Can’t Go Forward, Won’t Go Back: Truss’s Government Hits Buffers

(Bloomberg) --

For a British prime minister in modern times, things have never gone so wrong, so fast.

Less than a month in 10 Downing Street, Liz Truss and her team have already adopted an us-against-the-world mentality, after a brutal reaction to her economic plans triggered the humiliation of a central bank rescue.

Read More: Britain’s Crisis of Confidence Was Years in the Making

That’s turned what should have been a celebration at her ruling Conservative Party’s annual conference in Birmingham into a moment of peril. Almost unthinkably, some Tory MPs are already privately discussing a leadership change, just weeks after they ousted Truss’s predecessor, Boris Johnson.

“You would at least expect some kind of honeymoon period: There’s just been nothing at all,” said Alice Lilly, senior researcher at the Institute for Government. “It’s very difficult to imagine a worse start.”

Within the Tory party, the premier and her long-time ally and friend, Chancellor of the Exchequer Kwasi Kwarteng, are viewed as a political double-act, co-authors of a 2012 book, “Britannia Unchained,” which called for deregulation, low taxes and free markets. Having waited so long to put their theory into practice, those close to Truss say there is no prospect of a U-turn now.

But it’s also difficult to see how they can move forward with their plans.

The week since Truss and Kwarteng announced a massive package of tax cuts without saying how they would pay for them will live long in the memory.

After the pound hit a record low, criticism of Truss’s new administration poured in, from the International Monetary Fund to former US Treasury Secretary Lawrence Summers, who said Britain has the worst economic policy of any major country. Even Turkish President Recep Tayyip Erdogan -- himself no strange to a currency crisis -- couldn’t resist piling on. And adding to the drip-drip of negative commentary, S&P Global Ratings late Friday threatened to cut its rating on the country’s debt.

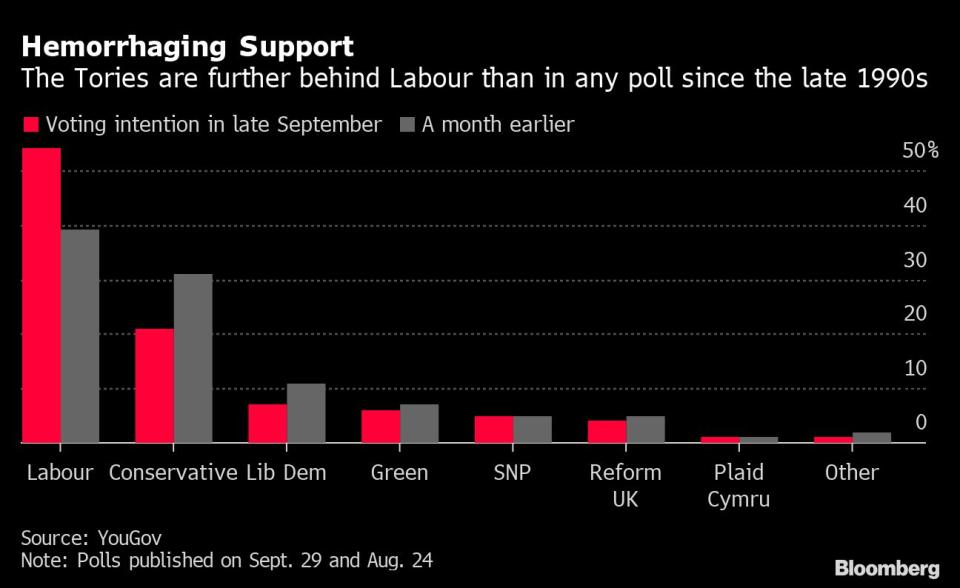

The Bank of England’s dramatic intervention to prevent a bond market meltdown was followed by evidence that a market crisis was now also a political one: A YouGov poll published Thursday gave the opposition Labour Party a record 33-point lead over Truss’s Conservatives.

Self-Inflicted Damage

When Kwarteng stood up in the House of Commons on Sept. 23, the most pressing issue facing the government -- helping Britons with soaring energy bills -- had already been dealt with by a price cap -- which starts this weekend -- without spooking markets.

