Study: These Americans have been hit hardest financially by the pandemic

As the economic fallout from the coronavirus pandemic still unfolds, the financial pain hasn’t been equally shared among Americans, according to a new report.

Those bearing the brunt are workers earning the least, Hispanics, and — to a lesser extent — those without a four-year degree, a new survey of 4,917 people by the Pew Research Center found.

“People who are already experiencing financial hardships have been among the hardest hit in the current crisis,” said Juliana Horowitz, associate director of research at Pew Research. “They're also the ones that have the least access to emergency funds, or to other resources that could help them financially.”

Low earners in dire financial straits

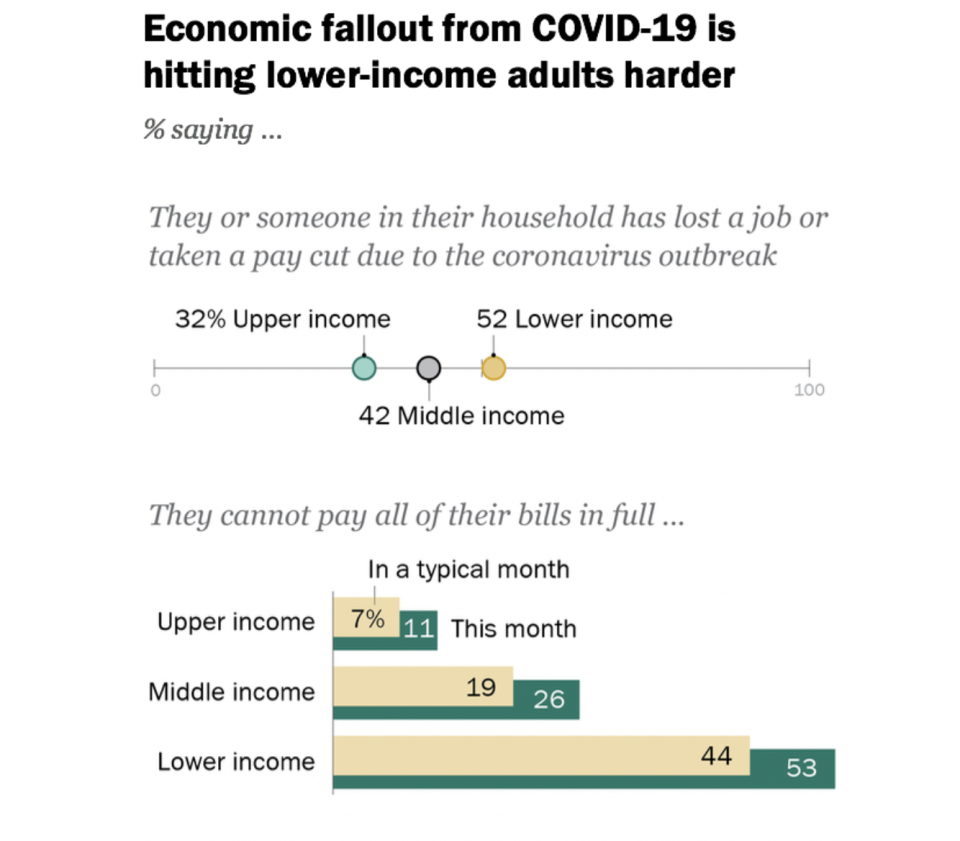

More than half of lower-income households earning up to $37,500 can’t pay all of their bills this month, while nearly the same share report that someone in their family has lost their job or taken a pay cut.

By contrast, only 1 in 4 middle-income and 1 in 10 upper-income households are unable to pay their bills this month, and smaller proportions have lost their jobs or taken a pay cut.

These poorer households also have little to lean on during difficult times. “They’re also the least likely to have emergency funds,” Horowitz said.

Less than 1 in 4 lower-income individuals have an emergency fund that can last three months versus 3 in 4 for upper-income Americans. Eight in 10 of lower-income families with no emergency funds also said they won’t be able to cover basic expenses — even if they borrow, sell assets or tap savings.

