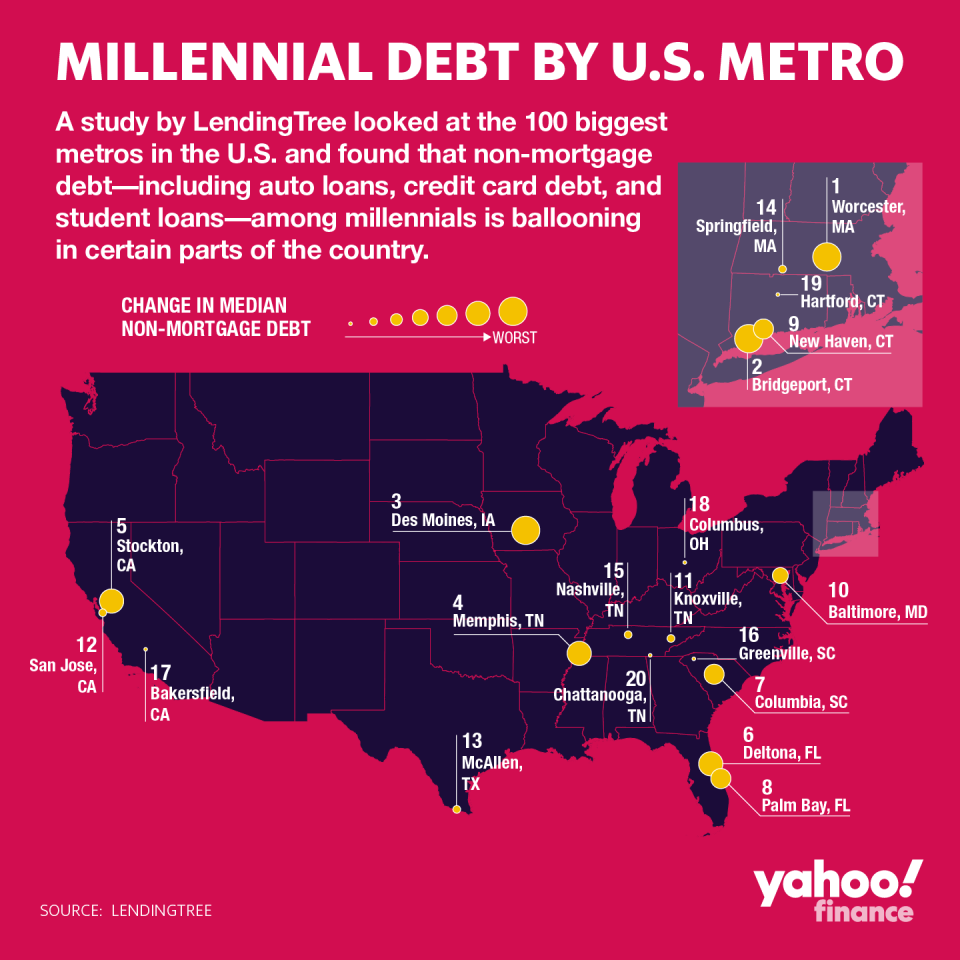

Millennial debt is rising in these U.S. cities

Millennials living in certain U.S. metro areas are seeing increases in non-mortgage debt, according to a study by LendingTree, at a time when Americans’ debt is hitting record highs.

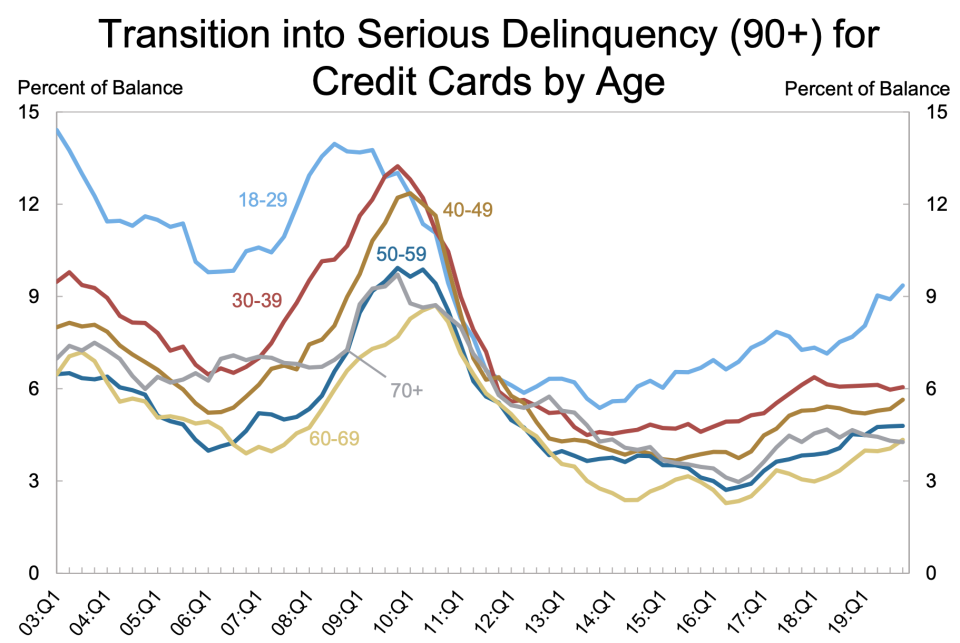

Auto debt and student loans account for the biggest portion of non-housing debt for millennials, the generation born between 1981 and 1996. A 2019 report by the New York Fed found that millennials have the worst delinquency rates when it comes to auto loans, and outstanding student debt currently stands at $1.6 trillion spread across 44 million borrowers.

How to repay student loans: The full breakdown

Six out of the top 10 metros where millennials are taking on the most non-mortgage debt are along the East Coast. In Worcester, Mass., for example, credit card debt rose by 27% among millennials. The median non-mortgage debt for millennials in Worcester increased by nearly 29%.

Chantel Bonneau, a wealth management advisor for Northwestern Mutual, told Yahoo Money that “there are many factors” as to why the eastern part of the U.S. seems to be getting hit harder by the trend.

“Some items that may contribute are general cost of living in dense East Coast metros, high state tax for some East Coast states, and many expensive universities that could leave millennials with significant student debt,” she said.

The role of credit cards and student loans

Despite the eastern U.S. being a hot spot for rising millennial debt, credit card and student debt among millennials are particularly concentrated in the South — nine out of the top 10 metros with the highest shares are located there. Bonneau said “there’s likely not one answer” as to why that is.

“Everyone has a different set of circumstances that could lead to more credit card debt — some behavioral and some circumstantial,” she said. “The data mentions decent amounts of auto debt and student debt in that area, and those competing costs could put pressure on monthly cash flow resulting in credit card debt.”

Nearly half of millennials are reportedly delaying buying a home because of their student loans. And ultimately, the trend is tied to debt in general: The more loans that millennials take on, the more inclined they are to put new expenses on their credit cards.

“The key for these millennials is to try to understand their budget, save when they can, pay down debt with bonuses or other opportunities, and to stay focused on long-term financial principles,” Bonneau said. “Financial wellness is a lifelong journey.”

Adriana is an associate editor for Yahoo Finance. She can be reached at adriana@yahoofinance.com. Follow her on Twitter @adrianambells.

READ MORE:

Read more personal finance information, news, and tips on Cashay

money

money