The Bank of Mom and Dad is 'the seventh-largest lender'

Half of Gen Xers aren’t ready for retirement because they’re lending too much money to their adult children, according to one expert.

“The Bank of Mom and Dad would be the seventh-largest [mortgage] lender,” in the U.S., said Catherine Prentke English, co-founder of Harness Wealth. Those loans are “taking up a big portion of the money that Gen X is making and thinking about using for retirement.”

One in 5 U.S. homeowners got financial help from family or a friend to make their purchase, according to a study this year from Legal & General, a U.K.-based financial services company. (Legal & General reported the “Bank of Mom and Dad” statistic.) Their generosity comes with real consequences, though.

One in 7 reports lowering their standard of living after lending money to their younger loved ones. About the same share feel less secure about their own future, the study found.

“The challenge for Gen Xers is they’re just closer to retirement,” English said on Yahoo Finance recently. “And so it’s a much more imminent need for them.”

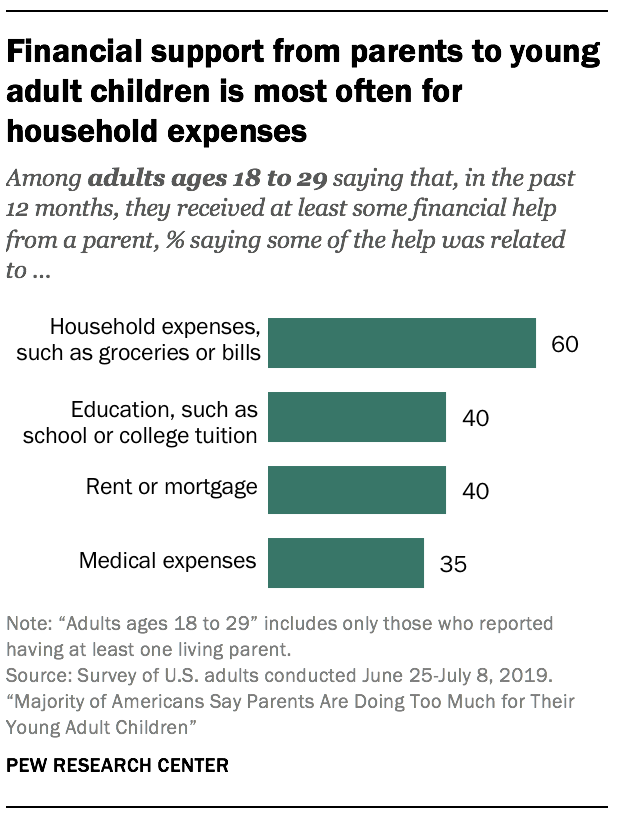

Young adults are also taking longer to become financially independent from their parents, the Pew Research Center recently found. Three in 5 parents with children between 18 and 29 have given their kids some financial help in the last year, including assistance with bills and groceries, education costs and rent or mortgage.

Many Gen Xers also feel financial strain from their elderly mothers and fathers. One in 7 individuals in their 40s and 50s are also taking care of aging parents, in addition to giving money to their children, English said.

That all plays into why 56% of Gen Xers feel anxious about managing their finances and 70% feel that financial planning is too complex, according to a survey put out by English’s firm.

To relieve some of that pressure, it’s imperative for everyone to figure out what they need for the future, English said, so they know how much financial help they can afford to offer loved ones now and later.

“What we are seeing across generations is really a strong need for people to understand financial planning,” English said, “and get rid of a lot of anxiety and complexity around that.”

Denitsa is a writer for Yahoo Finance. Follow her on Twitter @denitsa_tsekova.

Read more:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.

money

money