Mortgage delinquency rate hits 21-year high

The share of homeowners four months behind on their mortgage payments hit a 21-year high in July, according to the latest figures from CoreLogic, a financial data and analytics firm.

The 120-day delinquency rate stood at 1.4%, up from 0.12% in July 2019 and the highest level since CoreLogic started tracking delinquencies in 1999.The rate includes those homeowners who declared forbearance as a result of the CARES Act.

Read more: Here's how to negotiate with your landlord if you’re facing eviction

“What we’re seeing is a ‘pig in python’ effect with a spike in June for 90-day delinquencies and now in July with 120-day delinquencies,” said Dr. Frank Nothaft, chief economist at CoreLogic. “I think it’s a big concern especially as the CARES Act provided forbearance, but homeowners will still have to owe every payment.”

‘We will see 2 million loans seriously delinquent in 2021’

The report’s other findings also demonstrate the severity of the cash crunch.

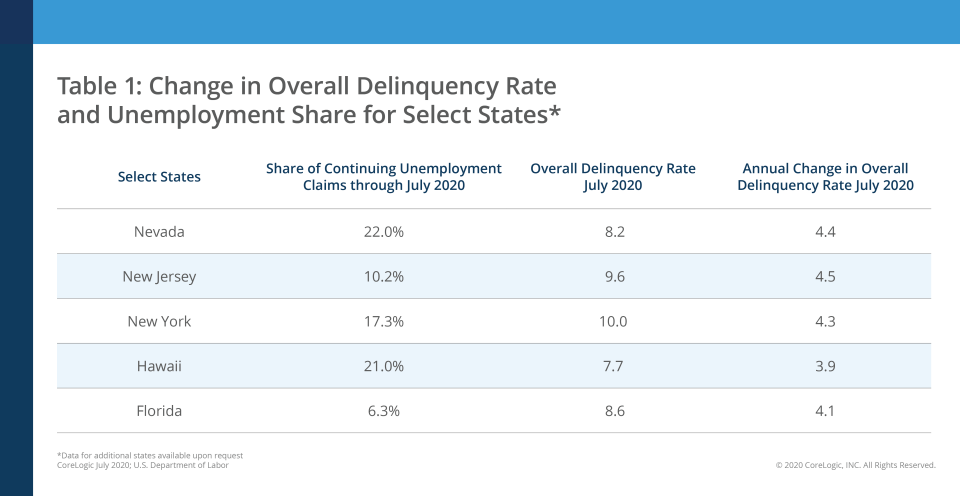

The rate of those at least 90 days past due jumped to 4.1%, up from 1.3% in the same month last year and the highest level since April 2014. All 50 states experienced an uptick in seriously delinquent mortgages, those characterized by payments 90 or more days late. But some bore the brunt more than others.

In New York, that rate climbed to 10% in July, up from 4.3% the year before. New Jersey’s rate hit 9.6%, up from 4.5%, while the delinquency rate in Florida increased to 8.6% from 4.1% in July of last year.

“If there continues to be financial stress we can see at least 2 million loans seriously delinquent by the end of 2021,” Nothaft said.

‘Additional fiscal stimulus will likely be needed’

As the next round of stimulus talks remain unresolved between Democrats and the White House — including additional unemployment benefits and direct payments — many Americans will be forced to stretch their dollars as far as they can.

Those who have chosen forbearance offered by government-backed mortgage guarantors still face the prospect of paying back months of past-due mortgage payments when the forgiveness period ends.

“While elevated savings may help households meet their payment obligations in the near term, additional fiscal stimulus will likely be needed to help households to bridge the gap until the labor market fully recovers,” said Rhea Thomas, senior economist at Wilmington Trust, a financial firm.

A more robust recovery in jobs is also needed to help American homeowners stay afloat. The unemployment rate remains elevated at 7.9%, with weekly jobless claims still coming in at high levels.

“Employment levels are only about half of pre-COVID levels,” Thomas said. “So a further recovery in jobs and incomes will help households in meeting payment obligations.”

Dhara is a reporter Yahoo Money and Cashay. Follow her on Twitter at @Dsinghx.

Read more:

Landlords can start the eviction process despite moratorium, government says

Housing expert: Eviction moratorium are ‘not enough’ during pandemic

‘Gone in 90 minutes:’ Rental Assistance is quickly running out for struggling renters

‘Not a rent holiday’: Trump’s new eviction order leaves renters on hook for back pay

Read the latest financial and business news from Yahoo Finance and Yahoo Money

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money