Sociedad Quimica (SQM) Q3 Earnings and Sales Beat Estimates

Sociedad Quimica y Minera de Chile S.A. SQM recorded a profit of $1,099.9 million or $3.85 per share for third-quarter 2022, up from $106.1 million 37 cents in the year-ago quarter. Earnings per share for the reported quarter beat the Zacks Consensus Estimate of $3.40.

The company registered revenues of $2,958.3 million for the quarter, up more than fourfold year over year. It surpassed the Zacks Consensus Estimate of $2,827.4 million. The company gained from higher in lithium prices and strong sales volumes in the reported quarter.

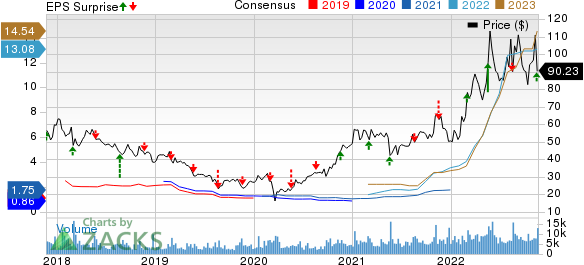

Sociedad Quimica y Minera S.A. Price, Consensus and EPS Surprise

Sociedad Quimica y Minera S.A. price-consensus-eps-surprise-chart | Sociedad Quimica y Minera S.A. Quote

Segment Highlights

Revenues from the Lithium and Derivatives segment surged more than twelvefold year over year to $2,334.9 million in the reported quarter. The upside was driven by significantly higher prices and volumes.

The Specialty Plant Nutrients ("SPN") segment raked in revenues of $292.5 million, up around 28% year over year. The upside was driven by higher prices.

Revenues from the Iodine and Derivatives unit came in at $215.1 million, up around 98% year over year. The segment benefited from higher sales volumes as well as higher average prices.

Revenues from the Potassium Chloride and Potassium Sulfate business fell roughly 32% year over year to $60.2 million. Sales were impacted by weaker prices in the potassium chloride market during the quarter.

The Industrial Chemicals unit recorded sales of $45.2 million, up around 12% year over year, aided by higher average prices.

Financials

The company’s cash and cash equivalents were $3,506.2 million at the end of the quarter, up around 88% on a year-over-year basis. Long-term debt was $2,195.5 million, down around 15% year over year.

Outlook

Moving ahead, the company envisions lithium demand to grow at least 40% in 2022 factoring in strong electric vehicles sales in China. It expects sales volumes to be more than 150,000 metric tons this year. The company also expects the high pricing environment to continue for the balance of 2022 and into 2023.

In SPN, the company expects lower demand and additional supply from China will pressure sale volumes. As such, it expects sales volumes to be significant lower year over year in 2022.

In Iodine and Derivatives, the company expects demand growth to reach roughly 2-3% in 2022. It also anticipates sales volumes to reach more than 12,500 metric tons this year.

For the potassium chloride business, SQM envisions the downward price movement to continue in the fourth quarter and sees sale volumes to be roughly 500,000 metric tons in 2022.

Price Performance

Shares of Sociedad Quimica are up 34.4% over a year compared with the industry’s rise of 18.3%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Sociedad Quimica currently sports a Zacks Rank #1 (Strong Buy).

Better-ranked stocks worth considering in the basic materials space include Commercial Metals Company CMC, Ashland Inc. ASH and Reliance Steel & Aluminum Co. RS.

Commercial Metals currently carries a Zacks Rank #1. The Zacks Consensus Estimate for CMC's current-year earnings has been revised 4.1% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Commercial Metals’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 19.7%, on average. CMC has gained around 31% in a year.

Ashland has a projected earnings growth rate of 8.9% for the current fiscal year. The Zacks Consensus Estimate for ASH’s current fiscal-year earnings has been revised 3.5% upward in the past 60 days.

Ashland has a trailing four-quarter earnings surprise of roughly 4.3%. ASH has gained roughly 5% in a year. The company currently carries a Zacks Rank #2 (Buy).

Reliance Steel, currently carrying a Zacks Rank #2, has a projected earnings growth rate of 29.7% for the current year. The Zacks Consensus Estimate for RS's current-year earnings has been revised 0.1% upward in the past 60 days.

Reliance Steel’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 13.6%, on average. RS has gained around 26% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

Ashland Inc. (ASH) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

money

money