NFT sales plummet more than 90% to 12-month lows

Sales of non-fungible tokens (NFTs) have slumped to yearly lows following a major downturn with the broader cryptocurrency market.

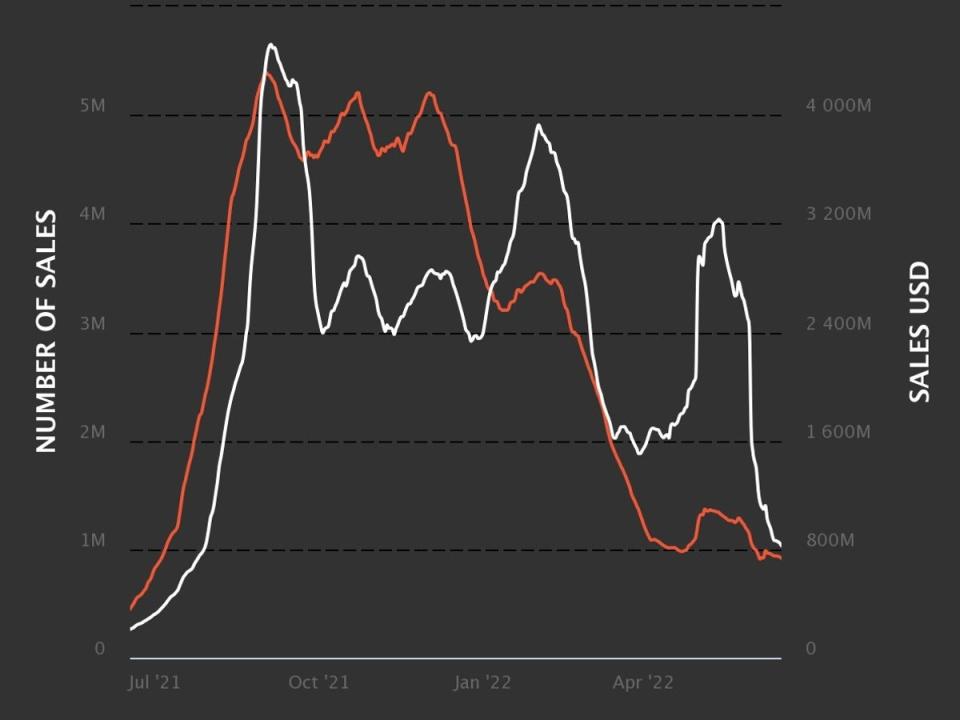

The average number of daily sales of NFTs, which typically come in the form of a unique piece of digital art, fell to around 19,000 in June 2022. At its peak between August and November last year, NFT sales were frequently topping more than 200,000 per day.

The total monthly transaction volume also plummeted to levels not seen since June 2021 dropping from a peak above $4 billion to below $800million, according to figures from market-tracker NonFungible.

The hype surrounding NFTs was fuelled by popular art projects like Bored Ape Yacht Club, which attracted celebrity owners like musicians Justin Bieber, Eminem and Madonna.

Former First Lady Melania Trump also launched her own NFT venture last year that allowed people to buy a digital painting of her eyes.

Despite their A-list appeal, data from blockchain analysis platform Chainalysis revealed earlier this year that ownership of NFTs is concentrated to just a few hundred thousand people.

This represents just a fraction of a per cent of the roughly 300 million people around the world that use cryptocurrency.

The decline in popularity of NFTs can partly be attributed to the crypto market crash over the last seven months, which has seen the cryptocurrency market fall in value from close to $3 trillion to below $900 billion.

The scale of the losses have led some market commentators to declare the onset of a so-called “crypto winter”, which could take years to recover from. Others remain hopeful that the overall utility of the technology will perservere through chaotic market conditions.

“NFTs are still a relatively new technology, with a vast range of use cases spanning across pretty much every industry,” Emily Wigoder, CEO of the NFT agency Ad Astra, told The Independent.

“What we are now seeing is the cooling down of the initial excitement, and with it, a cooling off of prices of NFTs. This ‘winter’ is in no way tracking a decrease in the use cases for NFTs or their aesthetiv value, and therefore does not imply any real loss of value.

“Instead of panicking, we should be using this lull to understand what projects are worth investing our time and energy into, and building those to enter the market.”

money

money