Coronavirus stimulus: 'The money works,' data shows, 'and the money is gone'

While the coronavirus devastated the economy, Americans’ personal finances got in better shape than before the pandemic began due to government relief.

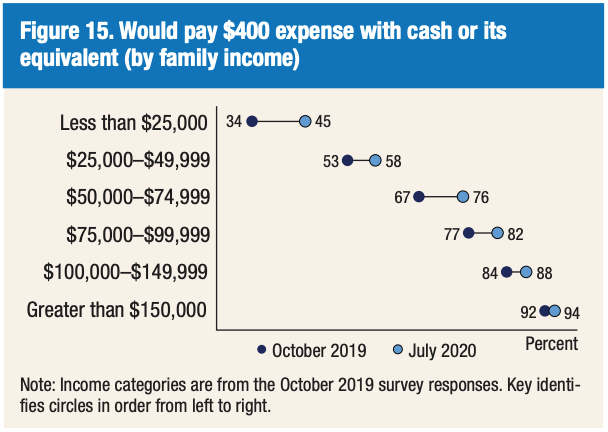

Seven in 10 Americans reported they could cover a $400 emergency expense using cash or its equivalent in July, a Federal Reserve survey found. This is the highest level since the survey started in 2013 and is a sharp increase since October 2019 when only 63% were able to cover it.

“The relief worked, it was supporting families,” said Claudia Sahm, a former principal economist at the Federal Reserve Board of Governors and now director of macroeconomic policy at the Washington Center for Equitable Growth. “And we see this whether it's with the stimulus [checks], the unemployment [benefits] or the Payroll Protection Program.”

‘The money works, and the money is gone’

Overall, 77% of adults said they were doing at least okay financially in July, an increase from 72% in early April and 75 % in October, the survey found.

Read more: Here’s what you need to know about unemployment benefits eligibility

The biggest improvement came from the lowest earners — 45% of those who make below $25,000 were able to pay a $400 unexpected expense in July compared with just 34% in October. That occurred even though low-income workers were the most likely to lose their jobs in the pandemic.

“This is a real signal that even low- and moderate-income households have been able to put some of that money away,” Sahm said. “The money works, and the money is gone.”

‘No reason to think that lasts’

The survey results echo other measures showing the resiliency of Americans’ personal finances. For instance, personal income also rose while the overall economy shrunk — again largely driven by government support that has mostly expired.

“This buffer won't last forever, especially if they still haven't gotten back to their jobs,” Sahm said. “There are still all these things looming for households and they've lost that infusion of extra support.”

The CARES Act provided a one-time stimulus payment of around $1,200 plus an extra $500 per dependent child, which were mostly distributed in May. The act also provided an extra $600 in weekly unemployment benefits, which lasted through July.

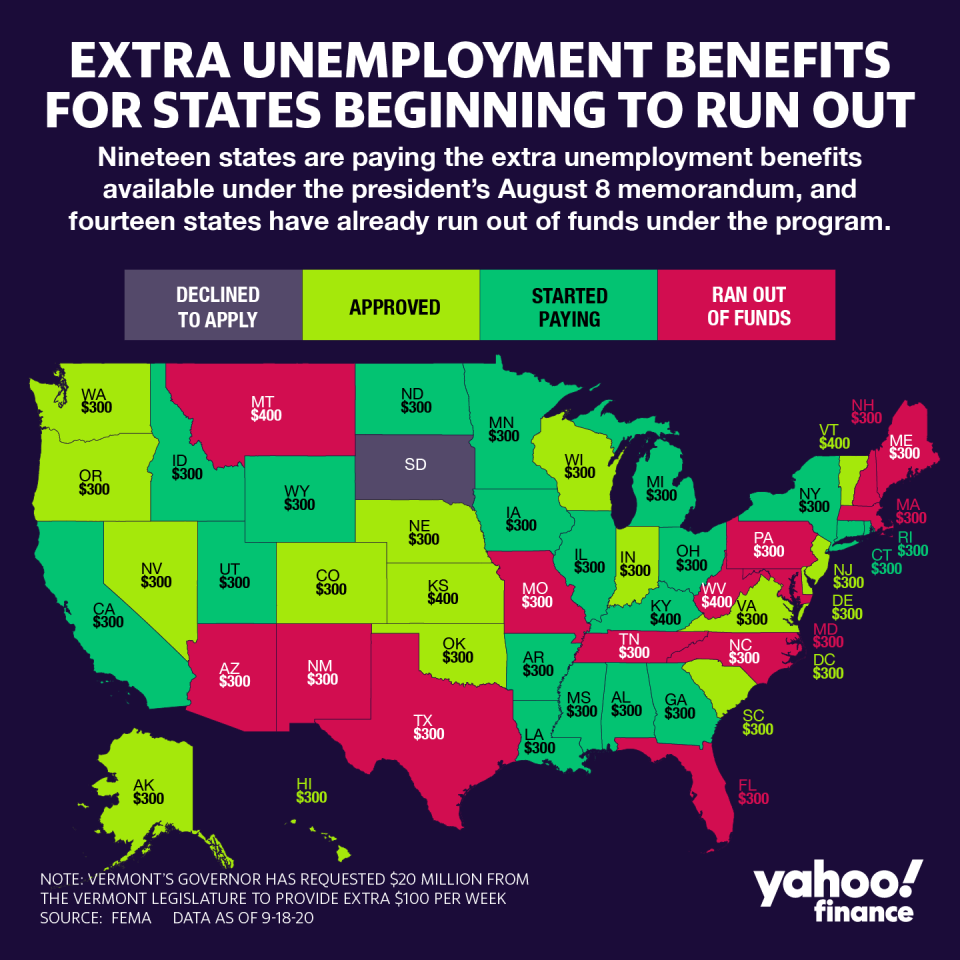

That was followed by six weeks of $300 or $400 a week for jobless Americans provided by the Lost Wages Assistance program, which has now expired in at least 17 states.

More relief remains uncertain.

Stimulus negotiations in Congress have been in a stalemate for more than a month and experts said the chances of reaching a new deal before the November election are fading. That means the recent gains in Americans’ personal finances could also disappear.

“In the absence of relief,” Sahm said, “there is no reason to expect that the extra financial security that people are telling us about in July — there's no reason to think that lasts.”

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

Read more:

New unemployment requirements make it tougher for workers to qualify

Even as GDP tanked, personal income grew thanks to government support

Read more personal finance information, news, and tips on Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.

money

money