Student loans are the biggest obstacle to home buying

Student loans are holding back home buyers — especially first-time ones — from purchasing a house, according to a new study from the National Association of Realtors (NAR).

“Student loan debt was the primary barrier for those who had trouble saving for a down payment,” the press release stated.

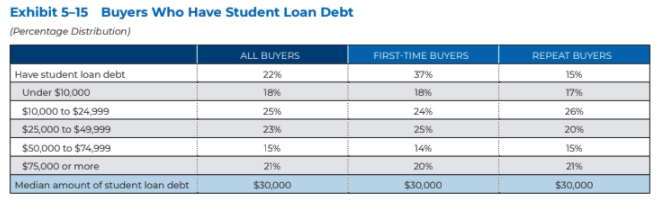

Based on the survey of 8,212 home buyers, 22% said they had student loan debt of around $30,000. Among first-time buyers, 37% had student debt.

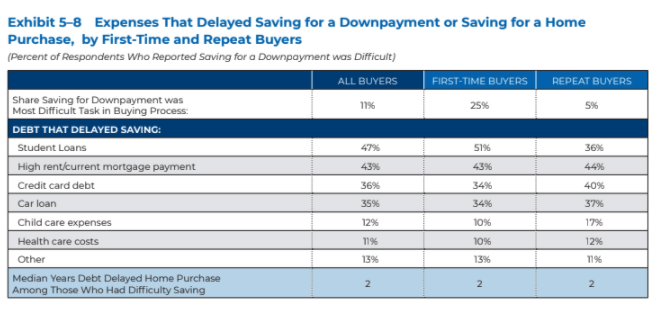

NAR said that 47% of home buyers said that their student loans had made it difficult to save for a down payment, compared with 43% citing high rent and mortgages, and 36% citing credit card debt.

For first-time buyers in particular, 51% said that student loans were holding them back from saving for their down payment.

NAR also broke down how student debt was affecting home buyers based on the composition of households. While 58% of unmarried couples found student debt to be a burden when it came to saving for their down payment, only 11% single females and 11% married couples found it to be an issue.

These findings could have implications for future U.S. economic growth.

“You do start to see longer-term negative effects on people who can’t pay off their student loans,” Federal Reserve Chairman Jerome Powell stated previously. “It hurts their credit rating, it impacts the entire half of their economic life.”

“As this goes on… it absolutely could hold back growth,” he said.

Aarthi is a reporter for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

Election 2020 'has enormous implications for student loan debt'

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money