Syneos Health (SYNH) Q2 Earnings Top Estimates, Margins Down

Syneos Health Inc. SYNH reported second-quarter 2020 adjusted earnings per share (EPS) of 58 cents, which beat the Zacks Consensus Estimate by 20.8%. However, the metric dropped 21.6% from the year-ago figure.

Reported EPS was 4 cents, marking a huge decline from the year-ago net earnings of 11 cents per share.

The year-over-year decline in adjusted earnings was the result of the impacts of COVID-19 on both Clinical Solutions and Commercial Solutions businesses, partially offset by benefit from cost management strategies, lower reimbursable out-of-pocket expenses, and lower interest expense.

Revenues in Detail

Revenues in the quarter totaled $1.01 billion. The top line declined 13.1% year over year on a reported basis (down 13.3% on an adjusted basis and 12.8% on a constant currency adjusted basis). However, it exceeded the Zacks Consensus Estimate by 0.9%. Adjusted revenues include revenues eliminated as a result of purchase accounting.

Segmental Details

The Clinical Solutions segment recorded revenues of $747.2 million in the second quarter; down 12.3% year over year on a reported basis (down 11.6% at CER). The downside resulted from reduced physical site monitoring visits and out-of-scope work related to COVID-19, the associated decline in reimbursable expenses, and the divestiture of the company’s lower-margin contingent staffing business as part of its portfolio rationalization.

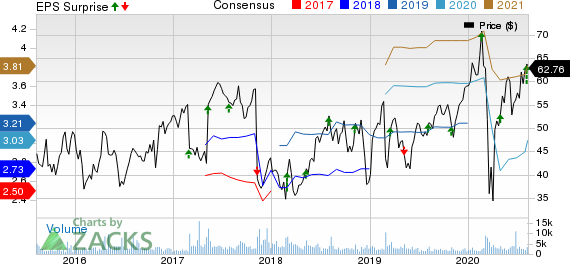

Syneos Health, Inc. Price, Consensus and EPS Surprise

Syneos Health, Inc. price-consensus-eps-surprise-chart | Syneos Health, Inc. Quote

Commercial Solutions revenues were $266.2 million in the reported quarter, down 16% year over year (adjusted revenues moved down 15.8% at CER). The decline was caused by the impact of COVID-19, including a decline in reimbursable expenses associated with reduced field team travel and lower investigator meeting expenses, as well as Deployment Solutions project start-up delays.

Margin Details

Direct cost (excluding depreciation and amortization) declined 12.2% to $805.9 million in the quarter. Despite that, gross margin contracted 89 basis points (bps) to 20.5%.

Selling, general and administrative expenses were down 5.3% year over year to $104.9 million.

Adjusted operating margin (excluding depreciation, amortization, transaction and integration-related, and restructuring and other expenses) contracted 174 bps from the year-ago quarter to 10.1%.

Financial Details

Syneos Health exited the second quarter of 2020 with cash and cash equivalents, and restricted cash of $343 million, compared with $335.9 million at the end of the first quarter. At the end of the second quarter, cumulative operating cash outflow was $155.2 million compared with $83.5 million a year ago.

Guidance

Following the withdrawal of its 2020 guidance in April, the company issued a fresh guidance this time around.

Full-year revenues are expected in the range of $4,470 million to $4,570 million while adjusted EPS is expected in the band of $3.16 to $3.38.

The current Zacks Consensus Estimate for 2020 revenues is pegged at $4.48 billion while the same for adjusted EPS stands at $2.97 billion

Our Take

Syneos Health exited the second quarter of 2020 with better-than-expected numbers. However, the year-over-year decline in both revenues and earnings was a dampener. The company registered significant sales decline in both of its business segments. Margin pressure continued to weigh on the bottom line.

On a positive note, Syneos Health won 35 COVID-19 related projects through the second quarter and still has a substantial pipeline of additional COVID-related opportunities.

Zacks Rank & Other Stocks to Consider

Currently, Syneos Health carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the broader medical space are West Pharmaceutical Services, Inc. WST, Thermo Fisher Scientific Inc. TMO and Hologic, Inc. HOLX.

West Pharmaceutical reported second-quarter 2020 adjusted EPS of $1.25, beating the Zacks Consensus Estimate by 37.4%. Net revenues of $527.2 million outpaced the consensus estimate by 6.9%. It currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Thermo Fisher, a Zacks Rank #2 company, reported second-quarter 2020 adjusted EPS of $3.89, beating the Zacks Consensus Estimate by 45.7%. Revenues of $6.92 billion outpaced the consensus mark by 0.1%.

Hologic reported third-quarter fiscal 2020 adjusted EPS of 75 cents, surpassing the Zacks Consensus Estimate by a stupendous 108.3%. Net revenues of $822.9 million exceeded the Zacks Consensus Estimate by 37.1%. It currently sports a Zacks Rank #1.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

With users in 180 countries and soaring revenues, it’s set to thrive on remote working long after the pandemic ends. No wonder it recently offered a stunning $600 million stock buy-back plan.

The sky’s the limit for this emerging tech giant. And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

Syneos Health, Inc. (SYNH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

money

money