More state funding for colleges improves graduation rates and debt repayment, study finds

Spending $1,000 more per college student would boost graduation rates and improve student loan repayment, a new report by the New York Fed found.

For those in four-year programs, the increase in funding shortens the time they take to get at least a bachelor’s degree by the time they’re 25. They are less likely to take on student loans, and even when they do, they take out less. Repayment is also affected: Students are less likely to default on their debt.

Students in two-year programs see even more benefit from increased state funding: They’re more likely to pursue a four-year degree, more likely to obtain at least a bachelor’s degree, and are less likely to default on their student loans.

“Our results underscore the importance of state support for higher education in driving student debt outcomes and the long-run returns to postsecondary investments that students experience,” the authors stated in the report, which drew on Equifax consumer credit records and enrollment and attainment data from the National Student Clearinghouse between 1986 to 2016.

Lower funding has ‘consequences down the line’

Higher education experts hailed the findings as key evidence that demonstrates the need for increased funding for colleges and universities.

"When states invest more in higher education, students respond,” Michael Itzkowitz, a senior fellow at Third Way, told Yahoo Money.

Douglas Webber, an assistant professor of economics at Temple University, who studies the impact of funding on higher education, said the Fed’s study is “a big, a big leap forward in terms of what we know about how school spending [affects] students.”

The report is also “especially important right now,” he told Yahoo Money, as “many states are getting ready to drastically pull back their support of public schools due to the pandemic. ... This report is evidence that that's going to have consequences down the line.”

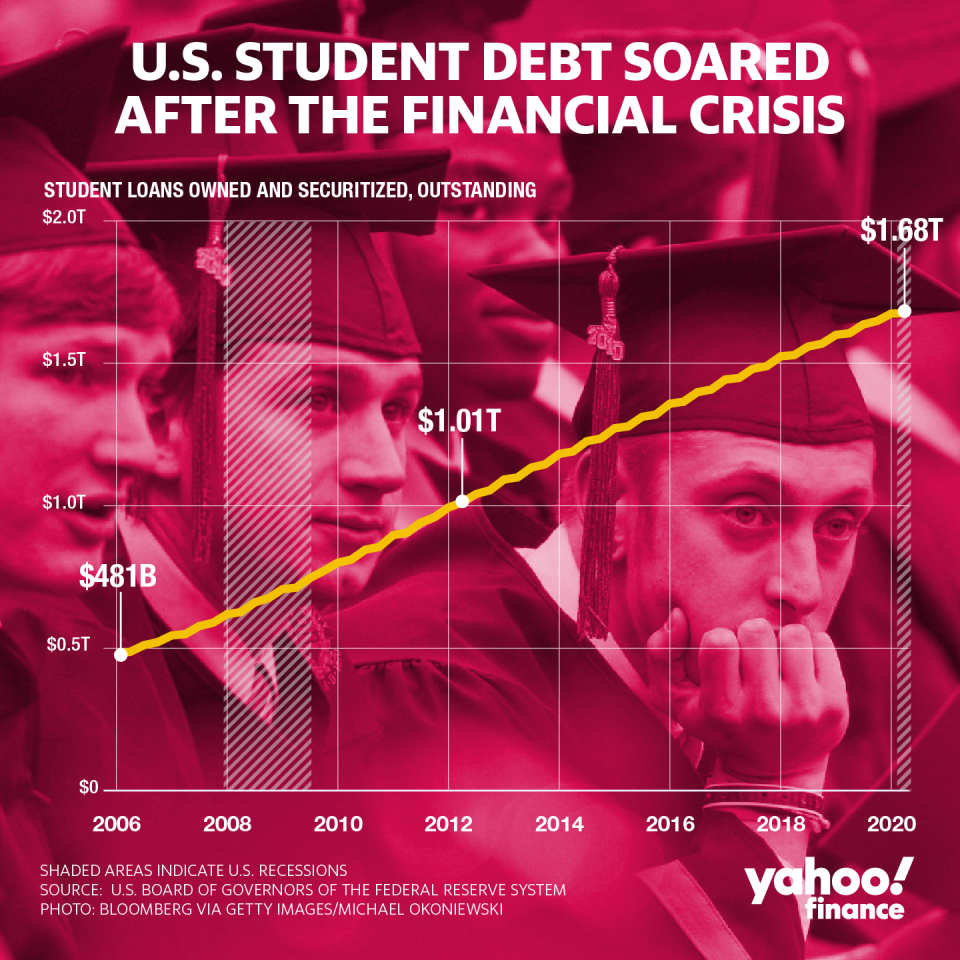

Funding for higher education has fallen over the years: Between 2008 and 2018, state spending at two- and four-year public colleges across the country have decreased by $1,220 per student — around 13%, the Center on Budget and Policy Priorities found.

Webber’s previous research has found that higher education’s funding is often on the chopping block when policymakers review their priorities.

Specifically, over the past 30 years, “state Medicaid spending is the single biggest contributor to the decline in higher-education funding at the state and local level,” Webber stated in a separate report.

‘More appropriations upfront is really a no-brainer’

A $1,000 increase in spending per student would represent a 11% hike to the 2019 national average of $8,196, based on data from the State Higher Education Executive Officers Association.

That increase in spending per student is likely to have a longer-term domino effect, the authors at the Fed stated.

For instance, students end up carrying lower debt loads and are more likely to own cars, have homes at lower debt levels, and have higher credit scores. Their neighborhoods also see an increase in annual gross income by almost $3,400 over time, based on a $1,000 increase in funding per student.

“The effects are even stronger,” for those at two-year schools, Itzkowitz noted, as students “are more likely to earn a credential, pursue higher degrees, pay down their educational debt, and obtain homeownership in later years.”

“If states want a more career-ready workforce that will ultimately invest more in their local economy,” Itzkowitz said, “providing more appropriations upfront is really a no-brainer.”

—

Aarthi is a reporter for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

Student loans in America are 'a federal government problem,' expert explains

Warren and Schumer urge student debt cancellation of up to $50,000 for all federal borrowers

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money