What Are No-Doc Loans? How to Get a No-Income-Verification Mortgage

Credible Operations, Inc. NMLS# 1681276, “Credible.” Not available in all states. www.nmlsconsumeraccess.org.

This article first appeared on the Credible blog.

When you apply for most traditional mortgages, you’ll hand the lender a stack of documents to prove your financial health and show you can repay the loan.

If your income is hard to document or you’re looking to guard your privacy, a different type of mortgage might appeal to you. No-documentation loans, as the name implies, require little to no documentation from the borrower.

But there’s a trade-off: You’ll typically pay a higher interest rate to get one of these loans. If your credit is good, a conventional loan may be a less costly alternative. Credible can help you get started in your search for a mortgage. Credible makes it easy to compare lenders and get pre-approved in minutes.

Here’s what you need to know about no-doc loans.

What is a no-doc mortgage loan?

A no-documentation home loan is a mortgage that doesn’t require the borrower to provide standard income documentation.

In lieu of pay stubs, W-2 forms and tax returns, lenders may accept bank statements as proof of income. They’ll also order a property appraisal to check the resale potential of the investment.

This type of loan has evolved over time. In the years leading up to the financial crisis of 2008, many lenders offered mortgages to borrowers without verifying their ability to repay the loan. When the market crashed, many homeowners lost their jobs and either defaulted or became underwater on their mortgages.

Today, all lenders must follow federal laws to verify the borrower’s income and assets to make sure they can afford their monthly mortgage payments.

Extra consumer protections make today’s no-doc loans a viable option for people with nontraditional income or those who have complicated tax returns.

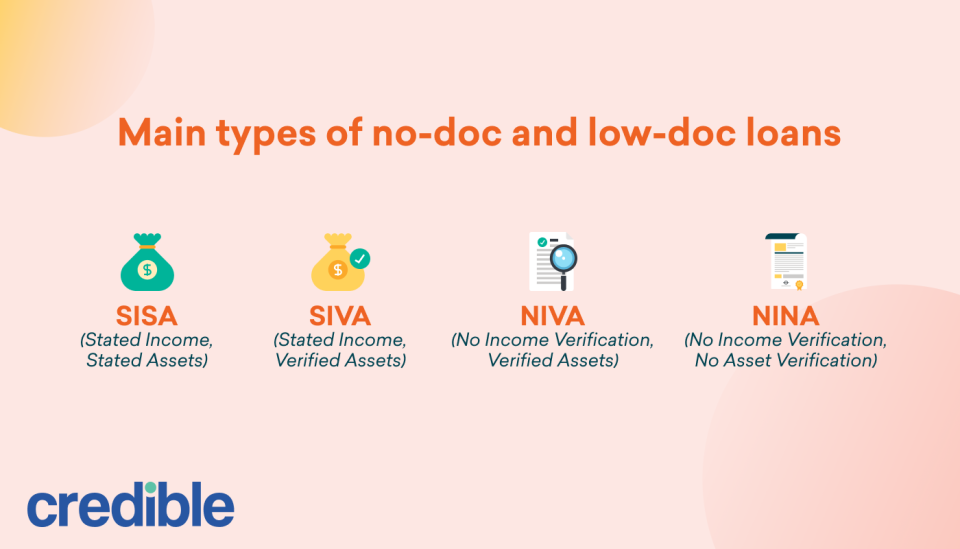

Types of no-doc and low-doc mortgages

Several types of loans fall under the “no-doc” umbrella.

Here’s what you might encounter when shopping for a no-doc or low-doc loan:

SISA (Stated Income, Stated Assets)

When you apply for a stated-income, stated-asset loan, you disclose your annual income and your assets on the mortgage application, and the lender agrees to accept the figures you provide.

These loans were prevalent leading up to the 2008 financial crisis and played a major role in the housing crash.

After the passage of the Dodd-Frank Act in 2010, these loans became severely restricted and are no longer available for owner-occupied properties.

A good fit for: Borrowers looking to purchase investment properties.

SIVA (Stated Income, Verified Assets)

With stated-income, verified-assets loans, the borrower again states their income on the mortgage application but the lender verifies the borrower’s assets. Lenders usually ask for six to 24 months’ worth of bank statements.

A good fit for: Self-employed borrowers with a high net worth. But people who rely mostly on cash for income, such as restaurant servers and sales people, might also benefit from this type of mortgage as long as they have a bank account.

