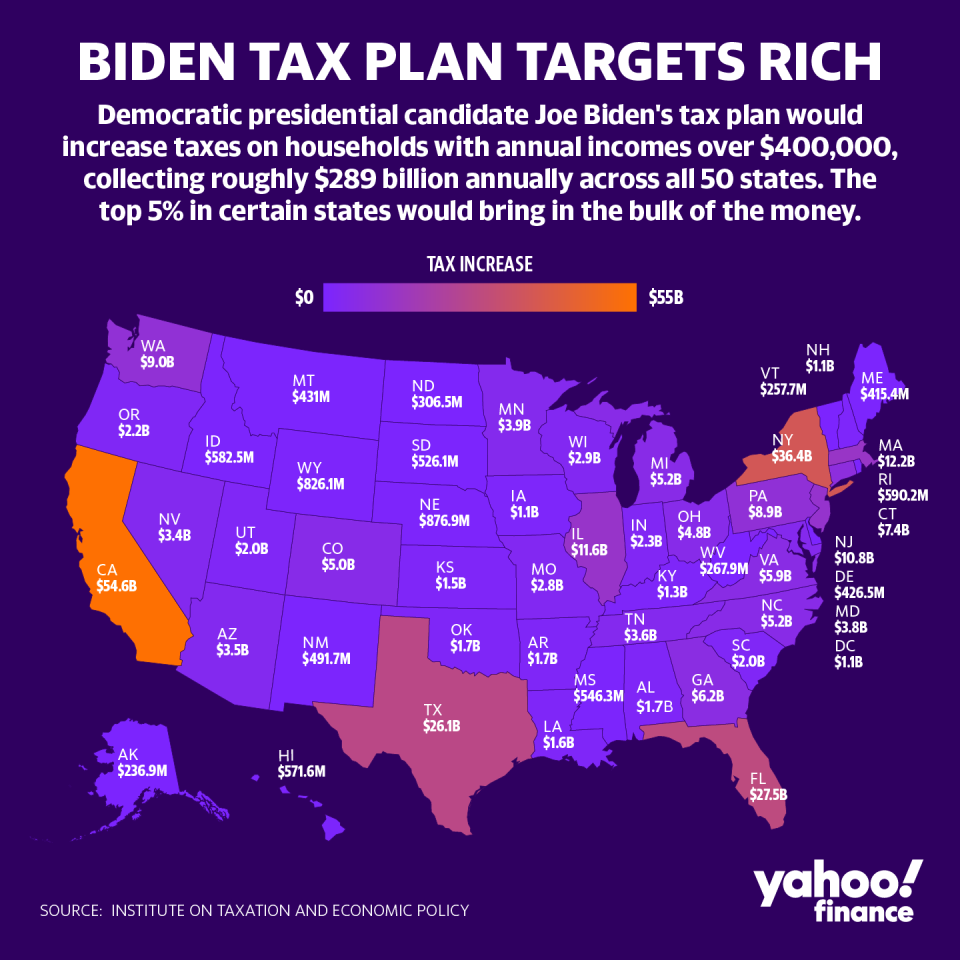

Most Americans are unlikely to see a tax hike under Biden’s presidency

If President-elect Joe Biden’s largest tax proposals manage to pass the Senate next year, most Americans won’t see a bigger tax bill.

The biggest tax pledges that Biden campaigned on were imposing a new 12.4% Social Security payroll tax for earnings above $400,000, and raising taxes on long-term capital gains above $1 million.

If fully implemented, Biden’s tax plan would be a direct tax hike for just the top 1.9% of the U.S. population, according to research from the Institute on Taxation and Economic Policy (ITEP). But it remains uncertain which of Biden’s proposals — if any — could become law.

Many of his proposals are aimed at repealing the 2017 Tax Cuts and Jobs Act passed under the Trump administration and supported by the Republican-held Senate. If the GOP retains control of the upper chamber, Biden’s chances for passing his most robust proposals become slim. Even with a Democratic majority, the proposals must gain support from moderate Democrats and withstand a filibuster.

“Given the Republicans control the Senate, which may be likely depending on what happens with the Georgia runoff, the prospects of most of the tax hikes in the Biden proposal are fairly low,” Garrett Watson, senior policy analyst at the Tax Foundation told Yahoo Money.

Here are Biden’s main tax proposals.

Social security payroll tax

Imposing a Social Security tax on higher earnings has been one of the most discussed of Biden’s proposals, but it’s also one of the least likely to become law due to its scale.

Right now, the Social Security payroll tax applies only to earnings up to $137,700 in 2020, a cap that’s adjusted each year for inflation. Under Biden’s plan to help fund Social Security, a new 12.4% payroll tax would apply to earnings above $400,000, split evenly between employer and the employee with each paying 6.2%.

Read more: How to reduce your taxable income

That means earnings below the initial cap and those over $400,000 would be taxed. The initial cap would continue to be adjusted, while the $400,000 threshold would remain the same. The “donut hole” between the two would eventually merge, meaning that all earnings would be subject to the 12.4% tax.

Such a tax hike is unlikely to happen because it’s a major change in the way the payroll system works, Watson said, so it will be hard to gather the needed support to pass the measure.

“I would be surprised if that went anywhere,” he said. “I actually think that's not even super likely, even in a scenario where the Democrats narrowly control the Senate.”

Personal income tax

One of Biden’s proposals also includes increasing the current top individual income tax rate for taxable incomes above $400,000 from 37% and 39.6%, the rate it was before the passage of the 2017 Tax Cuts and Jobs Act under Trump. Again, this would target higher earners, rather than low, middle, and upper middle class households.

But the change would face stiff opposition if the Senate remains controlled by Republicans during Biden’s years. The law that reduced the rate was passed by the GOP-held Senate in 2017.

Long-term capital gains

If implemented, Biden’s plan would raise the taxes on long-term capital gains — profits from selling assets — and qualified dividends to 39.6% for income earned above $1 million. Currently, capital gains and stock dividends are subject to just a 20% tax rate or the personal income tax, which has much lower rates than other types of income.

Read more: Taxes on your investments: What you need to know

Earned income tax credit and child tax credit

Biden proposes expanding the Earned Income Tax Credit (EITC) to childless workers above 65. He also proposed raising the Child and Dependent Care Tax Credit (CDCTC) from $3,000 to $8,000 per dependent with a maximum of $16,000. He also put forth increasing the maximum reimbursement rate for CDCTC from 35% to 50% of allowable expenses.

The CDCTC proposal would provide a 6.4% tax cut for the poorest 20% of American households and a 2.2% reduction to the second 20%, according to ITEP’s analysis.

Depending on the economic conditions, Biden proposes increasing the Child Tax Credit in 2021 from a maximum of $2,000 to $3,000 for children 17 or younger, and giving a bonus credit of $600 for children under 6.

These tax credits are similar to what House Speaker Nancy Pelosi (D-CA) had been negotiating to include in the next stimulus package. They are also the most likely of Biden’s proposals to become law, according to Watson.

First-Time homebuyers’ tax credit

Establishing the First-Time Homebuyers’ Tax Credit is also one of a Biden’s proposals. The tax credit was originally created during the Great Recession to help prop up the flailing housing market. This time around, it would provide a tax credit worth up to $15,000 for first-time home buyers.

Itemized deductions

Biden’s plan also includes suggested changes to the itemized deduction for those making above $400,000. One is to cap itemized deductions to 28% of their value for that income group. The second proposal is to restore the limit on itemized deductions for that same income group, which would reduce those deductions by 3% above a set limit.

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

Read more:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.

money

money