Oppenheimer: 3 “Strong Buy” Stocks With Over 30% Upside Ahead

Are the violent stock market movements here to stay? Investors see plenty of cause for worry, in rising coronavirus case rates that many say portend a second wave of the pandemic. In addition, some states are extending lockdown policies.

That said, watching the markets for the past few months, Oppenheimer’s asset management chief strategist John Stoltzfus sees reasons for a bullish outlook. He believes that volatility will rule through 2H20, but that markets will start rising again at the end of the year. Stoltzfus says that when the bull comes to run, investors will jump on, arguing they are “waiting for some catalyst to cross the tape that will justify taking near-term profits without FOMO…”

Among the catalysts that Stoltzfus sees as likely is the November election. Whatever the outcome, he believes that the resolution of uncertainty once the results are in will put investors in a buying mood. Stoltzfus has recommendations for that, too: “We like consumer discretionary. We also like industrials, because industrial stocks today use a lot more technology than ever before…”

Stoltzfus isn’t alone at his firm in pointing out reasons for a bullish market stance. Oppenheimer’s stock analysts have been busy putting the strategist’s tips into concrete recommendations. Using the TipRanks database, we’ve pulled up the details on three of those calls. Each offers investors plenty of upside, starting at 30%; let’s find out what else makes them so compelling.

Ulta Beauty, Inc. (ULTA)

Stoltzfus is bullish on the consumer discretionary segment, and so, first on our list is a cosmetic company. Ulta is a chain of beauty care stores. The company boasts an $11 billion market cap – a testament to the strength of the beauty sector – and nearly 1,200 locations spread across all 50 states. As part of its response to the COVID-19 pandemic, the company offered a curbside pickup service at over 700 locations.

Even so, the Q1 ‘corona quarter’ was tough on Ulta. The company lost $1.12 per share, and the stock price is still down 35% from its February peak. Lower sales during the period of shutdown policies and lower margins during the quarter were the main drivers of the poor performance. This is borne out by comp sales, which fell 35% during Q1 compared to a gain of 7% in the prior-year quarter.

As a liquidity measure, Ulta drew some $800 million from its $1 billion credit facility during the corona crisis. The funds were used for general operation. In a positive note, the company has been reopening stores since mid-May, and is forecasting a positive – albeit modest – net profit for Q2.

Oppenheimer’s Rupesh Parikh sees the current environment as a buying opportunity for investors. He writes, “With the resurgence of coronavirus infections and likely conservative planning from the ULTA management team, we are assuming a slower 2H20 recovery. Consistent with our recent views, we believe investors should take advantage of weakness in accumulating shares and not chase strength. We believe ULTA should emerge with stronger share gains driven by omni-channel investments and department store challenges post-crisis.”

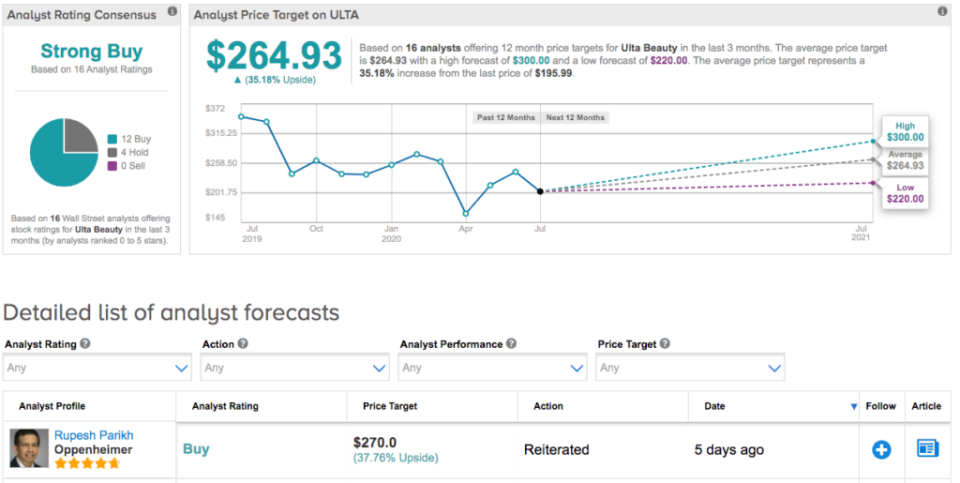

To this end, Parikh backs his Buy recommendation with a $270 price target, suggesting a 38% upside potential for the stock in the coming year. (To watch Parikh’s track record, click here)

