to 12 months’ worth of expenses to play it safe. But if saving for a year’s worth of expenses isn’t achievable right now, Garvey suggested targeting six months at the outset.

Tip: Capitalize on low mortgage rates

Paying off your mortgage can also be a challenge during this time. But, mortgage rates for common home loan terms are at record lows with interest rates below 3%, which is a boon for homeowners looking to refinance their mortgage.

Refinancing could mean saving hundreds of dollars every month, but it also might extend the life of the term.

Garvey shared that she’s having lots of conversations with her clients about refinancing and suggested looking at the 15- and 30-year rates to see what makes sense for each mortgage holder.

For those who own their homes outright, a cash-out refinancing and investing the surplus in the market might be a good play for long-term investors, she said.

Using the surplus cash for extra liquidity, adding to an emergency fund, paying down debt, or investing are all ways to bring optionality and financial freedom for households.

Stephanie is a reporter for Yahoo Money and Cashay, a new personal finance website. Follow her on Twitter @SJAsymkos.

Read more:

Coronavirus puppy scams 'seemed legit,' ensnared dog lovers amid pandemic: Illegal Tender podcast

Coronavirus stimulus: Arizona Senator's $4,000 travel credit is 'one of the wackiest' ideas

American tourists face bans and restrictions across the world amid shoddy pandemic response

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money