America's Social Security crisis is getting worse amid the coronavirus pandemic

Experts are warning that the economic effect of 55 million Americans filing for jobless claims and other issue amid the coronavirus pandemic will make the country’s Social Security crisis even worse.

The Old-Age and Survivors Insurance Trust Fund, which funds Social Security benefits, could deplete sooner than the projected 2035 date as fewer people pay into the system and the U.S. dollar continues to weaken.

“The coronavirus lockdown and current engineered artificial depression has made the Social Security system to be impaired as early as 2032,” Peter Earle, an economist at the American Institute for Economic Research, a non-profit academic think tank, told Yahoo Money. “Changes are going to have to be made, whether it’s lower benefits for recipients or different qualifications, such as a higher age to qualify.”

Read more: Retirement planning: Everything you need to know

A third of Americans depend on Social Security benefits for retirement, according to statistics from the Social Security Administration, with the average benefit hovering around $1,500.

The current economic situation, however, could affect how much money a person receives down the line.

“You don’t want millions of people to think: ‘I was going to get $1,500 a month and now I’m going to get $1,350,’” Dean Baker, senior economist at the Center for Economic and Policy Research, told Yahoo Money. “People [need] to have some degree of certainty about what they would look to get.”

‘It’s a game of musical chairs’

Today, workers pay 6.2% of their taxable earnings up to $137,700 into the system. But as of 2035 onwards, beneficiaries who’ve consistently paid this amount are expected to receive only 76% of their scheduled benefits, according to the SSA.

Economists have said it’s unlikely that the government will have a reasonable solution anytime soon.

“This isn’t helped by the fact that traditionally Social Security has been a third rail issue where people who seek public office don’t have an incentive to attack this issue,” Earle said. “It’s a game of musical chairs where people want to dance around until it’s staring them in the face.”

Democratic nominee and former Vice President Joe Biden has stated that he plans to tax high-income earners in order make sure the program remains on solvent ground, and provide higher benefits to those who have already received Social Security for 20 years.

His plan also keeps the minimum benefit to stand at 125% of the poverty level for those who have worked at least 30 years, and tweaks the cost-of-living adjustment so that it places greater weight on items that matter more to senior budgets.

Read more: How to stay on track for retirement during the pandemic

President Trump hasn’t outlined a specific proposal related to Social Security. The campaign has yet to respond to request for comment.

“I think, politically, it’s a no-win proposition because if you say everything is fine, then politicians are fed graphs and equations and anyone who says they’ll act now will face the wrath of the electorate,” Earle said.

Mark Zandi, chief economist at Moody’s Analytics, said that the issue revolves more around borrowing.

“Both candidates say Social Security will be promised, but it gets wrapped up in a broader issue of borrowing,” he told Yahoo Money. “Because the government can borrow in 0% interest rates, the concerns about the deficit are pushed on the back burner.”

‘We will need to get funds from other sources’

Another reason why there are concerns about Social Security’s solvency is that the U.S. dollar is continuing to weaken while the government passes more stimulus bills.

“With each additional dollar that comes out, it becomes a classic supply-and-demand scenario that more dollars lead to less [value],” Earle said. “This is why the Federal Reserve has a guarded view of the economy.”

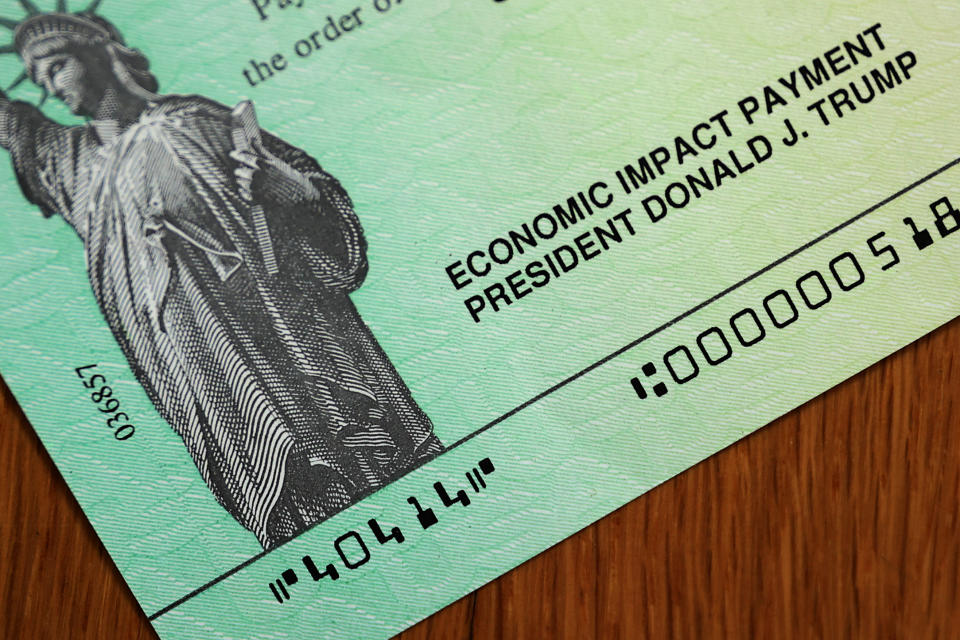

Earle alluded to how a weak dollar could prolong “sluggish” growth and thereby reduce the longevity of the Social Security program. His comment coincided with recent efforts by Democrats and Republicans to pass another round of $1,200 stimulus checks, which are still ongoing.

So how will the government likely solve this depletion issue? There are a handful of options.

“Everything and anything such as personal income taxes, corporate taxes, tariffs that are posed to China — and if that’s not enough, they’ll issue Treasury bonds and use that to pay Social Security,” Zandi said. “The [same] way we [feed] the State Department salaries.”

Other methods include raising the minimum working quarters or raising the retirement age, said Chad Parks, CEO of Ubiquity Retirement and Savings.

“They can probably raise the 40 quarters to that of 60 or 80 quarters, which is kind of harsh,” he told Yahoo Money. “Otherwise you can push up the retirement age to receive full benefits.”

He also said that the government could consider slightly raising the Social Security tax rate.

“The Social Security tax rate is 6.2%, and so if they can raise that by 1%, it has a really big aggregate difference,” Parks said. “It will help the program.”

And while both sides of the political aisle come up with a solution for solvency, Zandi says near-retirees should focus on the other two pillars of the three-legged retirement stool.

“In the long list of things people should worry about, this would be on the bottom,” he said. “There are so many things like ‘Can I get a job?’ or ‘Am I saving enough between stocks and bonds to live in retirement?’ There’s a boatload of questions people should be asking themselves and they should be saving as much as they possibly can.”

Dhara is a reporter Yahoo Money and Cashay. Follow her on Twitter at @Dsinghx.

Read more:

Read the latest financial and business news from Yahoo Finance and Yahoo Money

money

money