How one startup is helping student loan borrowers navigate the coronavirus

The coronavirus has disrupted the work life for many in the U.S., including student loan borrowers trying to pay back their college debt. A Washington, D.C., start-up wants to help them navigate the crisis.

Savi on Wednesday launched a new online tool that helps borrowers with federal loans who are affected by the COVID-19 pandemic apply quickly or an income-driven repayment plan, forbearance, or other options. In just under 15 minutes, the tool determines a borrower’s options and helps them fill the form out correctly.

It comes as the Trump administration has responded to the crisis by waiving interest on student loans, and New York state has gone further and paused collection for debts owed to the state.

“This is designed to help the people who are being impacted by this crisis or losing their job, having their hours cut,” Aaron Smith, cofounder of Savi, told Yahoo Finance. “There's a lot of uncertainty and anxiety right now that people are facing, and that has always been the case when it comes to student loans … That's why we're here to relieve some of that anxiety.

The tool is supported by the National Education Association Member Benefits, Service Employees International Union Member Benefits, the Association of Young Americans, Student Voice, and the National Housing Resource Center. Student Debt Crisis was also a key partner for the company on this effort.

Smith said that Savi has worked with over 25,000 student loan borrowers, and helped them get back over $100 million in forgiveness through various programs.

While the company traditionally works with companies, offering their services to human resource departments, it’s making this service “as widely available as possible” due to the pandemic, Smith said.

‘Options for borrowers’

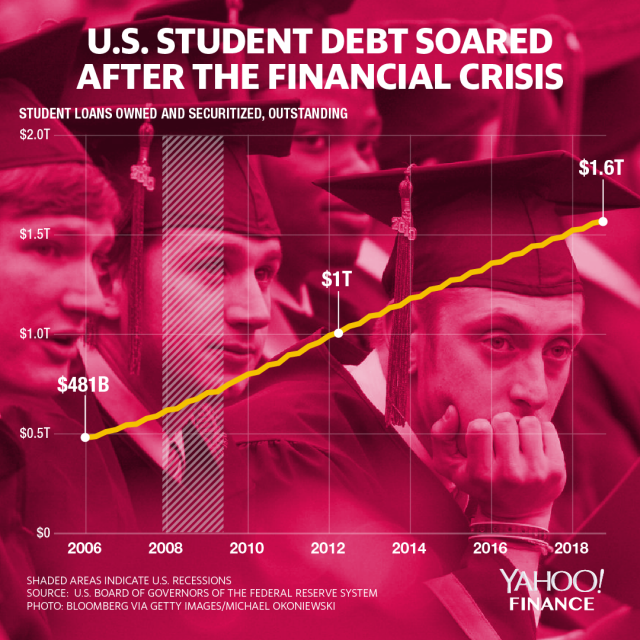

There are 45 million borrowers who owe $1.51 trillion in student debt at the end of 2019, according to the New York Fed.

For many borrowers, the reduced hours due to the coronavirus crisis could significantly affect their finances. The company’s cofounders hope to eliminate the headache of going through paperwork to get relief.

“Teachers right now have a lot of uncertainty about when they're even going to be going back,” Tobin Van Ostern, a Savi cofounder, said, referring to the many school shutdowns across the country. “Are they going back in a few weeks, are they not going back to the school year?”

“So if their income has been impacted, even if they don't know how long that's going to last, they can still use this tool to drop that payment down,” Van Ostern said.

He added that those on the Public Service Loan Forgiveness program can still make monthly payments, even if they’re facing a shortfall in income.

“Even if you're eligible for a zero-dollar payment, the government will still count those towards your public service credits,” he said. “That's a key difference with doing something like forbearance, where you can also not have a monthly payment, but you will not accumulate Public Service Loan Forgiveness credits. So for people in that situation, this is definitely the route to go.”

‘Nothing a borrower needs to do here’

The timing of Savi’s new online tool is fortuitous. Student loan servicers are scrambling to put their systems in place on the back end, responding to the Trump administration’s interest waiver directive.

"It's been a complicated process. We've been having conversations with the Department of Education,” Scott Buchanan, executive director of the Student Loan Servicing Alliance, which represents student loan servicers, told Yahoo Finance. “We've been communicating regularly."

Buchanan stressed that ultimately, there’s no action that needed to be taken on part of the borrowers.

"There's nothing a borrower needs to do here... the work needs to be done on the back end,” Buchanan said. "They will not see it yet... there are a lot of systems that need to be changed... before a borrower sees it."

Buchanan said that student loan servicers’ call centers are still open and active, but that could change depending on work-from-home requirements from state and local governments. He also stressed that all services remain available online such as making payments or requesting new payment plans.

But if borrowers are looking for immediate responses, Savi can help, the founders said.

“I'm sure the servicers are inundated with questions right now,” Van Ostern said. So instead of holding on the phone for a rep, the Savi tool can automate the process.

“They can go to the website that we've put together,” Van Ostern said, “just answer a few questions and we'll actually generate that paperwork and submit it to the servicer.”

Aarthi is a writer for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

Coronavirus update: New York suspends debt collection for medical, student loans

New startup aims to help student loan borrowers declare bankruptcy

Student loan servicer appeals landmark $220,000 bankruptcy ruling

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money