The rent is just too darn high in these U.S. cities

The cost of rent in the U.S., particularly in certain metro areas, is too darn high.

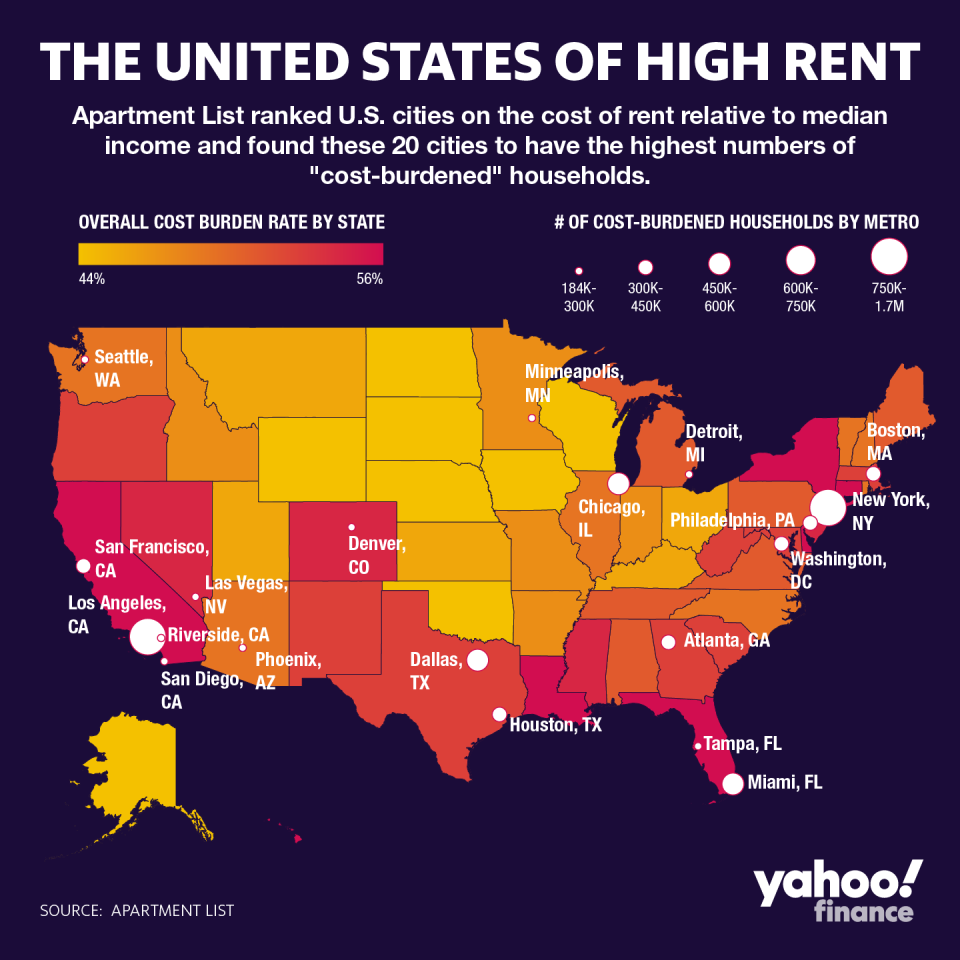

Nearly half of U.S. rental households are spending more than the recommended 30% of their income on rent, according to a report from Apartment List. (The national rate went from 49.5% in 2017 to 49.7% in 2018.)

And according to Apartment List, “in 19 of the nation’s 25 largest metros, a household earning the median renter income would be cost-burdened by the median rent. Of the 100 largest metros, the median renter would be burdened in 64 metros.”