Hispanics stung by job loss

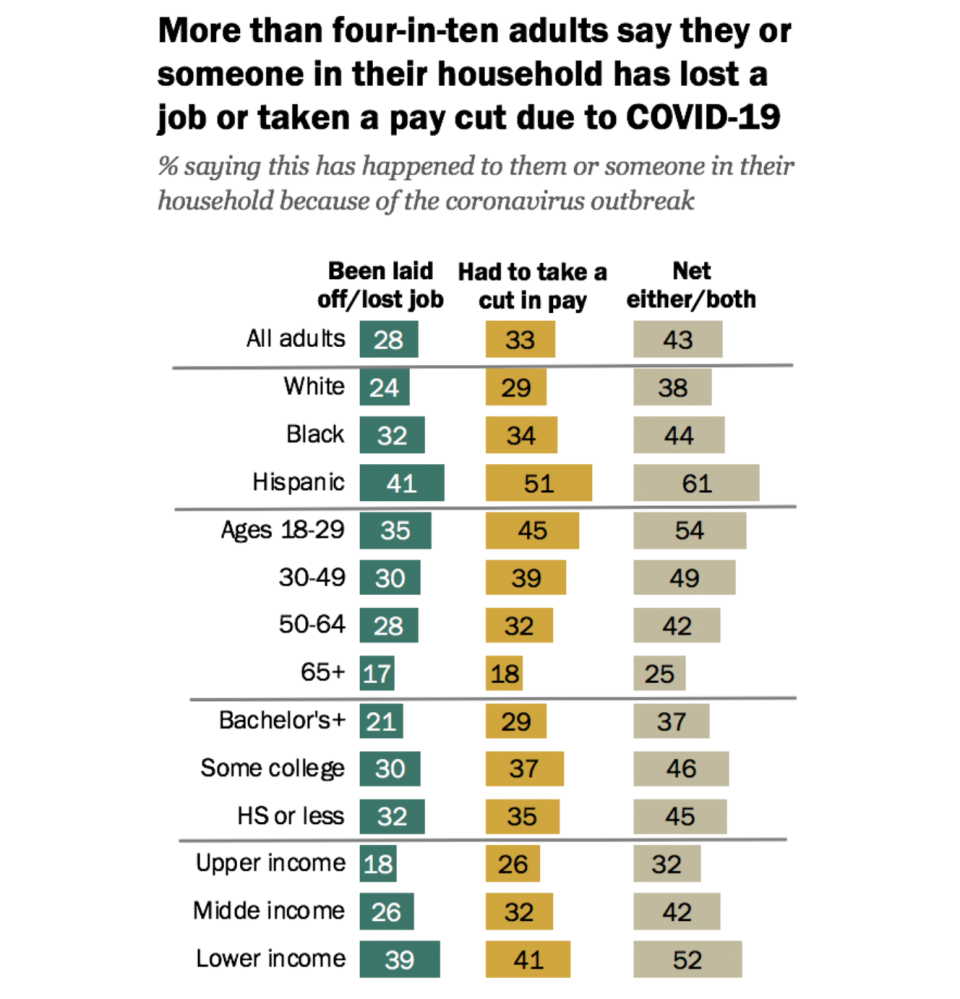

With unemployment claims reaching 22 million in the last four weeks, not all demographic groups have been equally affected by job and wage loss, the survey found. On the employment front, Hispanics have felt the worst sting.

Read more: Coronavirus: Here’s what to do if you can’t pay your mortgage

Sixty-one percent of Hispanics reported a job loss or pay cut in their household, compared with 38% of white adults and 41% of blacks, according to Pew.

Hispanics account for 18% of employment in the overall economy overall and 21% of employment in industries with high-risks of losing their jobs, according to a March study by Pew Research.

Similar to lower-income workers Americans, Hispanics aren’t well-equipped financially to handle the job disruptions. Only 3 in 10 have emergency savings, a similar percentage as blacks, but far lower than 5 in 10 of white adults.

The four-year degree advantage

While those without a four-year college degree fare better than lower-income adults and Hispanics, the gap between them and those with higher education is stark during the coronavirus.

