Could you get your second stimulus check by New Year's?

At long last, after months and months and months of dickering, Washington may finally be getting somewhere on providing more financial relief from COVID-19 — including a fresh round of those $1,200 "stimulus checks."

There's a report that the White House and Republican leaders in Congress are now leaning toward giving Americans new direct payments, to help households and stimulate the struggling economy.

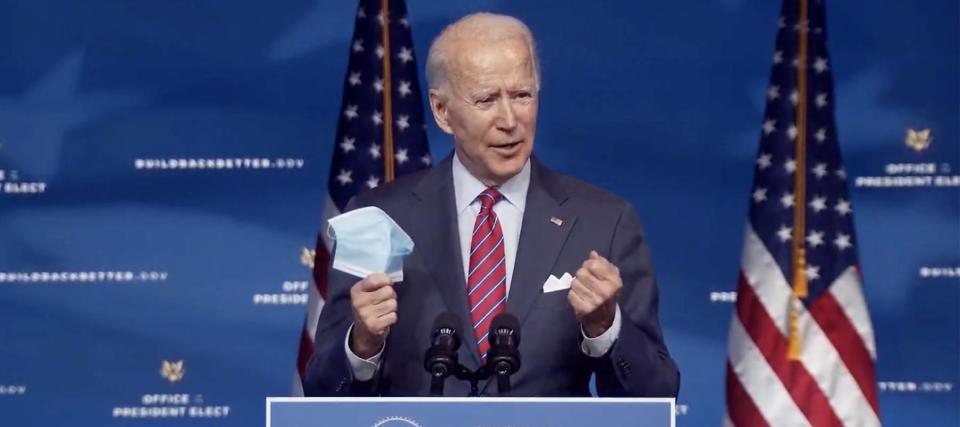

That's after a bipartisan group of senators last week pitched a $908 billion economic rescue plan that did not include more cash for consumers. A Republican senator said the omission was baffling, but President-elect Joe Biden had said optimistically that new stimulus checks "may be still in play."

And it appears they are. Here's what we know right now about whether the IRS might send you more cash by New Year's.

Americans are eager for more relief money

It's been more than seven months since the government began distributing the first round of stimulus payments, and Americans have been eager for another batch, especially as the pandemic has spiraled out of control in recent weeks, prompting new lockdowns and layoffs.

Consumers say new checks from Uncle Sam would put them in a merrier mood this holiday season. A Franklin Templeton-Gallup survey found 16% of people planned to spend more on gifts this year — but that jumped to 22% in the event of more $1,200 relief payments.

Meanwhile, 37% said they would spend less this holiday season, but that dropped to 30% if the government provided second stimulus checks.

New government cash may be coming closer. On Tuesday, Politico reporter Jake Sherman tweeted that Senate Majority Leader Mitch McConnell has "softened" his position against direct payments, and that President Donald Trump and other top Republicans want more checks.

Republican Sen. Josh Hawley of Missouri has urged Trump to veto any aid bill that doesn't include cash for households.

In an interview with Politico, Hawley says he told the president, "I think it's vital that any relief include direct payments, and I'm not gonna vote for it if it doesn't."

What's the possible timing now for second checks?

A survey from the U.S. Bureau of Labor Statistics found that close to 60% of Americans used their first stimulus checks to pay for basic expenses like groceries and utilities.

Some also invested the cash, the survey indicated, or found other, unspecified purposes for the money. Those may have included buying affordable life insurance— sales of life insurance policies have surged this year in the shadow of the pandemic.

President-elect Biden said at a news conference last Friday that a new relief package would be better with $1,200 cash payments for Americans rolled in.

"The whole purpose of this is, we’ve got to make sure people aren’t thrown out of their apartments, lose their homes are able to have unemployment insurance they can continue to feed their families on as we grow back the economy," Biden said.

"I understand (stimulus checks) may still be in play," he added.

If negotiators can reach an agreement this week — one that includes new direct payments — it's possible some Americans would start receiving money by the end of December, based on how quickly the money started flowing the first time.

But if no deal on stimulus checks comes now, you'll have to wait for the new Congress and new administration in January — meaning no cash before February.

What do you do in the meantime?

If you're hurting for cash and are tired of waiting for the government to get its act together, here are a few tips to help you rustle up another $1,200 on your own.

Slice your spending. Dump any subscription services you're not using. Do more of your own cooking and stop ordering delivery so much. And download a free browser add-on that will save you money every time you shop online by instantly checking for better prices.

Rein in your debt. If you’ve been leaning on your credit cards hard during the coronavirus crisis, you’re probably piling up a lot of interest. You can tame your credit card debt — and make it go away sooner — by rolling your balances into a single debt consolidation loan at a lower interest rate.

Tap the brakes on your insurance costs. As Americans have cut back on their driving this year, many car insurance companies have lowered their rates. But if your insurer won’t cut you a break, it’s time to start shopping around for a better option. You also might also be able to save on your homeowners insurance — by comparing quotes from multiple companies to find a lower price for your coverage.

Refinance your mortgage. Mortgage rates just hit a record low for the 14th time in 2020, and refinancing your existing loan could save you a ton of money. According to the mortgage technology and data provider Black Knight, 19.4 million U.S. homeowners could bring down their payments by an average $309 per month through a refi.

money

money