States struggling with highest credit card debt? Trump’s South

Nine out of the top 10 states with the highest credit card debt burden in the nation share two things in common: they’re in the South and they voted for Donald Trump in 2016.

The correlation between having voted for Trump and facing the country’s highest credit card debt burden extends to 22 of the top 25 states with the highest debt burdens, according to CreditCards.com.

By contrast, 17 out of the top 25 states with the lowest credit card debt burden voted for Hillary Clinton in 2016, including Massachusetts, New Hampshire, and California.

CreditCards.com industry analyst Ted Rossman points to economic conditions in the South as a leading factor as to why that region of the country is seeing higher levels of debt.

“I think that really illustrates a lot of what we saw in the last election [in terms of] why [Trump’s] message appealed to a lot of people in these Midwestern mostly and Southern states,” says Rossman. “These are places where incomes, generally speaking, are lower, unemployment rates are generally higher. These are the kind of people that have been left behind by the economic recovery... It cuts across geographic lines.”

During Trump’s administration, personal income in the South has grown by 1.7% a year, trailing Clinton-voting Northeastern states, where income grew by 2% over the same period. And in 2018, personal income in Southern states was lower than the rest of the country. The average income in Texas was $49,161; $45,834 in North Carolina; and $37,994 in Mississippi, according to the Bureau of Economic Analysis.

The unemployment rates of southern states with the highest credit card debt are also higher than the national 3.6% rate – except for Arkansas which has a 3.5% unemployment rate. The rate for Louisiana was 4.5% in October; West Virginia 4.8%; and Mississippi 5.5%.

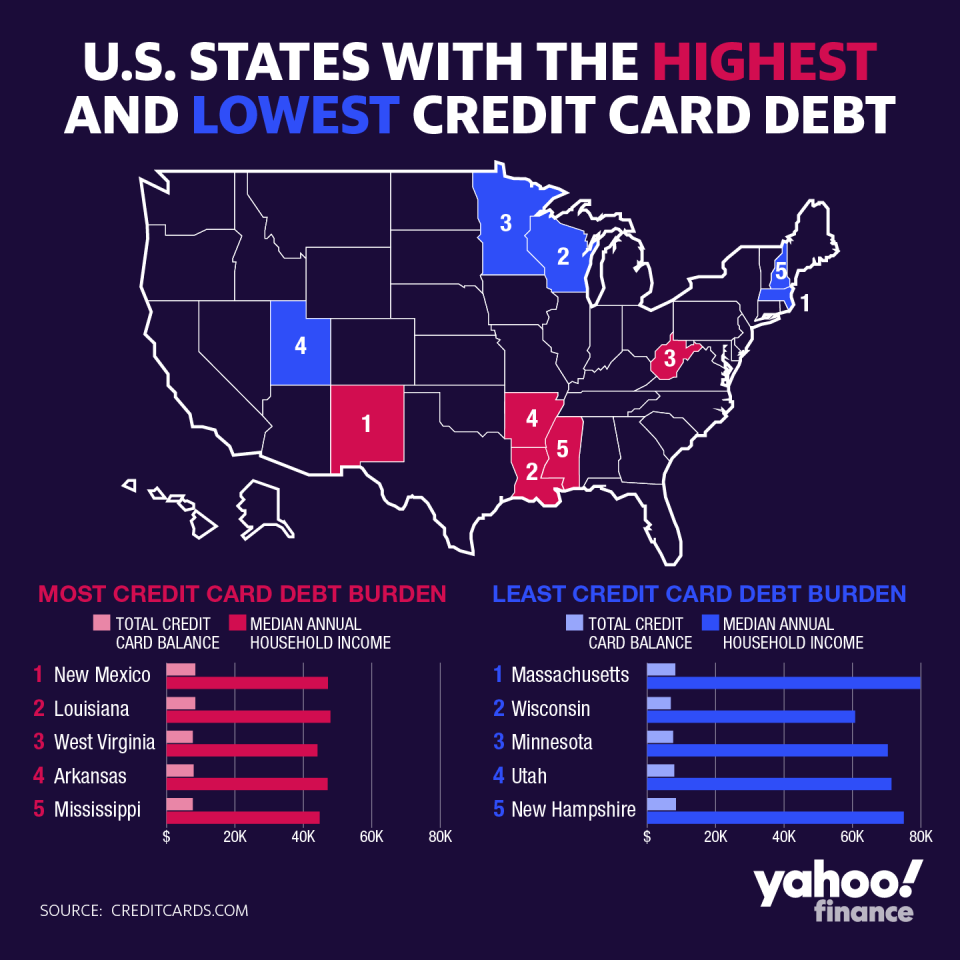

New Mexico has the highest debt burden, according to Creditcards.com. Total credit card balances for a typical resident and median annual household income were factored in to determine how many months it would take someone in that state to pay off the debt with an average APR of 21.10%.

Using the recommended strategy of setting aside 15% of earnings to pay off debt, it would take a typical New Mexico resident earning $47,169 annually 17 months to pay off a $8,356 credit card balance. The total interest paid would be $1,339.

While New Mexico was a blue state in 2016, the next nine out of the top 10 states with the most credit debt debt went for Trump, including Louisiana, West Virginia, Arkansas, and Mississippi. Louisiana has a total credit card balance of $8,364 with a median annual household income of $47,905. Arkansas’ credit card balance was $7,906, with a median annual household income of $47,062.

Trump reelection chances

Record low unemployment and a record breaking stock market have some feeling confident that Trump will get reelected in 2020. Though Trump’s national job approval rating hovers below 50%, support in key swing states gives him a better than 50% chance of winning more electoral college votes than he did back in 2016, according to Eurasia Group analysis.

With impeachment likely in the House, Trump’s reelection is to a large degree contingent on the state of the economy. There are signs pointing to an economic slowdown, with GDP growth falling from 3.1% in the first quarter to 2.1% in the third quarter.

“Generally speaking if you look at a strong economy, the incumbent usually wins, but this isn’t a traditional time. There’s a lot of polarization,” Rossman says. “This president’s approval rating is much lower than you would typically see for someone presiding over the lowest unemployment rate in 50 years.”

More from Sibile:

Here’s how Bloomberg may be saving money by running for president

Why a Trump win would be worse for markets than a Warren win

Trump’s claims on income growth challenged by data, ‘wage trap’

How millennials differ from other generations in holiday shopping

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

money

money