Stock market news live updates: Stocks fall, oil crashes into negative territory as energy demand concerns flare

Stock tumbled on Monday, as a dramatic cratering in crude prices stoked concerns over weak demand in an oversupplied market that’s been battered by the worldwide coronavirus outbreak.

The May contract for U.S. West Texas intermediate crude oil (CL=F), which expires on Tuesday, erased its entire value — plunging below zero for the first time in history before settling at -$37.63 per barrel. The June contract for the commodity (CLM20.NYM) also sank sharply, but held above $20 per barrel Monday afternoon.

[Click here to read what’s moving markets heading in Tuesday, April 21]

Prices for Brent crude oil, the international standard, also fell Monday morning, albeit by a less extreme margin than prices for U.S. oil. Brent was down 5.27% to $26.60 per barrel.

The steep move pushed blue-chip and tech shares sharply lower. It also underscored how weak demand means oil storages are filled to the brim with crude, which is unlikely to be used in a global economy frozen in place by the COVID-19 crisis.

“With a huge surplus in crude products filling inventories on land, there is a clear benefit to those producers whom are able to put their oil out to sea,” Joshua Mahony, senior market analyst at IG, wrote in an email.

“Unfortunately, the lack of demand and landlocked nature of production in the U.S. and Canada has already started to provide negative prices across a number of crude products in North America.”

The declines extended a months-long drop for the commodity prices, which have been anchored both by fears of a supply glut and demand destruction from the outbreak.

