Medicare Advantage plans 2020: Check out the new benefits

Considering switching to a Medicare Advantage plan during 2020 open enrollment? You’re in luck.

Many of these plans, which are administered by private insurers, come with new benefits, ranging from in-home personal care services to cooking classes. While some benefits like telehealth are already covered by original Medicare, perks like meal delivery are only covered by certain Medicare Advantage plans.

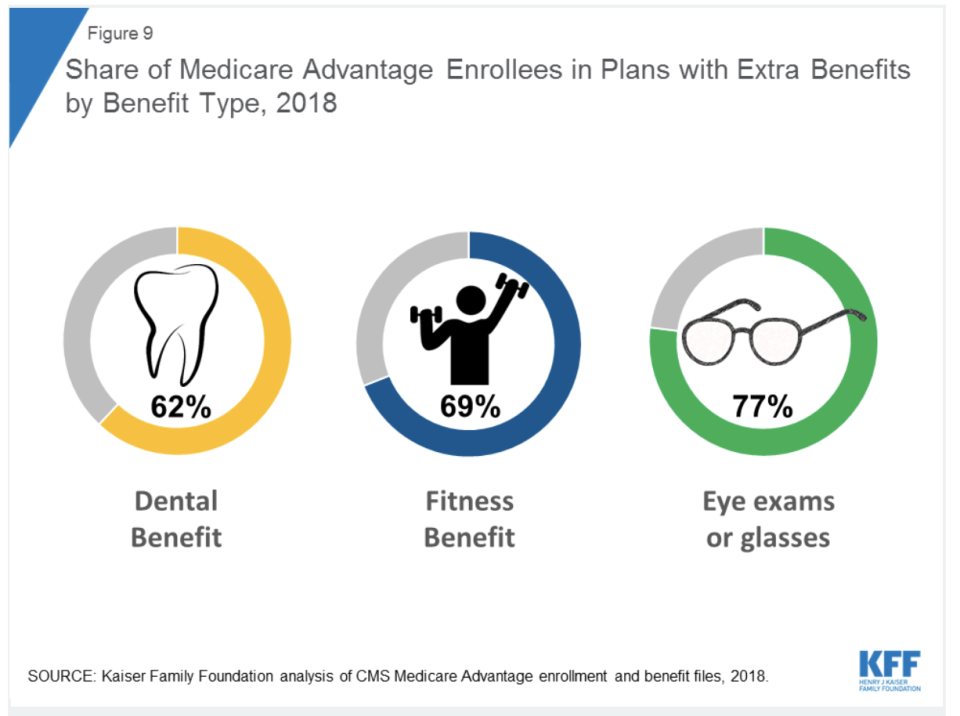

“Every plan has their own perks,” said Desirae Mearns, project director at the Serving Health Insurance Needs of Elders program in Florida. “Some offer dental, hearing, vision...maybe a certain dollar amount towards classes. The gym membership is really popular.”

Despite these added benefits, Medicare Advantage plans – an alternative to traditional Medicare provided by the federal government for those 65 and older – may not be optimal for everyone. That’s why it's important to understand the in’s and out’s of each offering before making a decision.

New Medicare Advantage benefits

In 2018, the Center for Medicare and Medicaid Services expanded the definition of health-related supplemental benefits covered by Parts A and B of traditional Medicare.

This year, CMS announced that chronically ill patients with Medicare Advantage plans can also receive those supplemental benefits that are not necessarily health-related, such as meal delivery and transportation for grocery shopping.

Those with asthma may find that the costs of home air cleaners and carpet shampooing services are covered by their Medicare Advantage plans. Some of these plans also cover a nutritionist or a diabetes education program if you suffer from the disease.

If you’re taking a cooking class to simply improve your health, your plan may cover that, too.

Check the details

Seniors should always know the details of the benefit before jumping into a particular plan, said Danielle Roberts, co-owner of Boomer Benefits, an insurance agency that specializes in Medicare-insurance related products.

“For cooking, cleaning, long-term care services, you have to look at the fine print,” she said. “It can be up to 10 hours a week or 10 hours a month.”

Don’t get carried away by the Medicare Advantage benefits, either, Roberts said. Review the basics of the plan, too.

“You need to check the online directory to see if your favorite doctors and hospitals are in the [plan’s] network,” she said, if that applies.

Many Medicare Advantage plans are health maintenance organizations, or HMOs, that require a referral to see a specialist. Providers also must fall under the plan’s network.

Telehealth expansions

Under the Bipartisan Budget Act of 2018, Medicare Advantage plans started offering telehealth benefits. Patients could receive health care advice from the comfort of their homes, rather than drive to a facility.

One of those extended benefits were tele-stroke evaluations, where doctors can evaluate a patient’s symptoms remotely if they suspect they had a stroke.

Previously these benefits were limited to seniors who lived in rural areas. Starting in 2020, those living in urban areas can also access tele-stroke evaluations under their Medicare Advantage plans that offer them.

What to watch out for

Chances are you may switch back to regular Medicare one day — especially if you wish to seek providers outside your network. But if you want to go back to original Medicare, the transition may not be seamless, Roberts said.

“If you’re on the Advantage plan for 12 months or longer and you want to return to Medicare, in most states, you have to answer health questions,” she said. “Sometimes people try Advantage plans for a few years and get sick. Then they get denied by Medigap plans.”

Medigap policies, also known as Medicare Supplement Insurance plans, are sold by private companies and help cover Medicare copayments, coinsurance and deductibles.

These Medicare Advantage plans also may require prior authorization from your doctor and insurance company to get these new benefits, said Diane Omdahl, founder and president at 65 Incorporated, a for-profit consultancy.

“The whole thing of prior authorization of any service is kind of a hidden element,” she said.

In general, enrollees, especially ones new to the process, should review options six months before the open enrollment deadline, so they can make the best decision.

“Don’t let it creep up on you,” Roberts said. “You’ll find yourself less likely to make mistakes.”

Dhara is a writer for Yahoo Finance. Follow her on Twitter @dsinghx.

Read more:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money