Student loan borrowers are paying a ‘secret price’ on other loans, study details

Carrying student loan debt can affect how much a consumer pays in interest for other financial products, such as mortgages and credit cards, according to a new report.

The report from the Student Borrower Protection Center (SBPC) found that “even borrowers who can afford their monthly student loan payment are paying an additional secret price on other credit products.”

Student loan deferment, forbearance, cancellation, and default: The full breakdown

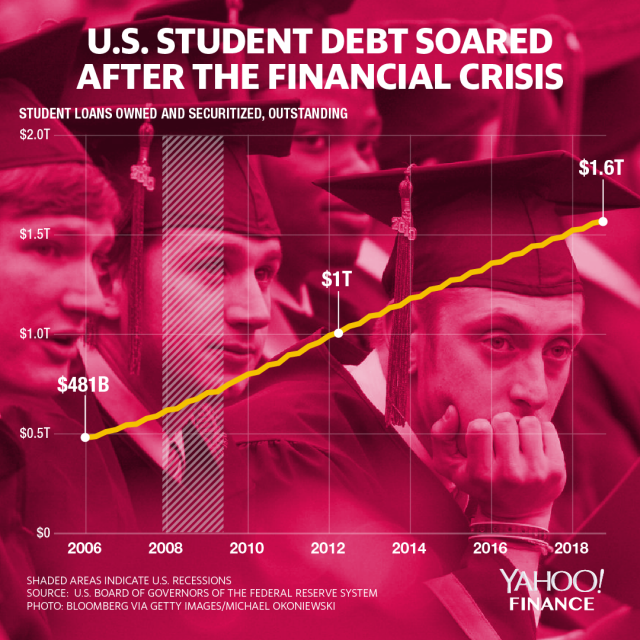

More than 44 million Americans owe $1.6 trillion in student loan debt. Some borrowers hold as much as a million dollars in debt.

The report “shows that the true cost of this [student] debt extends far beyond monthly student loan bills with borrowers forced to pay tens of thousands of dollars in extra costs when buying a house, purchasing a car, or using their credit card,” Seth Frotman, executive director of the Student Borrower Protection Center, said in a statement.

The details are particularly relevant amid the coronavirus pandemic, which has caused a nearly 15% unemployment rate and has led to many Americans to lean on their credit cards to weather financial shocks. Stimulus packages responding to the pandemic include relief for student loan borrowers.

‘Millions of student loan borrowers are charged a secret price’

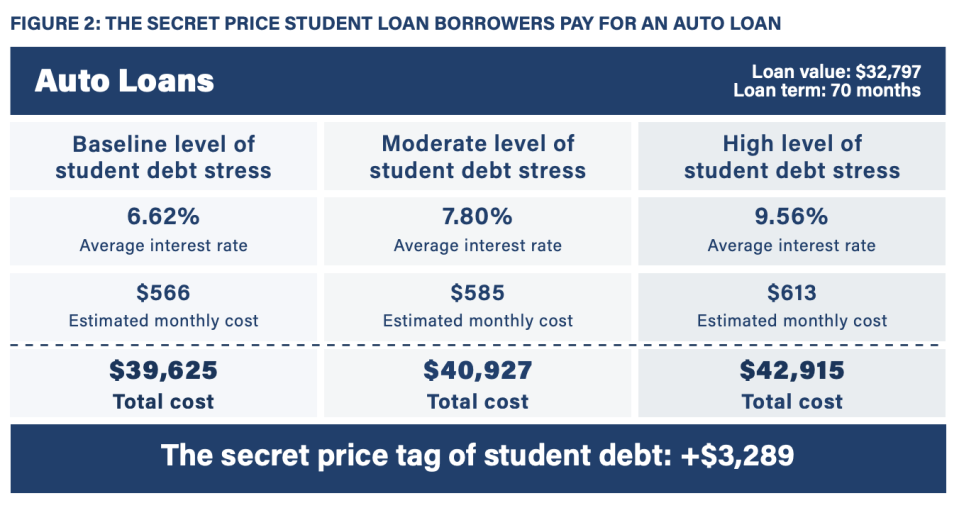

Using information gleaned from millions of consumer credit records maintained by Experian, SBPC modeled three scenarios of a student loan borrower carrying a low, medium, and high level of debt to determine how much they are charged for a separate auto loan, credit card balance, and a mortgage.

The authors found that in several circumstances, borrowers with high levels of student debt were paying additional costs for the same auto loan or mortgage as compared to another borrower with low levels of student loan debt.

For instance, a student loan borrower with a low level of burden taking out a $32,767 auto loan for 70 months would pay an interest rate of 6.62% — which comes up to $566 a month and $39,625 overall.

Another borrower taking out the same product at the same price, but holding significantly higher levels of student loan debt, would pay a 9.56% interest rate — which comes up to $613 a month and $42,915 overall.

“The difference in costs is attributable to the secret price — the interest rate premium imposed on student loan borrowers,” the report stated, later adding: “These findings suggest that millions of student loan borrowers are charged a secret price for other forms of credit.”

The same scenario similarly played out in terms of mortgage and credit card loans, the report found, noting that situations where credit products were “bundled” caused the “secret price of student debt”to be even higher.

Findings related to highly indebted borrowers “paint a stark picture,” the authors of the report stated. “Borrowers with higher levels of student debt stress, something that is already a burden, go on to face thousands of dollars of additional costs across various other forms of consumer credit.”

Student loan calculator from Cashay

‘Secret price’ can be avoided with research

Not all experts agreed with the report’s conclusion.

Debt-to-income ratios “can impact your eligibility for obtaining a loan, but your credit score determines the interest rate you'll be offered,” Credible General Manager Robert Humann told Yahoo Finance. “Just because you have a high level of student debt does not automatically mean you will pay a higher interest rate on your credit cards, or for an auto loan or mortgage.”

The impact on credit scores is more acutely felt when a borrower misses payments, Humann added.

“So there isn't really a 'secret' cost of student debt — consumers need to be aware of the amount of debt they are taking on and their ongoing obligations to paying it down,” he added.

Nevertheless, as credit scores are significantly affected by a borrower’s credit utilization ratio, “if one has significant debt, their credit score is usually adversely impacted,” Dara Duguay, CEO of Credit Builders Alliance, which partnered with SBPC on the report, stated in a statement.

And “since the credit score is such an important factor in whether one gets approved for credit, and if so, what their interest rate is, having a poor credit score will limit access to affordable credit.”

—

Aarthi is a reporter for Yahoo Finance.

Read more:

U.S. student loan interest rates plummet amid coronavirus downturn

Student loan startup offers free assistance to borrowers amid the coronavirus pandemic

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.

money

money