Medicare 2020: 4 major changes you should know about

Medicare open enrollment for 2020 begins this week, and it’s important for newcomers and repeat enrollees to understand some key changes to the program.

Between Oct. 15 and Dec. 7, you can sign up for the first time for Medicare. You can also change from Medicare to Medicare Advantage, health insurance plans administered by private insurers. If you’re unsatisfied with your prescription plan, you can switch plans during this time, too.

“People continue with the same plan without looking to see if their prescriptions have changed, whether there’s a new plan that is a better fit for them in terms of their coverage needs, personal values and preferences,” said Casey Schwarz, senior counsel at the Medicare Rights Center, a nonprofit. “We try to encourage people not to do so.”

There are also four major changes to Medicare from last year, so even veteran enrollees may be surprised with this year’s process. Here’s what you need to know for Medicare 2020.

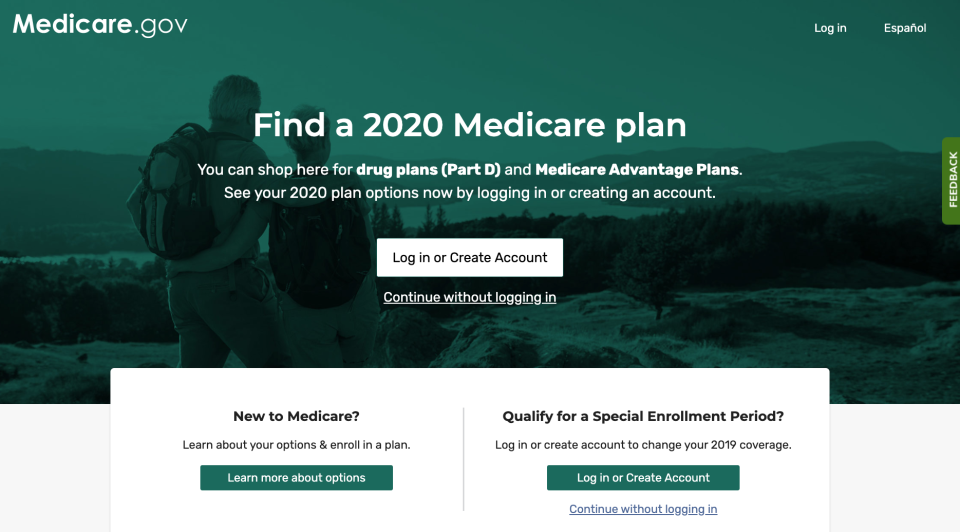

Medicare Plan Finder redesign

Medicare’s plan browsing tool, also known as the Medicare Plan Finder, received its long-overdue makeover this year. The layout has more blank space along with new sort-and-filter tools on the results page. While these changes are useful, there are some drawbacks to the new design.

Medicare ID requirement: Previously, you didn’t need a Medicare ID, an identification code assigned to beneficiaries, to save search results. Now, counselors, adult children and other caregivers need a senior’s login information to access their saved medication lists. This poses a problem for State Health Insurance Assistance Programs (SHIP), which rely on the tool to help seniors with their plan selection.

Pulling up last year’s information: If you want to compare this year’s drug list with last year’s, you must switch between the old plan finder and this year’s – a major inconvenience. That means if you want to make sure last year’s drug list is covered under this year’s plan, you must access the old plan finder first.

Caregiver access: If you’re a caregiver who needs access to your senior’s saved medical information on the old system, you need to first fill out an authorization form.

Closing the ‘donut hole’

Some Medicare Part D prescription drug coverage plans come with a coverage gap known as the “donut hole.” After you meet your deductible, you and your plan split costs for covered drugs up to a certain amount. In 2020, that is $4,020. After that, you have to pay more for those same drugs, which has been considered the donut hole.

The percentage you pay during the coverage gap – or donut hole – has been declining the last few years after the passage of the Affordable Care Act in 2010.

In 2019, you had to pay 25% of the sticker price for brand-name drugs and 37% for generic drugs. For 2020, you’ll pay no more than 25% for both brand-name and generic prescription medicine during the coverage gap until you reach the out-of-pocket spending limit of $6,350.

Changes to drug coverage

Medicare Part D plans come with a list of prescription drugs – both generic and brand-name – that they cover. These lists are called formularies. In 2020, Part D plans are able to choose which specific disease or symptom – called indication - a covered drug can be used for. That means if one drug can be prescribed for multiple illnesses, your Part D plan may only approve coverage for only one of those uses.

But if a plan covers a drug for only one use when there are multiple uses, the plan must include another “therapeutically similar drug”on its prescription drug list, or formulary, for the non-covered disease or symptom, according to a memo released in 2018 from the Center for Medicare and Medicaid Services.

Goodbye Medigap Plans

In 2020, Medigap policies C, F, and high-deductible F won’t be available for newly eligible Medicare enrollees. Four years ago, Congress passed legislation discontinuing these plans in 2020 to reduce overuse of medical services.

“It’s not eliminated completely,” said Desirae Mearns, project director at SHINE, a SHIP that offers Medicare counseling to candidates. “It’s just not being offered to newbies.”

These supplemental insurance policies cover the deductible from Medicare Part B – the policy that covers outpatient care and preventative services. Plans C and F also allow seniors to access non-emergency medical care with no out-of-pocket costs.

Other options exist for new enrollees, Mearns said, such as Part G. That covers all hospital expenses and 20% of the cost of Medicare Part B services once the annual deductible is met.

Dhara is a writer for Yahoo Finance. Follow her on Twitter @dsinghx.

Read more:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money