Personal Loans With 550 Credit Score: Can I Get One?

Content provided by Credible. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

This article first appeared on the Credible blog.

You’ll typically need good to excellent credit to qualify for a personal loan — which means you might have a harder time qualifying if you have a credit score of 550.

However, several lenders offer personal loans for poor credit. Credible makes it easy to compare personal loan rates from multiple lenders, without affecting your credit.

Here’s what you should know about getting personal loans with a credit score under 550.

Personal loans for credit scores from 550 to 600

Before you take out a personal loan, it’s important to compare as many lenders as possible to find the right loan for your needs. Be sure to consider not only credit requirements but also interest rates, repayment terms, and any fees charged by the lender.

Here are Credible’s partner lenders that offer personal loans to borrowers with credit scores from 550 to 600:

Avant

Min. credit score: 550

Avant offers personal loans from $2,000 to $35,000 with repayment terms from two to five years. If you’re approved, you could get your funds as soon as the next business day.

Best Egg

Min. credit score: 600

In addition to your credit score, Best Egg looks at more than 1,500 proprietary credit attributes from sources that include external data providers and your digital footprint. This means Best Egg might be more willing to work with you compared to traditional lenders if you have less-than-perfect credit.

With Best Egg, you can borrow $5,000 to $50,000 with terms from two to five years.

LendingClub

Min. credit score: 600

If you need a cosigner, LendingClub might be a good option — it’s one of the few lenders that accept cosigners on personal loans. You can borrow $1,000 to $40,000 with three- or five-year terms.

LendingPoint

Min. credit score: 580

LendingPoint specializes in working with borrowers who have near-prime credit — usually meaning a credit score in the upper 500s or 600s. You can borrow $2,000 to $36,500 with terms from two to five years.

OneMain Financial

Min. credit score: None

Unlike many other lenders, OneMain Financial has no minimum required credit score — which means you might have an easier time getting approved even if you have poor credit. In addition to your credit history, OneMain Financial considers your financial history, income, and expenses to determine your creditworthiness.

You can borrow $1,500 to $20,000 with repayment terms from two to five years. Keep in mind that larger loan amounts might require collateral.

Universal Credit

Min. credit score: 560

Universal Credit has a minimum credit score of 580 — perfect for borrowers with poor credit. They also offer free credit score monitoring, educational tools, and personalized recommendations to help you build your credit.

You can borrow $1,500 to $20,000 with repayment terms from two to five years.

Upgrade

Min. credit score: 560

With Upgrade, you can borrow $1,000 to $50,000 with a two, three, five, or six year term. Additionally, Upgrade provides free credit monitoring and educational resources that could help be helpful for building your credit.

Upstart

Min. credit score: 580

In addition to your credit, Upstart will also consider your education and job history to determine creditworthiness — which means you might still qualify even if you have little to no credit history.

You can view your prequalified personal loan rates from these and other Credible partner lenders when you visit Credible.

What is the minimum credit score needed for a personal loan?

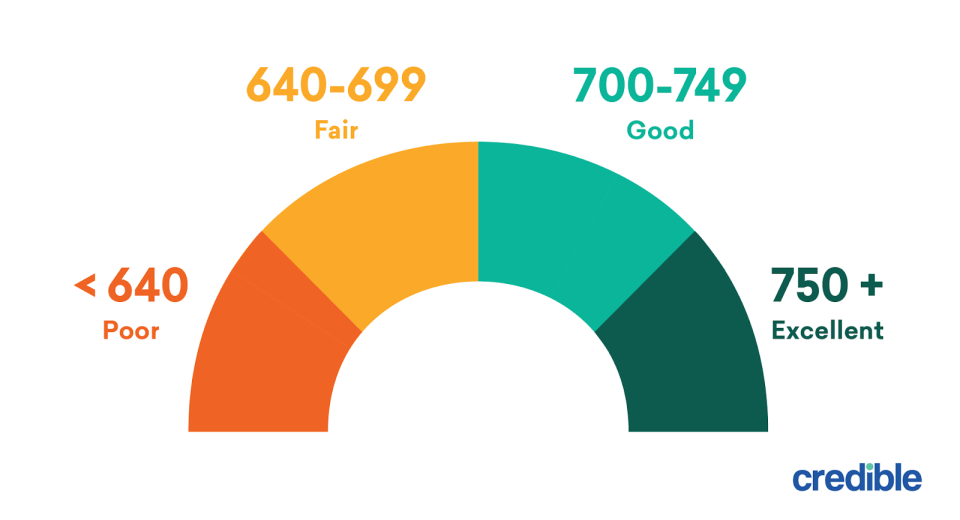

Generally, you need good to excellent credit to get approved for a personal loan — a good credit score is usually considered to be 700 or higher.

However, there are also some lenders that accept poor and fair credit scores. Keep in mind, though, that personal loans for bad credit usually come with higher interest rates compared to good credit loans.

Here are the credit score ranges you’ll typically come across:

Can you get a personal loan with a credit score under 550?

Yes, some personal loan lenders are willing to work with borrowers who have credit scores of 550 or lower. For example, the minimum required credit score for an Avant personal loan is 550, and OneMain Financial doesn’t require a minimum credit score at all.

Tip: If you’re struggling to get approved for a personal loan, consider applying with a cosigner. Not all lenders allow cosigners on personal loans, but some do. Even if you don’t need a cosigner to qualify, having one could get you a lower interest rate than you’d get on your own. You could also focus on building your credit before applying for a personal loan. Some potential ways to do this include making on-time payments on all of your bills and paying down credit card balances.

How to get a personal loan with bad credit or no credit

If you’re ready to apply for a personal loan, follow these four steps:

Check your credit. When you fill out an application for a loan, the lender will perform a credit check to determine your creditworthiness — so it’s a good idea to check your credit beforehand to see where you stand. You can use a site like AnnualCreditReport.com to review your credit reports for free. If you find any errors, dispute them with the appropriate credit bureaus to potentially boost your credit score.

Compare lenders and pick a loan option. Be sure to compare as many personal loan lenders as you can to find the right loan for your situation. Along with credit requirements, consider interest rates, repayment terms, and any fees charged by the lender. After you’ve compared lenders, choose the loan option you like best.

Complete an application. Once you’ve picked a lender, you’ll need to fill out a full application and submit any required documentation, such as tax returns or pay stubs.

Get your funds. If you’re approved, the lender will have you sign for the loan so the money can be released to you. The time to fund for a personal loan is usually about one week — though some lenders will fund loans as soon as the same or next business day after approval.

How credit scores affect personal loan rates

Your credit score plays a major role in determining the interest rates you could qualify for when you apply for a personal loan. In general, the lower your credit score, the higher the interest rate you’ll likely get.

Keep in mind: Average personal loan rates on most unsecured loans range from 4.99% to 36%. The higher your interest rate, the more you’ll pay in interest over the life of the loan.

For example, here’s how your credit score could affect how much you’d pay on a $10,000 personal loan with a three-year term. Note that the average APRs are based on the personal loan interest rates borrowers received when they applied for a personal loan through Credible in May 2021.

If you decide to apply for a personal loan, be sure to consider how much that loan will cost you. This way, you can be prepared for any added expenses. Credible makes it easy to compare personal loan rates from multiple lenders in minutes.

About the author: Dori Zinn has been a resident expert in personal finance for nearly a decade. Her writing has appeared in Wirecutter, Quartz, Bankrate, Credit Karma, Huffington Post, and more. She previously worked as a staff writer at Student Loan Hero.

money

money