Prepare for a decade of low stock market returns: Morning Brief

Monday, April 27, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Elevated valuations historically signal low returns

Who knows what the near future holds for the stock market? Certainly, no one could’ve predicted this year’s market crash, which was triggered by a pandemic no one saw coming. And few could’ve seen the market surge from its March lows.

It’s because of this unpredictability of the short term that investors are better advised to think long term.

Read more: How to think about stock investing: The full breakdown

Unfortunately, some of Wall Street’s top forecasters warn that stocks at current prices amid the gloomy economic backdrop are likely to deliver lackluster average returns for years.

“For reasons that will take time for historians to assess, equities did not immediately plunge to a level proportional to the historic collapse in the economy,” Citi Private Bank’s Steve Wieting wrote on Friday.

Specifically, they blame where stock prices are now relative to earnings.

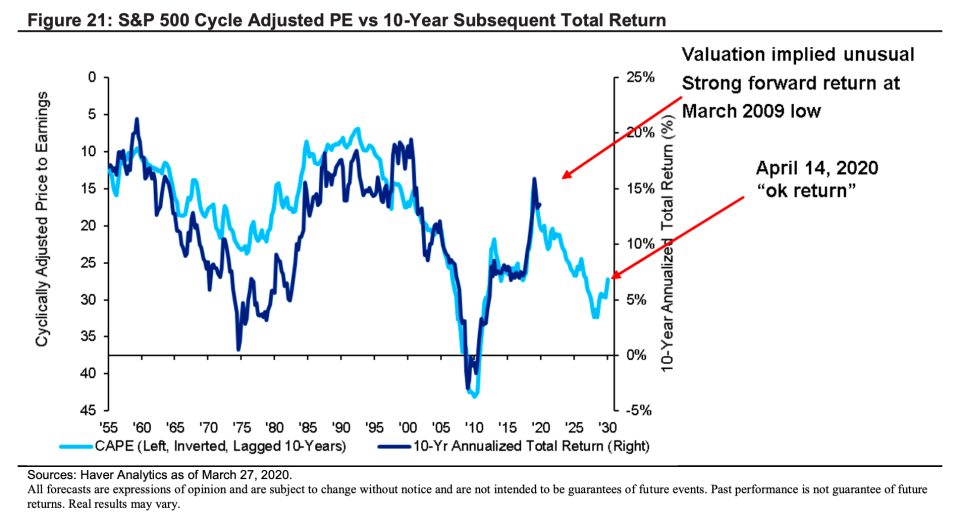

“Valuations indicate 10-yr annualized returns of 4-5%,” Bank of America’s Savita Subramanian wrote on April 16. The S&P 500 today is trading at similar levels as when she published her forecast.

“Whereas valuations are poor near-term market timing signals, valuation is almost all that matters for the long-term,” she added. “Based on regressions, today's valuations suggest S&P 500 annualized 10-yr price returns of 4%-5%. This is lower than average returns in prior decades and roughly half of the 8% annualized price return we've enjoyed since post-WWII (1947). But valuation metrics are mostly elevated relative to history, suggesting an inferior entry point vs prior years.”

Subramanian noted that this is in line with a recent San Francisco Fed study of 15 pandemics going back to the Black Death, which found economic effects tend to persist for years accompanied by below-average asset returns.

Wieting came to a similar conclusion after reviewing the cyclically-adjusted price-earnings (CAPE) ratio, a measure which was popularized by Nobel prize-winning economist Robert Shiller and is credited for predicting the dot-com bubble.

He notes that unlike the global financial crisis of 2008, the coronavirus pandemic isn’t offering a particularly attractive valuation proposition.

“Fast acting policymakers with the experience of 2008/2009 and the exogenous, largely temporary nature of the virus shock have helped,“ Wieting said. “Also, the severe weakness and double-digit returns that followed the Global Financial Crisis — with so many investors never comfortably taking equity risk — left money on the sidelines, looking for a dip to buy.”

“With neither fear nor greed vanquished for now, we believe U.S. large cap stock investors can look forward to more middling returns,” Wieting added.

At least Wieting and Subramanian see returns. The managers at GMO see annual real returns over the next seven years averaging -1.5% for large cap U.S. stocks.

Elsewhere in valuations, the ratio of the U.S. stock market capitalization to U.S. GDP — Warren Buffett once called it “probably the best single measure of where valuations stand at any given moment“ — is also elevated.

That said, history doesn’t always repeat. And for what it’s worth, Robert Shiller raised doubts about the CAPE ratio and Warren Buffett warned against considering market cap-to-GDP in a vacuum. And everyone will further tell you that low interest rates justify higher equity valuations. It’s a lot to think about.

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

Economy

10:30 a.m. ET: Dallas Fed Manufacturing Activity, April (-76.0 expected, -70.0 in March)

Top News

European stocks rise as countries discuss easing lockdowns [Yahoo Finance UK]

China's market regulator inspects Luckin Coffee [Reuters]

Deutsche Bank sets aside €500m for COVID-19 losses [Yahoo Finance UK]

Starbucks says in partnership with Sequoia Capital China for investments [Reuters]

YAHOO FINANCE HIGHLIGHTS

How hydroxychloroquine toes the line between promise and 'happy talk' in the coronavirus fight

Yale doctor: U.S. should 'have lockdown for as long as possible' amid coronavirus

Andrew Yang: Biden is 'weaker on the internet than Trump' — but the #YangGang could help

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay

money

money