How Much a $300,000 Mortgage Will Cost You

Credible Operations, Inc. NMLS# 1681276, “Credible.” Not available in all states. www.nmlsconsumeraccess.org.

This article first appeared on the Credible blog.

Taking out a mortgage comes with many costs — some upfront and some paid over long lengths of time. On a $300,000 mortgage, those costs might surprise you.

In fact, on a traditional 15- or 30-year loan of this size you might pay anywhere from $72,000 to $155,000 just in interest. The interest rate you receive on a mortgage will significantly affect the lifetime costs of your loan, so it’s important to comparison shop for the best mortgage deal available to you.

Credible makes it easy to compare mortgage rates from multiple lenders.

Monthly payments for a $300,000 mortgage

Monthly mortgage payments always contain two things: principal and interest. In some cases, they might include other costs as well.

Here’s what typically makes up a mortgage payment:

Principal: This money is applied straight to your loan balance.

Interest: The cost of borrowing the money. How much you’ll pay is indicated by your interest rate.

Escrow costs: If you opt to use an escrow account (or your lender requires it), you’ll also have your property taxes, mortgage insurance, and homeowners insurance rolled into your monthly mortgage payment, too.

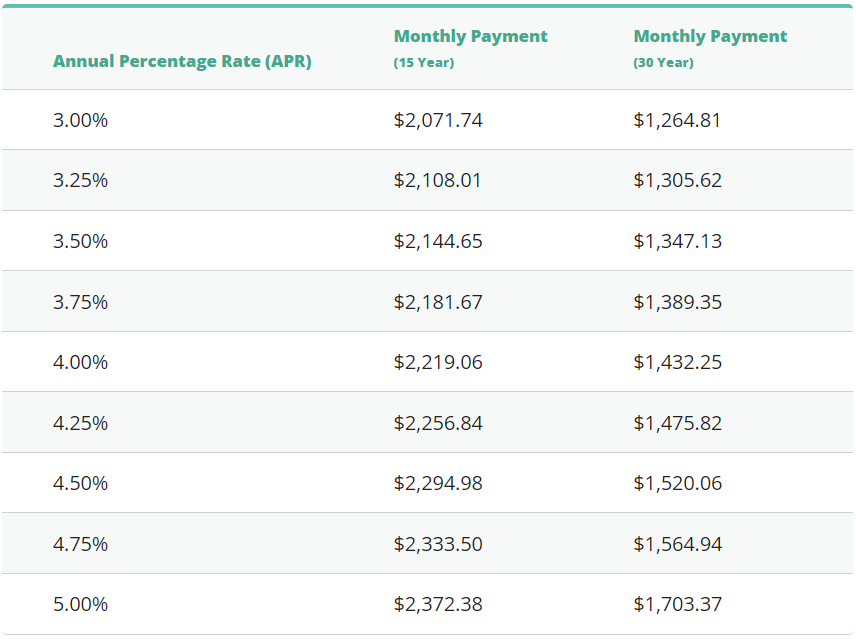

On a $300,000 mortgage with a 3% APR, you’d pay $2,071.74 per month on a 15-year loan and $1,264.81 on a 30-year loan, not including escrow. Escrow costs vary depending on your home’s location, insurer, and other details.

Here’s a quick look at what the monthly payment (principal and interest) would be for a $300,000 mortgage with varying interest rates:

Where to get a $300,000 mortgage

To get a $300,000 home loan, you’ll want to get quotes from at least a few different lenders. Though this can be done by reaching out to each mortgage company directly, you can also use an online marketplace like Credible.

Once you receive your quotes, you’ll want to compare them line by line. You should look at the interest rate, total costs on closing day, any origination fees, mortgage points you’re being charged, and more.

After you determine the best offer, you can move forward with that lender’s application and submit any required documentation.

Credible makes the process of finding the right mortgage rate easier and more efficient. You can get tailored prequalified rates from Credible’s partner lenders simultaneously — all with just one form — and it only takes a few minutes.

What to consider before applying for a $300,000 mortgage

Before taking out a mortgage of this size (or any home loan for that matter), you’ll want to have a good handle on the total costs of the loan. That includes your closing costs, the down payment, the total interest you’ll pay, and the monthly payment the loan comes with.

Total interest paid on a $300,000 mortgage

You’ll always pay more interest on longer-term loans. So, for example, a 30-year loan would cost more in the long haul than a 15-year one would (though the 30-year loan would have a smaller monthly payment).

With a 30-year, $300,000 loan at a 3% interest rate, you’d pay $155,332.34 in total interest, and on a 15-year loan with the same rate, it’d be $72,914.08 — a whopping $82,418 less.

You can use Credible’s mortgage calculator to see how much interest you’ll pay, as well as what your home will cost you every month.

Amortization schedule on a $300,000 mortgage

An amortization schedule breaks down how much you’ll pay in interest and principal for every year of your loan’s term.

At the start of your loan, the bulk of your monthly payments will go toward interest, but as you get further into the loan term, more will be applied to the principal balance.

How to get a $300,000 mortgage

Applying for a mortgage can be quite simple — especially when using a rate-shopping tool like Credible.

When filling your mortgage application out, you’ll want to have some financial details on hand, including your income, estimated credit score, homebuying budget, and info regarding your assets and savings.

Here’s a step-by-step guide on how the mortgage process usually goes:

Estimate your homebuying budget. Take a look at your finances, including your earnings, debts, and monthly expenses, and determine what you can afford in terms of home price, down payment, and monthly payments. A good mortgage calculator can help you here.

Do a credit check. Both your credit history and your credit score will play a major part in your loan application, so pull your credit report and evaluate your standing. If you have late payments, collections efforts, or other negative events on your report, you may want to work on addressing those before applying, as they could hurt your chances.

Get pre-approved. Always get pre-approved for a mortgage before searching for a home. A pre-approval letter can give you a good price range to shop in, as well as give sellers more confidence in your offers. You can use Credible to get a streamlined pre-approval letter for prequalification with multiple lenders at once.

Compare rates and mortgage offers. Next, you’ll want to compare options. Pay close attention to the interest rate and APR you’re being offered, the closing costs, and any fees the lender is charging.

Find and make an offer on a home. When you find that dream home, be sure to include your pre-approval letter in your offer, and work with an experienced real estate agent to get the best deal.

Complete the full mortgage application. After your offer has been accepted, fill out your lender’s full mortgage application and submit the documentation they require. This usually includes things like tax returns, bank statements, pay stubs, and more. You will also need to submit to a credit check.

Await approval. Your loan will then go into underwriting, which is when your lender verifies your income, savings, and other assets and makes sure you can repay the loan. The lender will also order an appraisal to gauge your home’s value (and make sure it’s worth the money you’re requesting to borrow for it).

Get ready for closing. Once your loan is nearing full approval, you’ll get a closing date, which is when you’ll sign the final paperwork and receive your keys. You’ll typically need proof of homeowners insurance by this day, so be sure to shop around for your policy early.

Close on your loan. When closing day rolls around, you’ll attend your appointment, sign the required paperwork, and pay for your down payment and closing costs (usually via cashier’s check or wire transfer).

With Credible, you can easily compare mortgage rates from multiple lenders without affecting your credit.

About the author: Aly J. Yale is a mortgage and real estate authority. Her work has appeared in Forbes, Fox Business, The Motley Fool, Bankrate, The Balance, and more.

money

money