Former Treasury Secretary Larry Summers is 'skeptical' about student loan forgiveness

Larry Summers is “skeptical” about general loan cancellation being discussed amid President-elect Joe Biden’s transition to office, arguing that debt forgiveness would benefit the rich and not the poor.

“I'd be rather skeptical of across-the-board, massive student debt reduction programs because I think many of those programs would benefit the well-off who made an investment in themselves, [and who] are earning a high return on that investment,” the former Treasury Secretary (1999-2001) and director of the National Economic Council during President Obama’s first term told Yahoo Finance Live (video above).

“I'm more worried about the Americans who don't go to college than the Americans who do,” Summers added. “So I worry that, unless it's done carefully, this could be upwards redistribution of income, rather than downwards redistribution of income.”

Marshall Steinbaum, a senior fellow at the Jain Family Institute, told Yahoo Finance that Summers’ view on debt cancellation lacked the nuance needed to solve the problem.

“Larry Summers doesn't understand the economics of student debt,” Steinbaum told Yahoo Finance. “I'm absolutely serious because like his whole reputation is like, he's the smart economist in the room... he just doesn't get it. He has misinterpreted the data.”

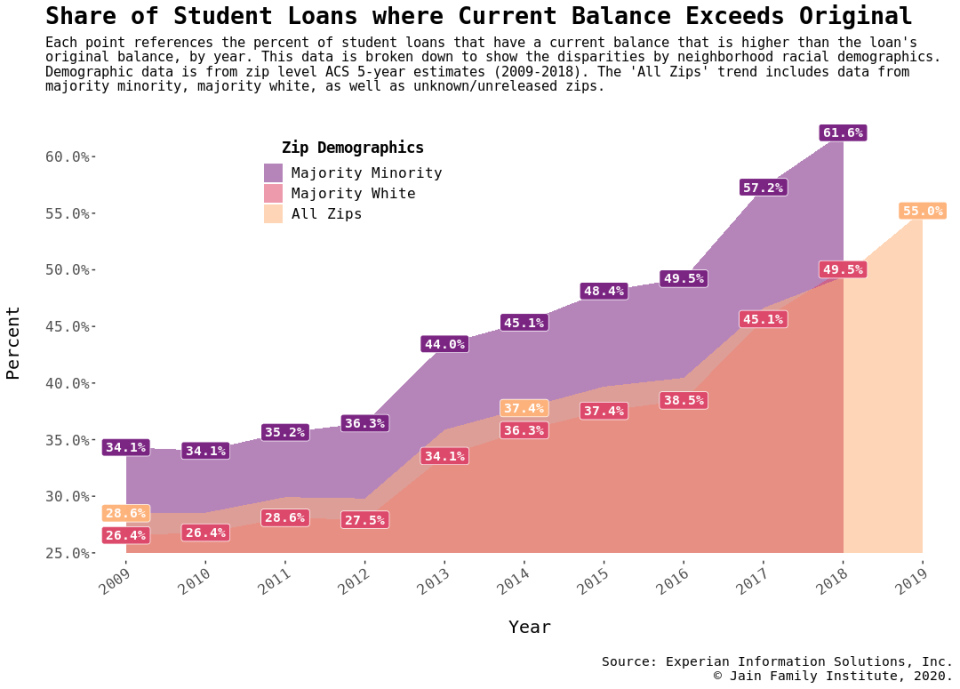

Steinbaum, who authored a new report showing that “non-repayment by student loan borrowers is getting worse over time, especially so for non-white debtors,” stressed that the student loan system “is fundamentally unsustainable” and bold action such as cancelling some student debt will be needed.

‘You're stuck in a debt overhang forever’