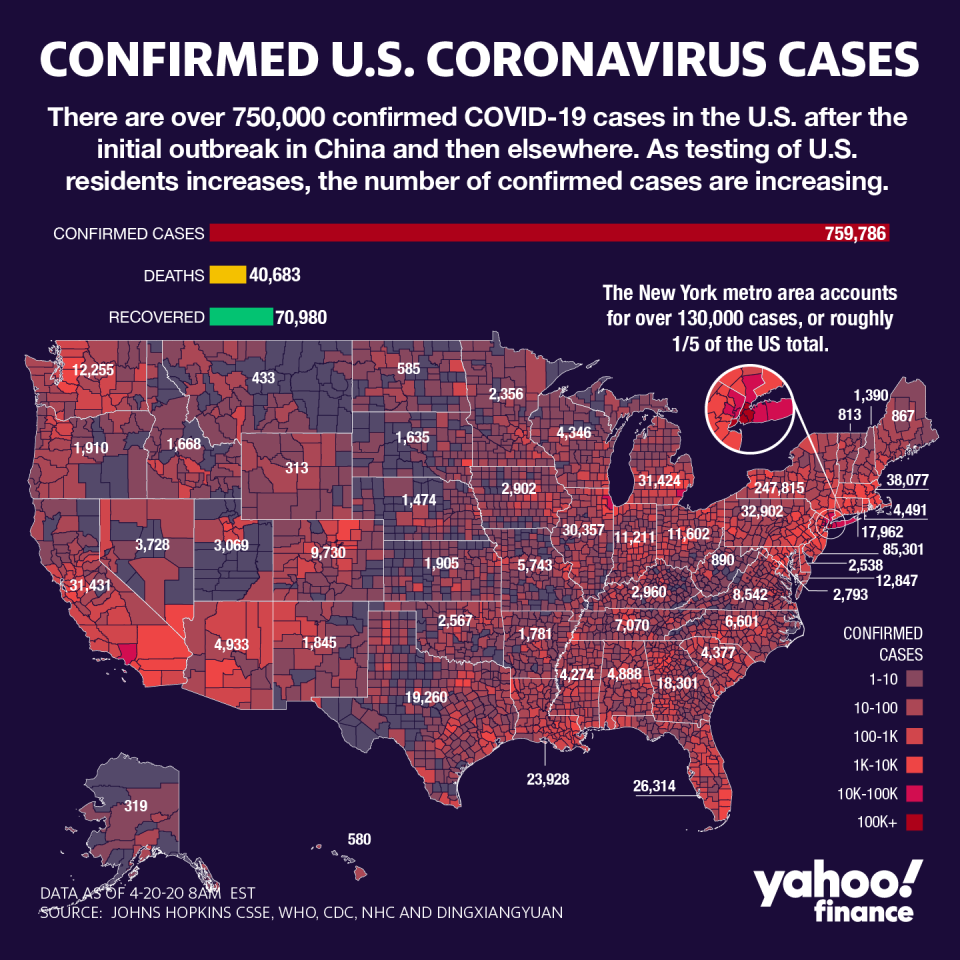

On Monday, coronavirus cases topped 2.4 million globally, and the death toll rose above 166,000, according to Johns Hopkins data. U.S. confirmed cases totaled more than 761,000, but tentative signs suggest the new cases are leveling off, especially in hard-hit New York.

Last week, the Trump administration outlined a three-phase plan for states to each gradually bring businesses and other daily operations halted during the pandemic back online. Still, individual state officials have been hesitant about announcing a near-term easing of social distancing standards in absence of widespread testing or viable treatment or vaccine. Northeast states led by New York last week extended social distancing measures to at least May 15.

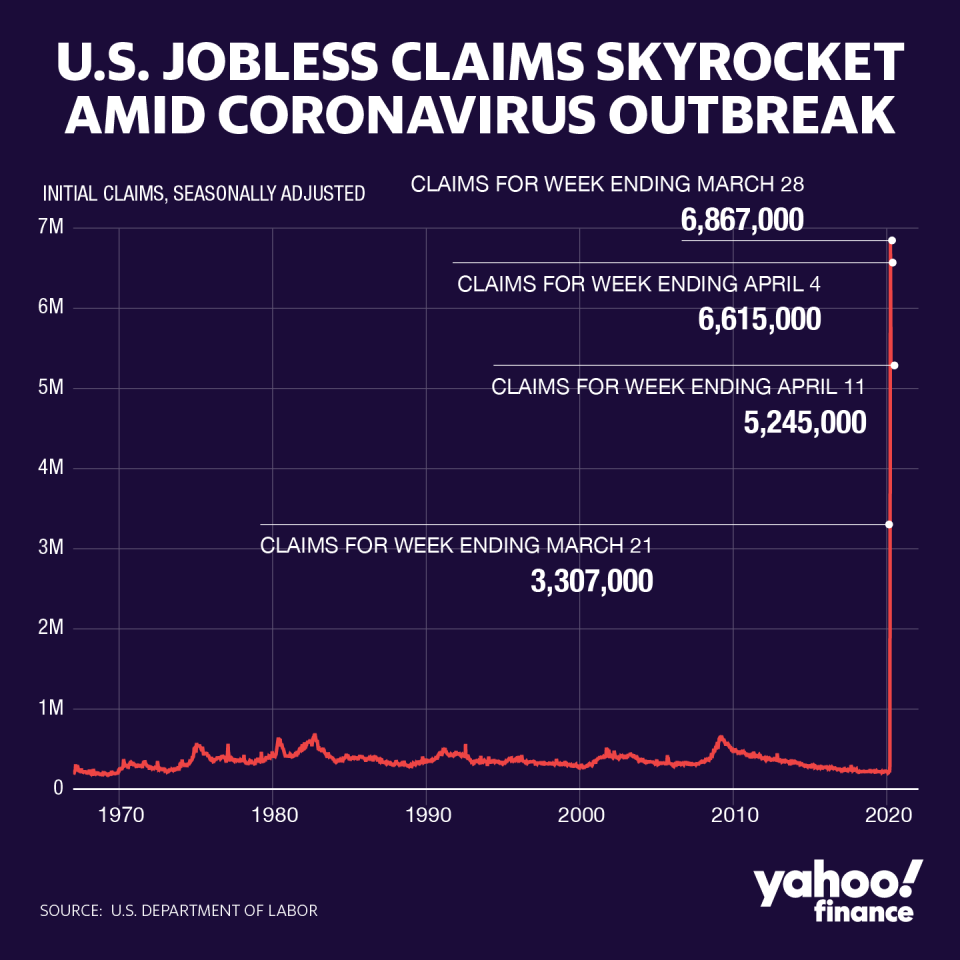

Distancing measures have helped keep new coronavirus cases in check but also contributed to broad economic stress in the U.S., triggering a staggering 22 million individuals to file for unemployment insurance over the past four weeks alone. Even when distancing begins to let up, many economists warn recovering these losses will take time.

