Leisure and hospitality drive jobs number higher

The May jobs numbers showed an unexpected jump in payrolls as certain sectors like leisure and hospitality made a comeback that dramatically beat estimates and surprised economists and market observers.

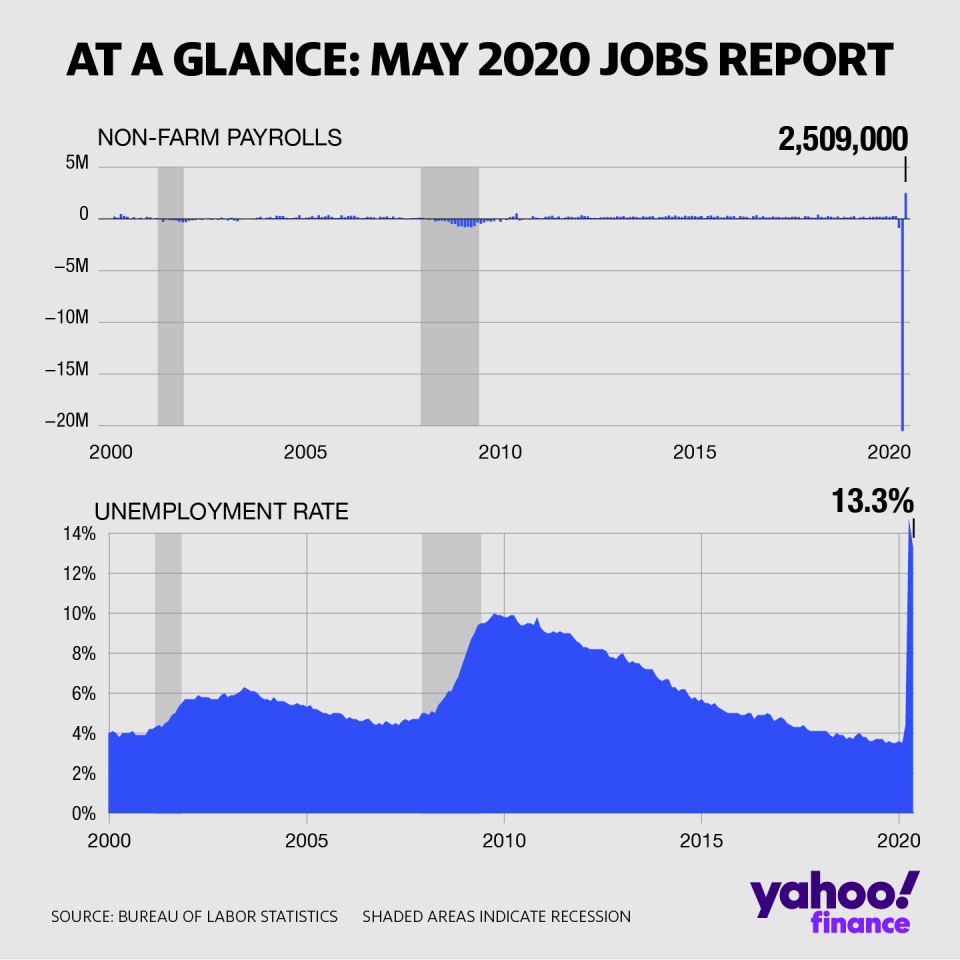

Non-farm payrolls jumped 2.509 million in May, compared to an expected loss of 7.5 million. This came after April, which saw 20.687 million jobs lost. This lowered the unemployment rate to 13.3% — far lower than the expected 19.0%. The unemployment rate was 14.7% in April.