NIVA (No Income Verification, Verified Assets)

No-income, verified-assets loans are similar to SIVA loans, except the borrower doesn’t disclose their income at all on the mortgage application. The lender only verifies the borrower’s assets.

A good fit for: Borrowers, such as retirees, who don’t have income from a job but regularly draw from retirement accounts. The retiree will need to provide statements from their pension, 401(k), or other investment accounts to document their assets.

NINA (No Income Verification, No Asset Verification)

No-income, no-asset loans have the fewest requirements of all the no-doc and low-doc loans. The borrower doesn’t state their income or assets on the mortgage application.

They’ll just provide their name, Social Security number, the down payment amount, and the address of the property being financed. But the lender still has to make a good-faith effort to check that the borrower can repay the loan.

Approval is based mostly on the value of the property, along with the borrower’s credit score, down payment and some type of proof of how they’ll make monthly payments.

For example, real estate investors buying rental properties can show they’ll have enough rental income from the property to cover the new mortgage payment.

A good fit for: Borrowers who can’t or don’t want to hand over the paperwork required on a traditional mortgage — for instance, someone looking for maximum privacy, employed by a foreign company, or using an inheritance to buy the house. They’ll typically need a pristine credit history to qualify.

Pros and cons of a no-doc loan

No-doc and low-doc loans make homeownership more accessible for nontraditional borrowers and have a quicker underwriting process, but they typically come with higher borrowing costs.

Pros

They make homeownership more accessible. If you previously couldn’t get a traditional mortgage due to strict documentation requirements, a low-doc loan might help you qualify for a loan.

They’re faster to apply for. On a traditional mortgage, the underwriting process usually stretches across several weeks. But you could get to the closing table much quicker with a no-doc loan because there’s less to verify.

Cons

These types of loans are rare. It might be hard finding a lender that offers no-doc or low-doc mortgages. Lenders might call one of their products a “no-doc” loan if it has less-strict requirements, but you’ll usually need to produce some kind of documentation.

They come with less favorable loan terms. The mortgage rates on some no-doc or low-doc home loans are as much as 3 percentage points higher than what you’d find on a conventional loan. It depends on the size of your down payment, credit score, assets and how much you can disclose about your employment.

Credit score and down payment requirements are higher. No-doc loans usually set minimum credit score requirements around 700. They also might require a down payment equal to 30% of the home’s value.

Is a no-doc mortgage right for you?

No-doc and low-doc mortgages exist for a reason. Maybe you can’t easily prove your earnings, or you just don’t want to provide a ton of documents to a stranger.

Here are some situations in which you might consider a no-income-verification mortgage:

You deducted large business expenses last year. As an entrepreneur, deducting expenses will generally lower your net income — which can potentially hurt your chances of mortgage approval. A low-doc mortgage might put you back in the running.

You have an irregular income. Your income might fluctuate every month and even throughout the years if you work in certain industries, such as sales, or you’re self-employed. If you have money in the bank but your income is volatile, then a low-doc mortgage might be a good fit for you.

You’re a real estate investor. With a low-doc loan, lenders might approve the mortgage based entirely on the value of the property. If the home you’re buying is an investment, then your expected rental income can help you get approved without any other asset or income documentation.

You have a high net worth. If you no longer work because you’ve saved enough for retirement, inherited money, or won the lottery, then a no-doc mortgage loan may allow you to qualify based on your considerable assets.

While Credible doesn’t offer no-doc loans, it makes it easy to compare rates for 15-year and 30-year mortgages from multiple partner lenders.

Alternatives to no-doc loans

If you don’t want to deal with the drawbacks of a no-doc or low-doc loan, you have other options.

For instance, if you’re self-employed, you can qualify for traditional loans if you’re willing to meet the paperwork requirements.

Here are some ways to help you qualify for a traditional mortgage:

Keep detailed financial records. To be eligible for a mortgage, you’ll need to provide proof of income, tax returns, and bank account statements.

Boost your credit score. Every mortgage program has different eligibility requirements. Focus on boosting your credit score before applying for the loan to improve your chances of qualifying.

Lower your DTI. Your debt-to-income ratio measures how much of your monthly income goes toward debts. Lenders generally look for a DTI of 43% or less. You can improve this metric by paying down your debt or increasing your income.

While Credible doesn’t currently offer no-doc loans, prospective homebuyers can use its pre-approval tool to compare interest rates from different lenders.

About the author: Kim Porter is an expert in credit, mortgages, student loans, and debt management. She has been featured in U.S. News & World Report, Reviewed.com, Bankrate, Credit Karma, and more.

money

money