Overall, ULTA gets a Strong Buy rating from the analyst consensus, based on 12 Buys and 4 Holds given in recent weeks. The general thought is that this company is fundamentally sound despite the pandemic. Shares are selling for $195.99, and the average price target of $264.93 implies a one-year upside potential of 35%. (See Ulta stock analysis on TipRanks)

WillScot Mobile Mini Holdings (WSC)

Next up, WillScot is a holding company with subsidiaries involved in the modular office space sector. This unusual niche is probably more familiar to you than you realize; modular offices are commonly seen at construction sites, where modified containers are used as on-site office space. WillScot produces the luxury version.

The company saw a unique opportunity arise during the coronavirus pandemic, as a sudden need arose for temporary testing sites, quarantine units, and the like. It was able to use that need to its advantage. Besting the consensus estimate, WSC reported a 9-cent per share profit. Along with the better-than-expected quarter, WillScot also completed an offer of $650 million in senior secured notes, a move that improves liquidity and gives the company flexibility in dealing with the ongoing public health crisis.

The note offering also allowed WillScot to complete a merger with Mobile Mini during the second quarter. The deal created a combined company worth $6.6 billion, with a leading market share in the North American modular sector.

Scott Schneeberger, a 4-star analyst with Oppenheimer, points out that WillScot’s business model lends itself to recurring revenue over the long-term, keeping the company resilient. He writes, “Its rental assets typically remain on-site through project-end even if the project were suspended a few months. WSC indicated in early-May no material COVID-19 impact to the lease duration/renewal/payment activity of its existing uniton-rent installed base.”

In line with his positive view of the company’s business, Schneeberger rates WSC a Buy, and increases the price target to $17. This new target implies an upside potential of 38% for the coming 12 months. (To watch Schneeberger’s track record, click here)

Wall Street is slightly more bullish than Schneeberger. The Strong Buy analyst consensus rating is unanimous, based on 5 Buy ratings, and the average price target comes in at $18. This suggests a one-year upside potential of 46% for the stock. (See WillScot stock analysis on TipRanks)

DraftKings, Inc. (DKNG)

Last on our list is DraftKings, the online venue for sports fantasy leagues. In a way, DraftKings has come into its own during the coronavirus crisis. Major sports have been mostly halted for now – but when they start up, they will do so without fans. This has already happened in German soccer. That will leave fantasy leagues, which are already popular, as the main outlet for fan participation.

At least that’s the thought process behind the company’s stock surge which began in May. Despite a net loss of $74 million in Q1, DKNG shares are up 80% since February 19, dramatically outperforming the broader markets.

In its earnings report, the company stated that it does not expect a long-term income hit from the pandemic, and has not changed its plans for 2H20. As its business is conducted entirely online, direct customer contact is not a problem. Additionally, with both the NBA and Major League Baseball planning truncated regular season play for the second half of the year, DraftKings has reason to believe that the fantasy leagues will return to play.

5-star analyst Jed Kelly initiated coverage of DKNG for Oppenheimer with a Buy rating. He specifically cited a new niche as an opportunity for the company: legalized in-game sports betting. Kelly says, “Legalized sports betting and iGaming markets are in their very early stages of growth, and we see an $18 billion revenue opportunity at scale, that also benefits from a sophisticated in-game wagering market.” Noting that DraftKings already operates online and in-game, he sees the company as having a uniquely strong position here.

Kelly backs his Buy rating with a $46 price target, suggesting a robust 42% upside potential for the stock. (To watch Kelly’s track record, click here)

DKNG is trading at $32.43 now, and the average price target of $48 implies a 48% upside potential. The analyst consensus here is a Strong Buy, based on 11 reviews breaking down as 10 Buys and 1 Hold. (See DraftKings stock analysis on TipRanks)

money

money