Just under half of adults with some college (46%) and those with a high school diploma or less (45%) reported a job loss or pay cut. That compares with only 37% of adults with a bachelor’s degree or higher.

Read more: Coronavirus: How to find a job in a tough economy

Similarly, those with college degrees are twice as likely than workers with a high school diploma or less to have stashed away enough money to cover three months of expenses. Two-thirds of those with a four-year degree had emergency savings, versus only a third of those whose highest education level was high school, the study found.

Using the stimulus checks to pay their bills

Many Americans are getting stimulus payments up to $1,200 — plus a $500 bonus for children under 17 — to help them financially ride out job loss, reduced work hours, and other money hardships they’re facing.

Read more: Coronavirus: What banks, lenders, utilities and more are doing to help customers financially

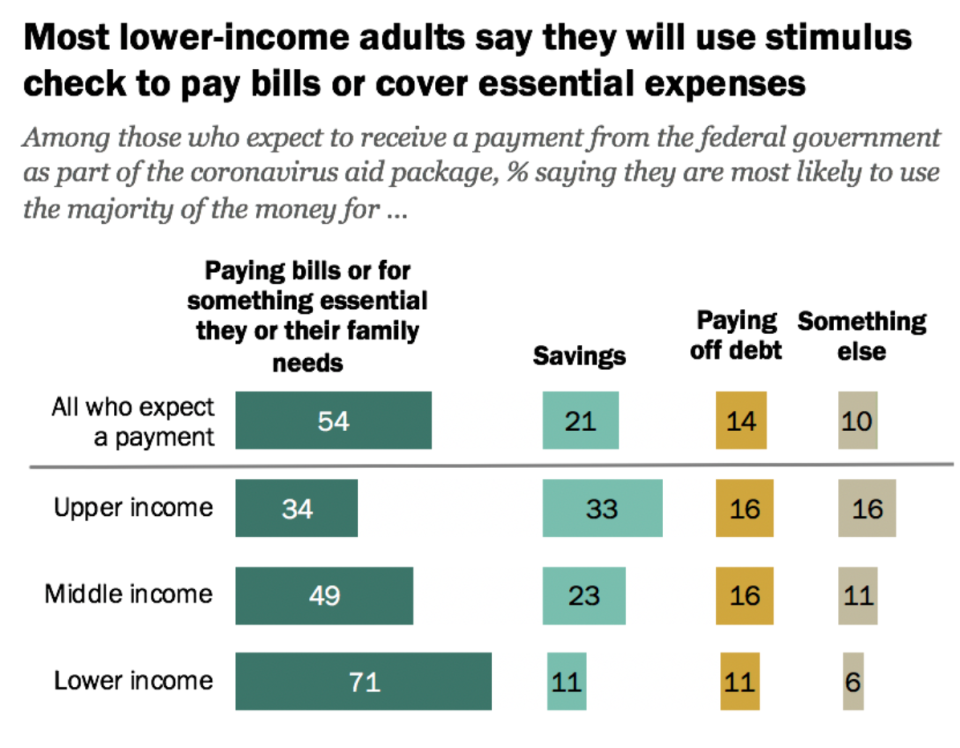

But low-income households are more than twice as likely to use these payments for paying bills or essential needs versus upper-income adults. Lower-income individuals are three times less likely to put the payment towards savings than upper-income ones.

“That's consistent with a finding that lower-income adults are less likely to have emergency funds,” Horowitz said, “Also, that they're the most likely to say that it will be difficult for them to pay bills.”

Similarly, almost two-thirds of Hispanics will use their payments for basic needs or bills, while 62% of those with a high school diploma or less put the money toward these obligations, the study found.

Worrying about health care, debt, and retirement

The near-term financial turmoil that many Americans, but especially lower-income workers, are facing is also affecting their plans for longer-term considerations.

“Lower-income people were already worried about their ability to pay bills, and the cost of health care,” Horrowitz said. “About half of lower-income adults will be worried about this every day or almost every day.”

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

Read more:

'Replaceable': Household help are left unpaid during coronavirus pandemic

Coronavirus stimulus checks: Americans vent frustrations about problems receiving the money

Read more personal finance information, news, and tips on Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.

money

money