Election 2020: San Francisco passes tax on companies with ‘overpaid’ CEOs

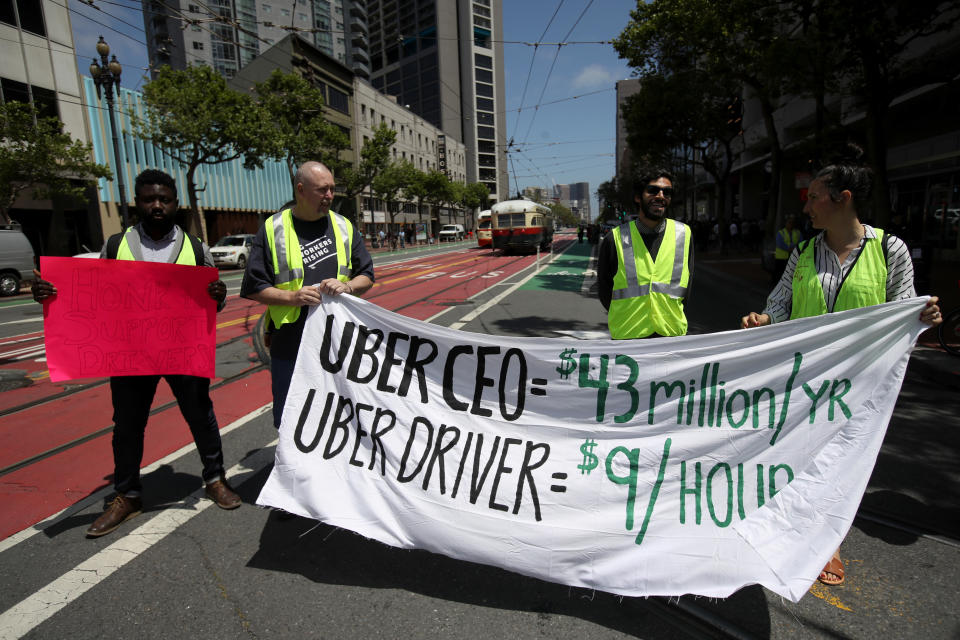

San Francisco voted to pass a tax hike on companies that have CEOs who earn disproportionally more than their employees — dubbed the “overpaid executive tax.”

San Francisco’s Proposition L passed with roughly 65% of the vote last week, making it the first city to implement tax hikes both on private and public companies based on their CEO-to-worker compensation ratio.

“Income inequality is such a huge concern for residents in San Francisco and beyond, and it’s only gotten worse during the pandemic,” San Francisco Supervisor Matt Haney, who introduced the measure, told Yahoo Money. “This is a solution that finally aimed directly at this issue of income inequality in our city and voters were clearly very supportive.”

‘Truly effective in changing economic outcomes’

Under the proposition, companies will have to pay an additional tax of 0.1% to 0.6% of gross receipts or 0.4% to 2.4% of payroll expenses if their top executive pay is more than 100 times employee pay. Only companies with gross receipts over $1.17 million will be targeted.

This comes as the ratio of CEO-to-worker compensation increased to 320-to-1 in 2019, up from 293-to-1 in 2018. In 1965, that ratio was just 21-to-1, according to the Economic Policy Institute.

Read more: Here's how these 4 workplace measures on state ballots turned out

Portland, Oregon, is the only other city to implement a similar tax hike in 2018 — which applies to public companies only — but Haney said that the overwhelming support of the measure may mean more cities will pursue similar ones in the future.

“I do think it will encourage other cities, states, and maybe even the federal government to adopt similar proposals,” Haney said. “I think for this to be truly effective in changing economic outcomes more broadly, it needs to be done at higher levels of government as well.”

‘Largely going to fall on retailers and certain service industries’

Instead of revising their pay structure, Haney expects companies will choose to pay the tax, resulting in $60 million to $140 million in new revenue for the city per year.

But the revenue may not primarily come from tech companies that are known for their executives' high compensation, but rather it will largely come from retail and service industries in the city, according to Jared Walczak, vice president of state projects at the Tax Foundation.

“Here is a tax that is largely going to fall on retailers and certain service industries, while exempting a lot of businesses with strong blueprints in the city that have very highly compensated CEOs,” Walczak told Yahoo Money.

The median compensation of employees is based on the salaries of employees working in the city. That means the CEO-to-worker compensation ratios for the tech industry may not be as high because of the highly-paid engineers and programmers these companies employ in the city.

On the other hand, fast food companies, retailers, and others who employ wage workers may be the most likely to pay this tax, according to Walczak.

“It's easy to see the response being less employment of low skilled workers, rather than higher compensation for them or lower compensation for the CEO,” he said. “Taxes are a blunt instrument for accomplishing social change and they don't always yield the results that policymakers want.”

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

Read more:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.

money

money