The Natera (NASDAQ:NTRA) Share Price Has Soared 366%, Delighting Many Shareholders

For us, stock picking is in large part the hunt for the truly magnificent stocks. You won't get it right every time, but when you do, the returns can be truly splendid. One such superstar is Natera, Inc. (NASDAQ:NTRA), which saw its share price soar 366% in three years. It's also good to see the share price up 11% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 20% in 90 days).

See our latest analysis for Natera

Given that Natera didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years Natera has grown its revenue at 18% annually. That's a very respectable growth rate. Some shareholders might think that the share price rise of 67% per year is a lucky result, considering the level of revenue growth. After a price rise like that many will have the business, and plenty of them will be wondering whether the price moved too high, too fast.

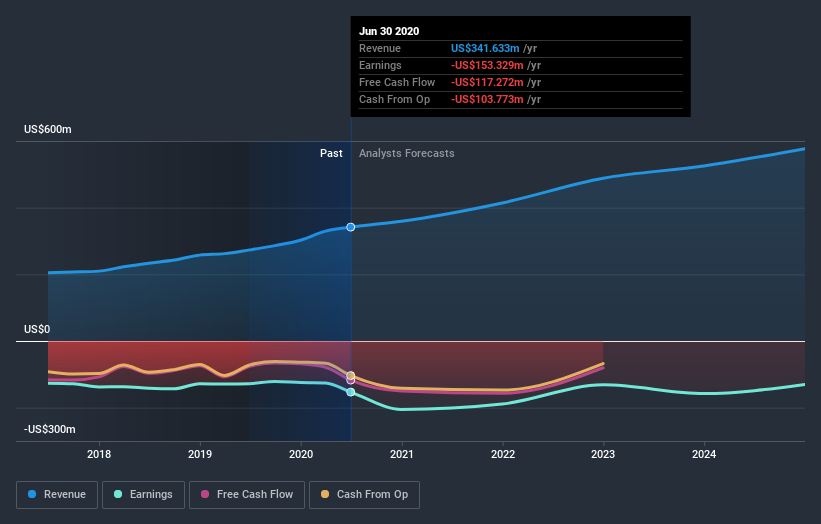

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that Natera shareholders have received a total shareholder return of 75% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 28% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 4 warning signs for Natera you should be aware of.

Of course Natera may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

money

money