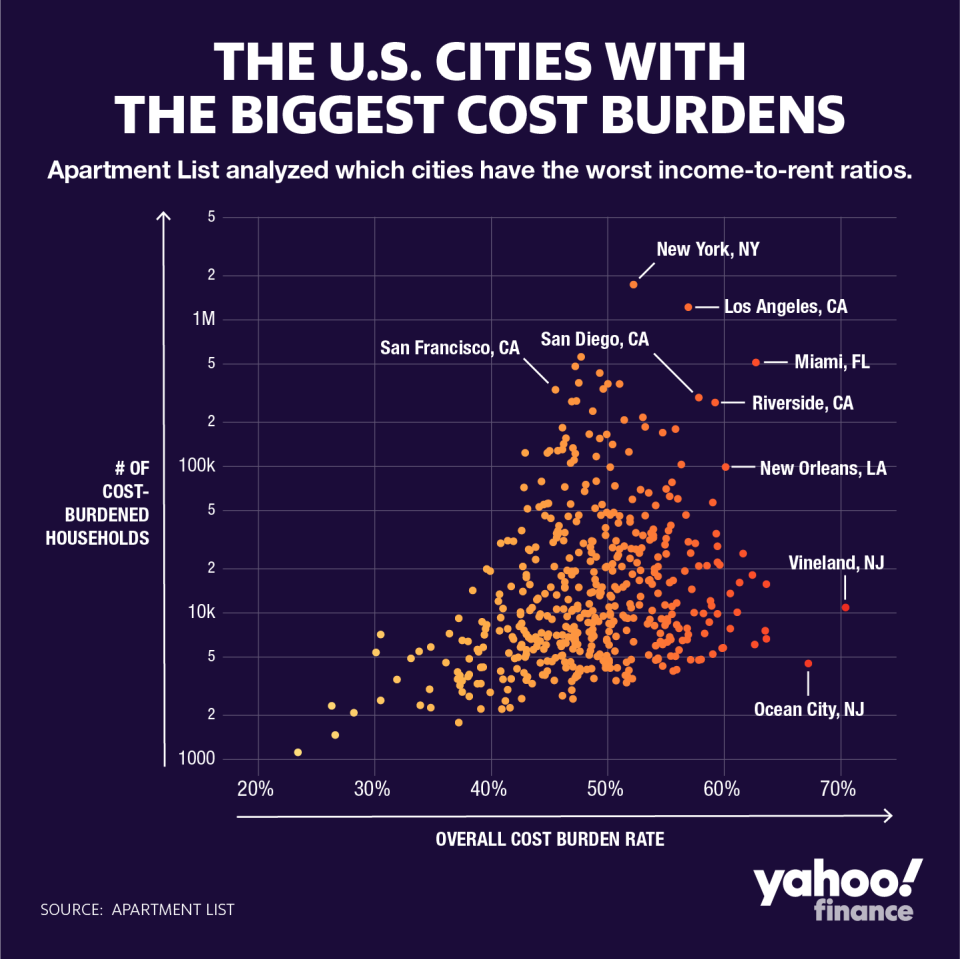

Among the biggest metros in the U.S., Miami has the highest cost burden rate at 62.7% — this means that 62.7% of its renters are spending more than the recommended 30% on rent. Not far behind is New Orleans at 60.1% The two largest metros in the U.S. by population, New York and Los Angeles, are at 52.2% and 56.9% respectively. Given their size, NYC and LA house the highest number of cost-burdened individuals.

“Certainly, the worst offenders — places like Los Angeles, Boston, San Diego, Miami — these are places where it’s not always easy to build as many houses as you’d like, but also their economies have been very strong, so the increases in rental [costs] become an unfortunate byproduct of that,” Igor Popov, chief economist at Apartment List, told Yahoo Finance.

By state, Florida has the highest cost burden rate at 56.5%. Other high cost-burdened states include New York, New Jersey, California, Colorado, Louisiana, and Connecticut — notably places along the coasts.

“We’re seeing that especially coastal cities — where adding new housing is difficult but economies are booming — those are the places where affordability issues are stacking up the most,” Popov said. “With that said, it is a national problem so even cities that aren’t necessarily in the housing affordability debate every day still have a lot of renters who are struggling.”

Supply and demand

Then there is San Francisco, which has a cost burden rate below the national average — despite the fact that the city has the highest rent in the country. This is because of rent control, Popov explained.

“A lot of the people who are able to live and rent in San Francisco are ones that have been in rent-controlled apartments for some time,” he said. “And so a good chunk of the city is covered by rent control. When you look at who’s actually able to rent in the market, a lot of families are able to afford it because they are basically paying below market rates.”

He continued: “The market rates in San Francisco are essentially the highest in the country. If you’re just moving to San Francisco and looking for an apartment, the prices are very high. But formally, the majority of people that are able to comfortably add rent are the ones who aren’t paying the market rate, but are usually in a rent-controlled apartment. Rent control often plays a role in these affordability numbers, often driving a wedge between the market rate that a new resident would pay, versus the rent-controlled rate the existing residents pay.”

Because of high rents in many of these cities, residents often turn to surrounding areas to reside for more financially feasible places to live. This is the case of Riverside, Calif., a city near Los Angeles, where the median rent accounts for approximately 36% of a person’s income.

“Riverside is actually seeing a lot of people who are migrating from the LA metro in search of more affordable options, but that demand is, in turn, driving up the price there as well,” Popov said.

‘I guess we went in the wrong direction’

Supply and demand wasn’t the only factor that affected the increase in rent-burdened households last year. Rental increases also outpaced wage growth in 2018, the first time since 2011.

“There’s a lot of factors for why that might be but on a very macro level, I think this economic expansion has been one that hasn’t [benefited] low-income households very well,” Popov said. “That shift was a bit surprising especially given that … we’ve seen a lot of high-income renters flooding in the rental market. In some ways, they’ve been padding the stats, so to speak, because they’ve come in and they’ve typically been able to afford their rentals, so they’ve made it look like things are getting better but this year, I guess we went in the wrong direction.”

From 2017 to 2018, there were nearly 300,000 more cost-burdened rental households throughout the U.S., which Popov described as “a big change in the number of people that have gone from being able to afford their housing to technically living in a place that they’re unable to afford.”

“You risk them moving away and that could both affect the economy and the economic diversity of a city when the renters move away, and you risk not being able to attract talent to grow the economy, and you risk not having basically that next generation being able to come and move to the city to keep it vibrant,” Popov said. “I think of this on a city-by-city basis and on that level, there are a lot of markets where maybe the flag isn’t being raised for the first time — maybe it’s been raised for a while.”

Adriana is an associate editor for Yahoo Finance. Follow her on Twitter @adrianambells.

READ MORE:

'A national problem': U.S. housing affordability is out of whack with minimum wage

'A vicious cycle': High rent is keeping Americans from health care

Research details the 'rapid increase in homelessness' in certain U.S. cities

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money