“A double-digit rebound in GDP growth in the third quarter still seems like a decent bet, but it won't recover all the lost ground,” Ian Shepherdson, chief economist for Pantheon Macroeconomics, wrote in a note Sunday. Shepherdson’s anticipation is for a 30% annualized drop in GDP in the second quarter, a margin about in-line with many other economists’ grim outlooks for the quarter.

“That can't happen if, for example, restaurants have half the seating density than in the pre-virus era, cinemas can sell only one third of their seats, and airlines have to leave the middle seat empty,” he added. “No matter how much fiscal stimulus Congress pumps in—and more is coming—earnings across wide swathes of the economy will be crushed for an extended period.”

U.S. policymakers have been working on providing further relief to the small businesses hit hardest by the coronavirus. The PPP first passed in Congress’s $2.2 trillion stimulus package late last month ran out of funds in less than two weeks.

—

4:02 p.m. ET: Dow closes 592 points lower after oil prices plunge below zero

Here’s where the major indices had settled as of 4:02 p.m. ET:

S&P 500 (^GSPC): -51.40 (-1.79%) to 2,823.16

Dow (^DJI): -592.05 (-2.44%) to 23,650.44

Nasdaq (^IXIC): -89.41 (-1.03%) to 8,560.73

Crude (CL=F): -$53.7600 (-294.25%) to $-35.4900 a barrel

Gold (GC=F): +$9.70 (+0.57%) to $1,708.50 per ounce

10-year Treasury (^TNX): -2.8 bps to yield 0.6260%

—

2:42 p.m. ET: Crude oil futures crash into negative territory, settling at -$37.63 per barrel

May West Texas intermediate crude oil futures (CL=F) sank below zero for the first time in history, erasing all value as traders sold off the commodity, which has been hit by both extreme supply and demand concerns during the coronavirus pandemic.

The May contract for West Texas intermediate crude oil, set to expire tomorrow, settled at -$37.63 per barrel.

The June contract for West Texas intermediate – the more actively traded contract – fell 18% to $20.44 per barrel as of 2:34 p.m. ET.

—

1:45 p.m. ET: Crude oil drops to just over $1 per barrel as energy slump accelerates

West Texas intermediate crude oil May futures sank further Monday afternoon to just $1.19 per barrel, representing the lowest level on record by a wide margin, and a one-day drop of 93.5%.

—

12:20 p.m. ET: S&P 500, Dow negative while Nasdaq turns positive

The S&P 500 and Dow held in negative territory Monday afternoon as a sell-off in oil prices spooked investors. Advances in shares of Amazon and Advanced Micro Devices helped buoy the tech-heavy Nasdaq into positive territory.

Here were the main moves in markets, as of 12:23 p.m. ET:

S&P 500 (^GSPC): -14.17 points (-0.49%) to 2,860.39

Dow (^DJI): -216.46 points (-0.89%) to 24,026.03

Nasdaq (^IXIC): +17.54 points (+0.20%) to 8,667.56

Crude (CL=F): -$9.00 (-49.26%) to $9.27 a barrel

Gold (GC=F): +$11.90 (+0.07%) to $1,701.10 per ounce

10-year Treasury (^TNX): -1.9 bps to yield 0.637%

—

—

12:05 p.m. ET: ‘The chance for a correction has increased,’ Morgan Stanley analysts say

On the heels of an 11% rise for the month to date, stocks are at risk of correcting, according to Morgan Stanley analyst Michael Wilson. Lingering uncertainty from corporations about the outlook as the coronavirus outbreak continues will likely contribute to renewed declines, Michael Wilson said in a note Monday.

With many risk assets now overbought, we would not be surprised if a correction in U.S. equities begins soon. In addition to what is likely to be a partisan debate on more fiscal stimulus, we expect more bad news from companies on earnings results as well as their outlooks for 2020 ... While there is little doubt [2021] will be better than 2020 in our view, it’s also hard to have much precision or confidence about the magnitude of the snap back we should expect.

