More than 66 million U.S. jobs are at 'high risk' of layoffs amid coronavirus, St. Louis Fed finds

As the coronavirus, or COVID-19, wreaks havoc on the U.S. economy, more than 66 million jobs across sales, production, and food preparation services are at “high risk” of layoffs, according to a St. Louis Federal Reserve economist.

Using 2018 occupational data from the Bureau of Labor Statistics (BLS) detailing 808 occupations, the St. Louis Fed’s Charles Gascon found that 66.8 million people — 46% of working Americans — are employed in these occupations that are at “high risk” of layoffs.

These included people involved in food preparation and serving-related occupations as well as those in sales, production, installation, maintenance, and repair jobs.

Jobs at “low risk” of layoffs were professions essential to public health or safety (such as the police), which comprised of 17% of the total share of employment, those that could work from home (such as a computer programmer), which formed 33%, and those in salaried occupations (such as an elementary school teacher), which constituted 3% of employment.

“There are four things that you need to have be in the lucky bucket: having access to paid leave, having access to health care, having the ability to telework, and decent wages,” Heidi Shierholz, senior economist at the Economic Policy Institute, told Yahoo Finance. “If you have those four things you're lucky — you're a very small minority of the U.S. workforce — that means things are in place for you to be okay. But most of the U.S. workforce does not fit that.”

Sales, restaurant, and events staff are ‘out of luck’

Gascon’s work also showed that the occupations facing the highest risk of unemployment also tended to be lower-paid. The average income for those in high risk occupations was about $36,600. The average earnings of those in the low-risk category is about $64,600 — 75% higher.

Furthermore, 60% of those who can work from home belong to households that earn more than $100,000 a year, according to a separate blog post by the St. Louis Fed. Consequently, as “businesses close their doors or send their workers home, the financial burden of the crisis will likely be felt hardest by lower-income individuals in nonprofessional occupations,” the economists wrote.