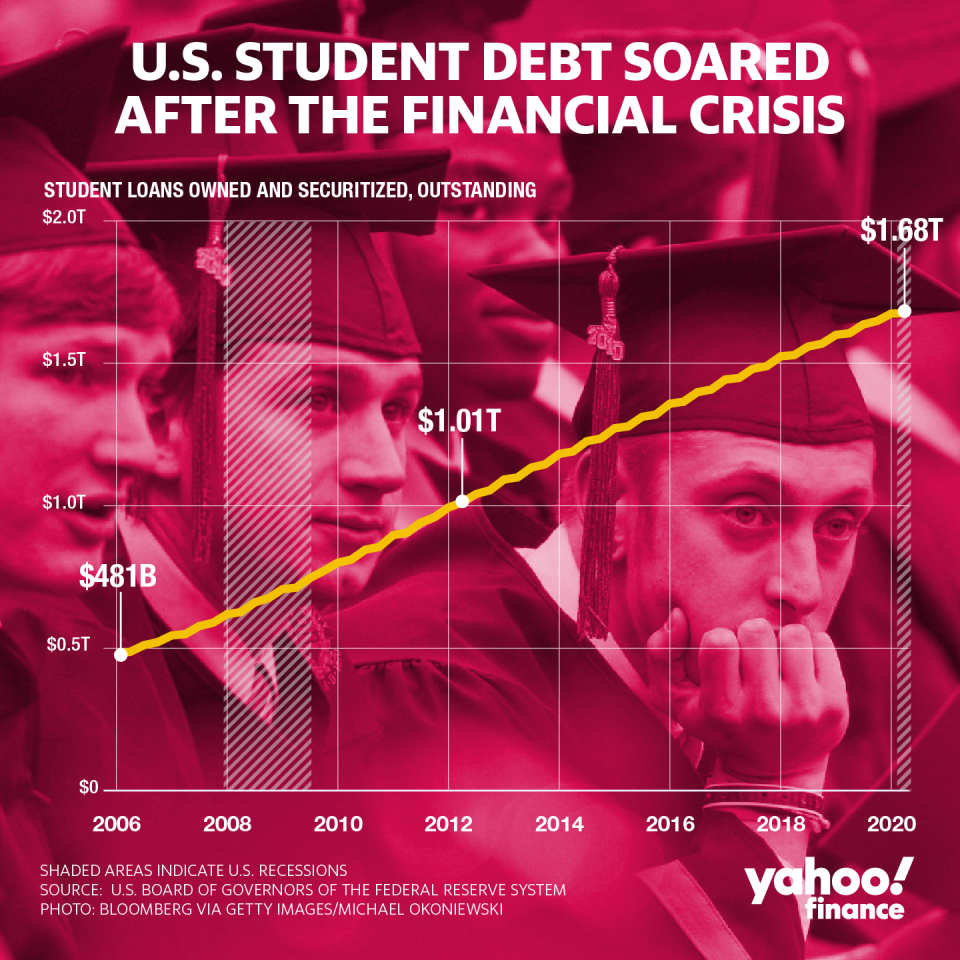

Outstanding student loan debt is at $1.55 trillion in the third quarter of 2020, up $9 billion from the last, the New York Fed reported this week. Notably, serious delinquencies have plummeted, due to the forbearance enacted and extended by President Trump and the CARES Act stimulus amid the coronavirus pandemic.

The average undergraduate student loan borrower, as of 2017, had about $7,200, which is up 10% from 1995, the Congressional Budget Office noted in a recent report. For graduate students, the average was up 47% to $25,700. Parents with PLUS loans on average borrowed about $16,600.

Summers is correct in that relatively higher income Americans hold more student debt: The highest-income 40% of households (i.e., those with incomes above $74,000) owe about 60% of all outstanding debt. At the same time, however, lower-income borrowers bear bigger repayment burdens so any debt relief would directly benefit these borrowers.

Using demographic and economic data from the American Community Survey, Steinbaum found that over half the people who had taken out student loans in 2009 have yet to pay it all off. Looking deeper into zip codes, he found a major disparity between races: While more majority-minority neighborhoods had access to higher education because of student loans, their share of student debt has been steadily rising.

“We already have a great deal of student debt outstanding that isn’t being repaid and isn’t going to be repaid,” Steinbaum wrote in the recent Jain Institute report. And while this debt pile-up isn’t going to cause a macroeconomic crisis, he added, “that just means that you're stuck in a debt overhang forever.”

Amid the circumstances, both in terms of student debt levels and the shift to a Democratic president, 236 organizations wrote a letter to Biden and Vice President-elect Kamala Harris to lobby for executive action directed at cancelling some amount of student loan debt.

President-elect Biden made a campaign proposal to erase $10,000 for roughly 37 million Americans who owe federally-backed student loan debt. Democratic leaders are calling for the President-elect to forgive $50,000 for each borrower through executive order once he assumes office.

Natalia Abrams of the advocacy organization Student Debt Crisis emphasized that there is “so much at stake,” stressing that “this is the most urgent opportunity to help the country heal from the health crisis, heal from economic harm, and heal from the history of racial disparities.”

Summers acknowledged that the system clearly needed work and that some relief will be required.

“There are clearly cases where relief is needed,” he said. “There are clearly cases where it's not possible to restructure student debt, and it should be.”

Aarthi is a reporter for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

Student debt cancellation already in focus amid President-elect Biden transition

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money