In short, ‘high expectation’ stocks are the most vulnerable to a near term correction. In S&P 500 terms, we believe the index will find very strong support at the 200 week moving average, or 2,650. Likewise, should markets continue to look through the near term bad news, it should face resistance at the 50 week moving average, or 2,995.

—

10:58 a.m. ET: Crude oil futures slide further, hitting the lowest level since 1986

May futures for West Texas intermediate crude oil dropped 40.78% to $10.82 per barrel as of 10:58 a.m. ET, tumbling to the lowest level in more than three decades. If prices fall below $9.75 per barrel, they will have reached their lowest level on record, based on crude oil futures data spanning back to 1983.

Brent crude oil prices fell 5.13% to $26.64 per barrel.

Speaking to Yahoo Finance on Monday, veteran oil trader John Caruso said he believes crude is bottoming out, and that there’s a “100% premium” priced into the June contract. However, he added that with U.S. crude this cheap, it’s going to be “very difficult” for a lot of domestic drillers to survive the current rout.

—

9:33 a.m. ET: Stocks open lower amid oil price slump

Here were the main moves in markets, as of 9:33 a.m. ET:

S&P 500 (^GSPC): -41.22 (-1.43%) to 2,833.34

Dow (^DJI): -451.39 points (-1.86%) to 23,791.10

Nasdaq (^IXIC): -70.20 points (-0.81%) to 8,579.94

Crude (CL=F): -$7.28 (-39.85%) to $10.99 a barrel

Gold (GC=F): -$0.60 (-0,04%) to $1,698.20 per ounce

10-year Treasury (^TNX): -2.7 bps to yield 0.629%

—

9:00 a.m. ET: Chicago Fed data adds to market’s glum mood

The Chicago Federal Reserve published its index of the national economy, which dived to levels consistent with recession as the pandemic’s effects took hold. That reading took a complete 180-degree turn from growth that was above trend in the weeks prior.

—

7:49 a.m. ET: Halliburton slashes capital spending, projects declines in North America business

Halliburton (HAL) on Monday joined peer oilfield operators in slashing capital spending plans for the year to rein in costs as oil prices slump. The company expects capital spending to be down 56% to $800 million in 2020.

For the fiscal first quarter, Halliburton delivered adjusted earnings per share from continuing operations of 31 cents on revenue of $5.04 billion, with the latter down 12% over last year. The adjusted EPS figure excludes $1.1 billion in impairment and other charges during the quarter. Net losses were $1.2 billion, versus net income of $152 million in the same quarter last year.

Halliburton said it “cannot reasonably estimate the period of time that the COVID-19 pandemic and related market conditions will persist, the extent of the impact they will have on the Company’s business, liquidity, consolidated results of operations and consolidated financial condition, or the pace of any subsequent recovery,” according to a statement. “For the remainder of 2020, the Company expects a further decline in revenue and profitability, particularly in North America.”

Shares of Halliburton fell 7.7% to $7.00 per share as of 7:49 a.m. ET Monday. The stock was down 69% for the year to date through Friday’s close.

—

7:08 a.m. ET Monday: Stock futures add to losses as oil prices slide

Here were the main moves in markets, as of 7:08 a.m. ET Monday:

S&P 500 futures (ES=F): down 43.75 points, or -1.56% to 2,825.25

Dow futures (YM=F): down 395 points, or -1.64% to 23,764.00

Nasdaq futures (NQ=F): down 86.5 points, or -0.98% to 8,722.50

Crude (CL=F): -$5.17 (-28.30%) to $13.10 a barrel

Gold (GC=F): -$3.20 (-0.19%) to $1,695.60 per ounce

10-year Treasury (^TNX): -2.7 bps to yield 0.629%

—

6:06 p.m. ET Sunday: Stock futures open lower

Here were the main moves at the start of the overnight session for U.S. equity futures, as of 6:06 p.m. ET Sunday:

S&P 500 futures (ES=F): down 15.6 points, or -0.54% to 2,854.50

Dow futures (YM=F): down 142 points, or -0.59% to 24,017.00

Nasdaq futures (NQ=F): down 37 points, or -0.42% to 8,772.00

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay

money

money