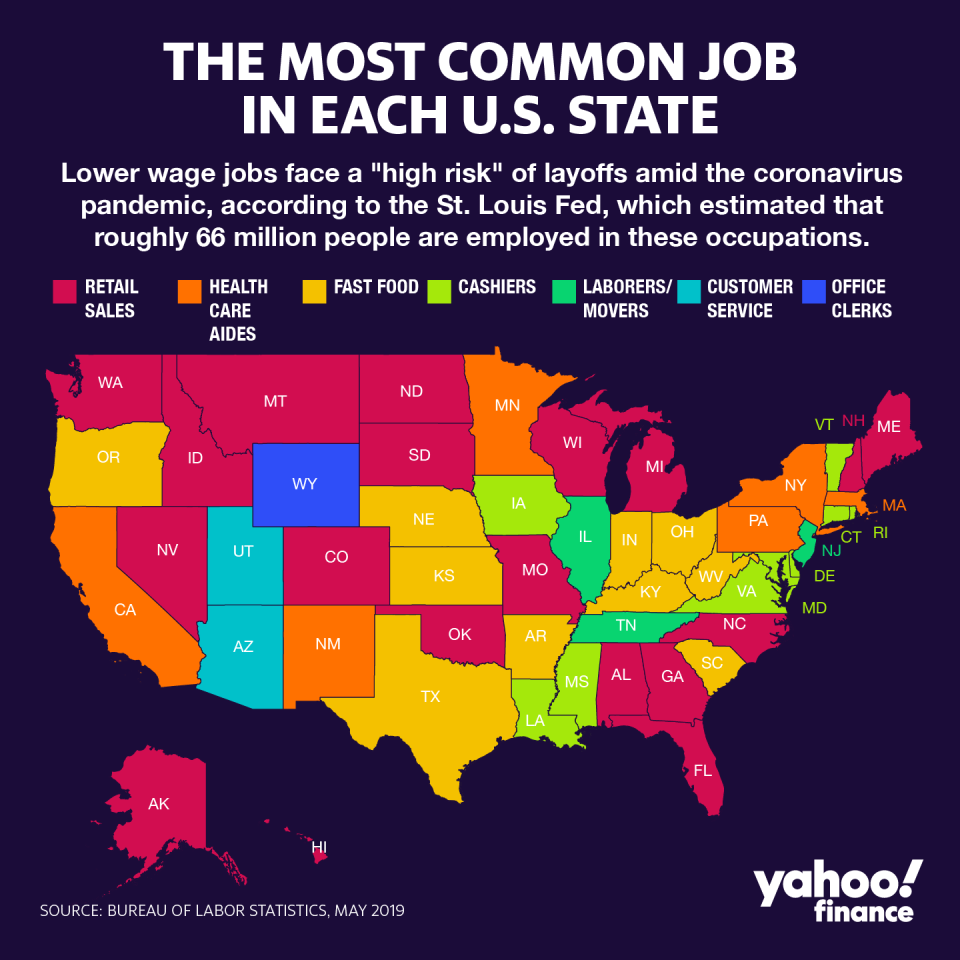

According to BLS data, as of May 2019, the occupation held by the most number of workers across the U.S. was “retail salesperson” followed by “fast food and counter worker.” (Other lower wage jobs, particularly health care aides, may see demand rise amid the pandemic.)

In the past, “low middle income workers [have been] hit harder by recessions,” Shierholz explained. “But this is going to be more true than ever before in this recession, because many of the workers who are profoundly affected by the social distancing measures are low wage workers… they’re brick-and-mortar retail staff, they’re restaurant workers, they’re event staff. People aren't doing work in those jobs, and so those are folks who tend to have low wages, lack of health insurance, lack of paid leave, like they're just sort of out of luck.”

Macy’s recently announced that it was furloughing a majority of its 125,000 employees because of the coronavirus. Waffle House has closed more than a fifth of its restaurants. Major event venues have also shuttered — from Broadway to casinos, theaters, and so on.

‘Absolutely unprecedented territory’

The extreme turn of events has left economists scrambling to make sense of the numbers.

In February, unemployment was at a 50-year low of 3.5%. But that number could surge to at least 10%, or go as high as 42%, St. Louis Fed President James Bullard said in an interview with Bloomberg.

In the meantime, the number of Americans filing for unemployment benefits skyrocketed to a record-breaking 3.283 million for the week ended March 21.

The previous record was 695,000 claims filed the week that ended October 2, 1982.

The number is expected to be even more grim on Thursday, when the latest figures are released.

“We are in absolutely unprecedented territory,” Shierholz stressed. “I have been a labor economist for a long time, and I've never seen this just like I've never seen graphs like what we saw with insurance claims before. That's just not what labor market graphs look like, and count now.”

Recent college grads hit the hardest

The implications of this sudden and quick downturn are also expected to be long lasting.

“Corporate America is engaged in giant experiment regarding what tasks can be done remotely,” RSM Chief Economist Joe Brusuelas told Yahoo Finance. “Firms are learning what can be done and who can do it. Once this is sorted out, then firms can reduce their expensive physical commercial real estate footprint.”

And that was going to benefit younger workers who are more tech savvy, he added, as they can navigate this environment more comfortably.

But not all young workers are going be at an advantage. For those graduating this spring, it’s a really tough situation, Shierholz said.

“Basically, anyone who is looking for a job is hit the hardest. And there's evidence that cohorts get set back in a pretty lasting way, by trying to enter the labor market in a downturn,” she explained. “So this is gonna have a sort of a negative, long run effect on the young people of this downturn.”

According to research by economist Lisa Kahn, 15 years after graduation, workers who entered the market during the recession in the early ‘80s were found to have earned wages that were 2.5% lower than graduates who didn’t start out in a downturn.

—

Aarthi is a reporter for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

Bill Gates on coronavirus: U.S. testing needs to increase ‘quite dramatically’

Public health expert: ‘Coronavirus is going to hit every city in America’

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.

money

money