Student loan official who resigned: CFPB has been a ‘complete failure’ over the last year

The former student loan ombudsman for the Consumer Financial Protection Bureau (CFPB) believes that agency has been a “complete failure” over the last year and has “completely walked away from its mission” regarding student loan borrowers.

Seth Frotman, who resigned in protest in August 2018, expressing outrage at the then-leadership’s treatment of the nearly $1.5 trillion student loan industry, asserted that things have gotten even worse since his departure.

“I honestly don't say this lightly, but I don't know how you could look at the things that have happened over the last year … [and] under the new leadership of the bureau and not say that it is a complete failure in doing its job on behalf of student loan borrowers,” Frotman said. “The current political leadership at the CFPB has prioritized the interests of the student loan industry over the very real plight of the 44 million Americans who have student loan debt.”

The CFPB declined to comment for this story.

‘There's congressionally mandated reports that they have failed to do’

“The agency was created to stand up for consumers and to stop companies from ripping off borrowers,” added Frotman, who is now the current Executive Director of D.C.-based nonprofit Student Borrower Protection Center. “Instead, leadership has shielded student loan companies from accountability.”

Frotman’s new team highlighted a list of recent CFPB failures related to student loans, including:

In December 2017, the CFPB refused to publish findings that showed how Wells Fargo was charging college students fees that were much higher than other banks.

In February 2018, the CFPB leadership stopped its employees from alerting the Department of Education of the harm that borrowers would face because of the DOE’s attempts to place student loan servicers above state consumer protection laws.

In May 2018, the interim head of the CFPB downgraded the student loan division to the bureau’s consumer information unit.

In May 2019, the CFPB noted difficulties in obtaining information about student lenders and loan servicers from the DOE.

In August 2019, the CFPB replaced Frotman with someone who had been a former executive responsible for compliance at a student loan servicer.

Outstanding student loans currently stand at $1.48 trillion as of the second quarter this year, according to the New York Fed. About 35% of the loans in the severely derogatory balance were student loans.

“What is happening at the CFPB now, when it comes to the student loan market, is just an utter neglect of the duty that they are supposed to perform,” said Frotman. “There's congressionally mandated reports that they have failed to do, that the new director herself admitted that the Bureau is essentially being blocked from overseeing nearly a trillion dollars of student loans and they refuse to take action on their account to stand up for borrowers. … These consumers deserve a watchdog to be working on their behalf.”

‘Conflict of interest demonstrates who the Trump Administration really works for’

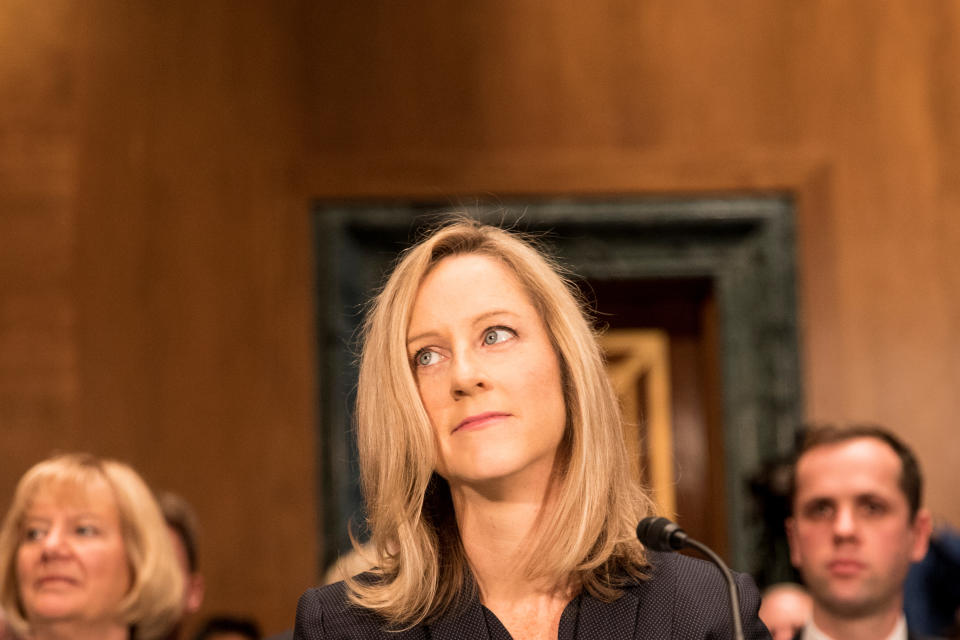

Frotman testified to Congress earlier this year and maintained the same grievances about the agency run by CFPB Director Kathy Kraninger.

Kraninger came under fire from Congress in March for not doing her part to enforce the laws that were designed to protect borrowers.

The new CFPB Student Loan Ombudsman Appointee Robert Cameron has drawn sharp criticism from the person who spearheaded the creation of the CFPB after the 2008 Financial Crisis: Senator Elizabeth Warren (D-MA).

“Student loan debt has reached crisis levels, yet the Trump Administration has turned its back on effective oversight of student loan companies out to make a buck off the backs of students,” Sen. Warren told Yahoo Finance. “It took over a year for the CFPB to hire a new student loan watchdog, and then CFPB appointed a former executive of a student loan giant accused of cheating students to do the job.”

The presidential candidate, who has proposed a large scale debt forgiveness plan, added: “This kind of conflict of interest demonstrates who the Trump Administration really works for — student loan companies, not students.”

States coming to student borrowers’ defense

There was a silver lining, according to Fortman.

While “Washington has turned its back on borrowers, this work by states, cities and other groups has never been more important,” he said.

States like Maine, for example, passed a “Student Loan Bill of Rights” to protect borrowers in June this year. California is also trying to enact the same.

Both these states follow in the footsteps of many others across the U.S., which are trying to help their constituents who are saddled with high levels of student debt.

But back in D.C., “it is crystal clear now that the Bureau has just completely walked away from its mission to stand up for those who have student debt,” Frotman said.

—

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

'Severely derogatory': U.S. student debt defaults have 'grown stunningly'

Dimon: U.S. student loan debt is ‘now starting to affect the economy’

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.

money

money