Read More: Kwarteng’s Affinity With Truss May Win Him Keys to UK Coffers

Scrapping a rise in payroll taxes and a planned one in corporation tax had also been flagged by Truss during the leadership campaign. But the decision to remove the top rate of income tax, as well reducing a levy on home purchases, came as a major surprise. Given all the moves were unfunded, investors reacted swiftly.

Senior Tories including Mel Stride, chairman of Parliament’s Treasury Select Committee, blame Truss and Kwarteng for not commissioning the government’s fiscal watchdog to run a full analysis to reassure markets.

Ministers have since acknowledged their plans weren’t yet ready for full scrutiny, with accompanying policies still under development.

Party Appeal

That Kwarteng and Truss went ahead anyway reflects how they came to power. Her victory against former Chancellor of the Exchequer Rishi Sunak, who spent much of the campaign warning Truss’s plans would trigger economic carnage, was never really in doubt among grassroots members who have long-favored the tax-cutting, small-state message she delivered.

That’s a major reason why Truss can’t perform a U-turn without her administration being severely damaged.

So Kwarteng, who told MPs on a private call he’d been taken aback by the market reaction, is planning to try to build some momentum with growth-targeting measures ahead of his medium-term fiscal plan on Nov. 23.

By prioritizing tax cuts for Britons’ biggest earners, though, Truss ensured everything she now does is viewed through a prism of diverting funds to help the richest. Any whiff of austerity will be seized on by Labour given public services have yet to recover since the global financial crisis.

Angry Tories

Yet the immediate challenge is keeping her own MPs on side. Though party rules say Truss is safe from a leadership challenge for a year, those could be easily changed if there is a mass move against her. Similarly, she could end up facing overwhelming internal pressure to resign.

She starts from a position of weakness: Two-thirds of her MPs voted against her in the contest to replace Johnson in July, and she only claimed victory because she was the preferred choice of the grassroots.

There’s already a gallows humor among her team. When the moving trucks brought some of Truss’s personal effects to 10 Downing Street, staff joked that they might want to hold off on shipping anything else, according to a person familiar with the matter.

They also wondered whether Truss will outlast George Canning, whose 119 days in office in the 19th-century is the shortest tenure for a prime minister, the person said.

Crisis Management

Behind the scenes, Truss’s approach to a crisis is very different to Johnson’s. Whereas he used to have a daily 8:30 a.m. meeting to pore over newspaper coverage, Truss doesn’t. After an early morning run, she tasks her team with focusing on longer-term goals.

On the flip side, her team is less nimble when it comes to putting out fires, according to one MP. Some backbenchers resent the bunker mentality, which resulted in days of silence this week while markets imploded.

When Truss finally appeared in a series of tetchy local radio interviews on Thursday, MPs were shocked. One remarked that she would have been better off staying silent.

Hands Tied

But just as Truss’s hands are effectively tied by the ideology that has defined her career, so Tory MPs also have limited options.

Some privately said there is currently no movement to unseat her, in part because of the chaos that would reveal to voters -- though they point out Truss’s authority has already waned. She would be more in danger if the next general election was further away than 2024, they said.

Polling this week has left many MPs fearing for their jobs. A YouGov survey on Monday gave Labour what was already a record 17-point lead -- which then almost doubled just three days later.

Read More: Truss Should Resign as UK Premier, More Than Half of Brits Say

“The government has not so much shot itself in the foot as it has shot its leg off,” said Tim Bale, professor of politics at Queen Mary University of London. “I’ve never seen a government make such a big mistake or suffer such a big poll swing so early in its life. It’s the most disastrous week for any newly-minted prime minister that we’ve seen in modern times.”

But there’s also a view that while markets have calmed somewhat since the BOE’s dramatic intervention, much of the political damage has already been done. Some MPs say Truss’s weakened administration will limp on to the next election, facing rebellions on key votes.

Her plans including relaxing planning rules, which Truss regards as key to boosting growth, will be more difficult to get through Parliament.

A lot, though, depends on what markets do next.

It was not meant to be this way for a new leader going into a party conference still holding a 71-seat working majority. One MP said the mood would be despondent, with no champagne drunk in case photos emerge of Tories enjoying themselves while voters worry about their mortgages.

Truss is likely to strike a defiant tone. But there’s a feeling in the party she has already ruined her big chance.

(Adds S&P in eighth paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

money

money