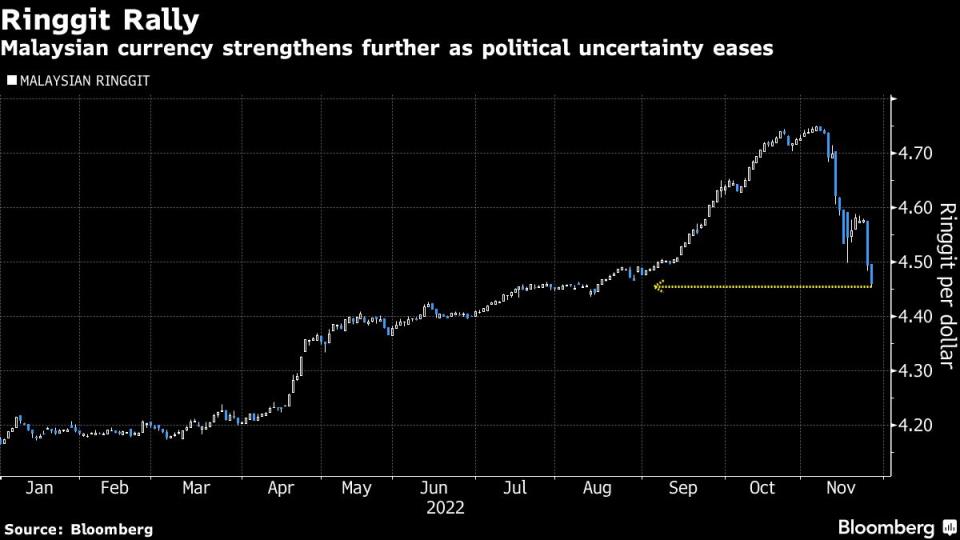

Ringgit Rises to Three-Month High as Anwar Takes Malaysia’s Helm

(Bloomberg) -- The ringgit jumped, making the currency the best performer in Asia for a second day, following the appointment of Anwar Ibrahim as Malaysia’s new prime minister.

Most Read from Bloomberg

Chevron to Resume Venezuela Oil Output as US Eases Sanctions

At Nantucket Retreat, Biden Family Weighs Run for Second Term

US Shoppers Kick Off Holiday Season With a Muted Black Friday

The ringgit rose by as much as 0.9% against the dollar to 4.4542, its strongest level since mid-August. The currency had surged by 1.8% after Anwar’s appointment on Thursday, the largest single-day gain since March 2016.

Meanwhile, the stock benchmark index declined as much as 1.3% on profit-taking after the market added close to $19 billion in value -- the largest in a single day since March 2020 -- on Thursday.

Anwar’s appointment removes a key uncertainty in the market and snuffed out concerns of potentially strong influence by the conservative Parti Islam Se-Malaysia, known as PAS, the biggest party in rival Perikatan Nasional bloc.

Still, analysts said the political risk premium on Malaysian equities remained given that the “unity government” model is unchartered territory and Anwar still has to test lawmakers’ support for his leadership with a confidence vote on Dec. 19.

“Until the country attains reasonable political stability, the KLCI index would likely be commanding ‘sub-optimal’ valuation,” Vincent Khoo, head of research at UOB Kay Hian, wrote in a note.

Investors will also continue to watch the announcement of the cabinet line-up and the tabling of a revised Budget.

Local markets are closed on Monday for a holiday.

Here is what analysts are saying:

Belinda Boa, chief investment officer of emerging markets equities at BlackRock Inc.

Malaysia’s economy is doing well, in our view -- balancing political challenges with integration opportunities into tech related supply chains. Malaysia is coming up as a scalable alternative to China and, in some cases, Taiwan. Additionally, higher oil and commodity prices continue to have a positive impact. Inflation may be understated, liquidity remains a hurdle, but the market looks relatively attractive at the margin.

Vincent Khoo, head of research at UOB Kay Hian

As the emergence of a unity government has snuffed out fears of sin sectors being affected by adverse regulation, investors will refocus on the promising growth outlook and depressed valuations of the gaming and brewery stocks. We are again overweight on the gaming and brewery stocks.

Tentatively trimming end-2022 FBMKLCI target to 1,550 from 1,585 (to be finalised post 3Q22 results season). We continue to expect the FBMKLCI to trend up towards year-end, in rejoining the global equity uptrend as US core inflation eases. Our tentative end-2023 target is 1,640

Joshua Ng, analyst at Kenanga Research at

After the initial euphoria, we believe the market will assess the effectiveness of the ‘unity’ government, which is unprecedented in Malaysia.

We expect the continuation of prevailing policy inclinations including pro-business, protectionism for local industries, business-as-usual for government-linked companies, strong fiscal support to the economy with cash handouts, fuel and food subsidies, and pump-priming.

We raise our end-2022 FBM KLCI target back to 1,500 points from 1,450 points to reflect the resolution of the political deadlock. We continue to advocate investors to seek refuge in domestically-driven sectors including banks, telcos, auto makers/distributors, mid-market retailers and construction, amidst rising external headwinds.

Alexander Chia, analyst at RHB

We expect the relief rally to be extended as equities play catch up to build on the recent tentative shift in investor sentiment on the back of rising hopes that the pace of monetary tightening will begin to ease and as the market looks ahead to a more pragmatic approach by China’s government to contain Covid-19.

In the short-term, however, we caution investors not to get too carried away, especially after the initial euphoria. The new unity government needs to prove its ability to work together as a team, something unimaginable just a week ago.

Another spike in markets should invite some short-term profit taking but further out, investors ought to re-focus on fundamentals with a preference for large-cap value stocks.

Ivy Ng, head of equity research at CGS-CIMB Securities

We raise our end-2022F KLCI target to 1,602 points from 1,484 points, based on 13.8x forward P/E. If the political instability concerns ease over time, there is potential for KLCI to re-rate to its pre-GE14 valuations of 16.5x, which is close to its 3-year average mean P/E of 16x and values it at 1,855 points.

Our picks following the appointment of the new PM are consumers, banks, gaming and brewers. Construction, telco, utilities and property sectors could also do well in a more stable political environment.

The market will be closely watching the announcement of the cabinet lineup, which we estimate could take 7-10 days, first sitting in Parliament on Dec. 19, tabling of provisional and full Budget 2023, among other things.

Sailesh K Jha, group chief economist and head of market research at RHB

In foreign exchange, the move down in USD/MYR below 4.50 yesterday was massive and we would be cautious in believing that these prints below 4.50 are sustainable. We believe that USD/MYR could trade back up to around 4.60 by year-end. Our 1H23 USD/MYR forecast of 4.70-4.80 remains unchanged for the time being.

--With assistance from Marcus Wong and Ishika Mookerjee.

(Adds market moves and comments from BlackRock Inc.)

Most Read from Bloomberg Businessweek

Apple’s Reliance on China Grows Perilous With Chaos in iPhone City

The Robot Tractors Are Coming, Just as Soon as We Crush a Few Bugs

Professor Behind Effective Altruism on What SBF’s Fall Means

Crypto’s Crash Is Helping a Few Couples Rekindle Their Relationships

©2022 Bloomberg L.P.

money

money