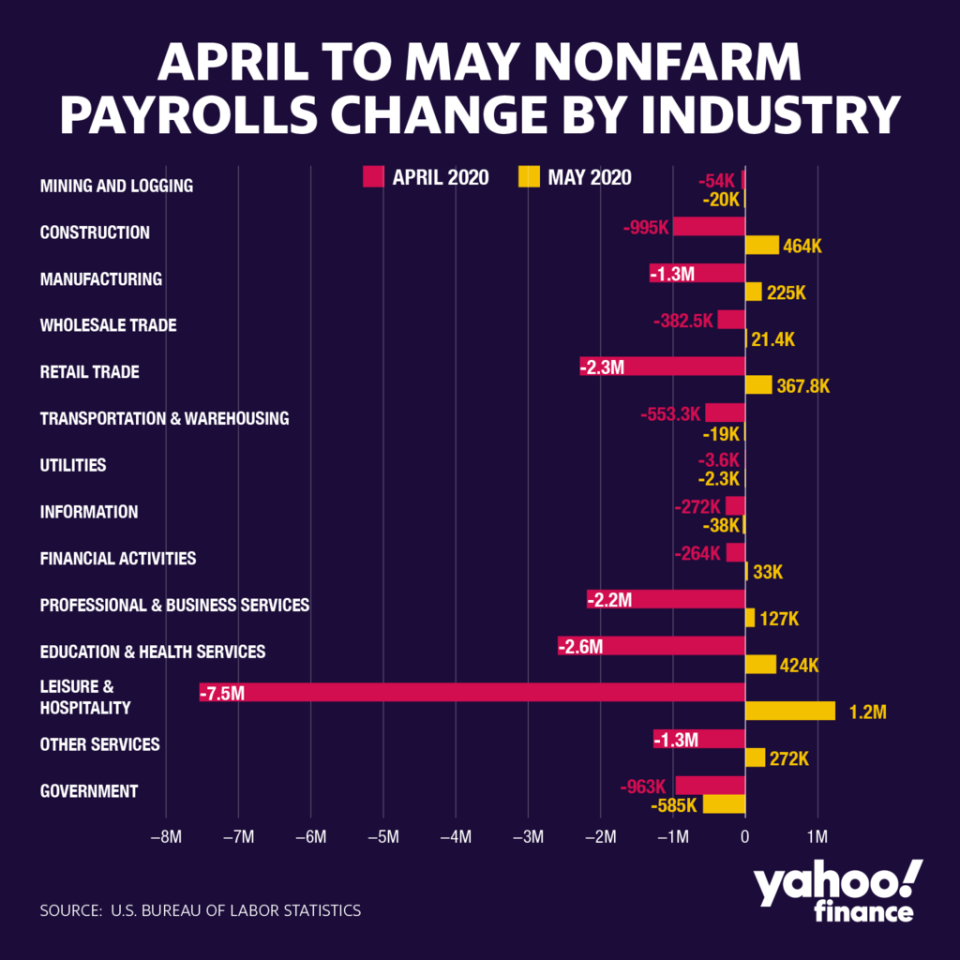

Leisure and hospitality sectors, which had been hit sharply by the coronavirus’s shutdowns, added 1.239 million jobs, the largest rebound. The industry had lost over 7.5 million jobs since the beginning of the coronavirus crisis, the most of any other industry.

Many of these workers were on temporary layoff, which the Bureau of Labor Statistics said decreased by 2.7 million in May to 15.3 million — after a 16.2 million surge in April.

Explaining the unexpected bump, the Bureau of Labor Statistics attributed the improvements to businesses reopening after more than a month of shutdown to contain the COVID-19 pandemic.

“Food services and drinking places employment grew by 22%. But employment in these industries are still far below pre-virus levels,” wrote Indeed’s economic research director Nick Bunker, who said the bounceback came earlier than he had expected.

The challenge for restaurants reopening is that they must do so with some measure of social distancing in place; being restricted to lower capacities could pose a threat to many more hospitality jobs coming back.

“This much better-than-expected report reinforces our view that April likely marked the trough in U.S. economic activity,” wrote Brian Coulton, chief economist at Fitch Ratings. “The sharp pick-up in leisure and hospitality jobs and in construction and retail employment speaks to the impact of the easing in lockdowns in May and to the huge share of unemployed in April who were reported to be on ‘temporary’ lay-off.”

Analysis from JPMorgan pointed out that the jump in leisure and hospitality jobs also likely drove down average hourly earnings.

“Just as the composition effect of laying off lower-paid workers boosted average earnings in April that effect partially reversed itself in May,” its note said.

Besides leisure and hospitality, construction, education, health services, and retail also saw notable gains.

All this came as a surprise for many economists and market observers.

“Today was a shocking jobs number – and for the first time this year it was a positive shock,” wrote Chris Zaccarelli, chief investment officer for Independent Advisor Alliance.

The surprise upside hasn’t been accounted for yet, but Pantheon’s Ian Shepherdson wrote it could be because estimates didn’t take into account that laid-off workers don’t need to formally reapply through a job site — their employer has their number.

Still, much of the economists’ commentary about the jobless rate stresses the fact that the economy is far from recovered.

“The labor market is still in a terrible spot with employment only 87% of where it was before the coronavirus crisis began,” wrote Indeed’s Bunker. Zaccarelli pointed out that the unemployment rate is still higher than the worst of the last financial crisis.

“We’ll have to see many months of job growth this strong to get the labor market back to a healthy place,” wrote Bunker. “And it’s far from clear we’ll see numbers like this consistently moving forward.”

Though temporary layoff numbers improved, the BLS data found permanent job losses rose once again, increasing by 295,000 in May to 2.3 million.

--

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. Follow him on Twitter @ewolffmann.

2021 health insurance rates are coming out despite 'unprecedented uncertainty'

McDonald’s to end public soda fountains due to coronavirus pandemic

Insurance premiums expected to rise 4% to 6%, before factoring in COVID

High-yield savings banks finally hit by the Fed's coronavirus rate cut

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube

money

money