Introducing AssetMark Financial Holdings (NYSE:AMK), A Stock That Climbed 12% In The Last Year

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But not every stock you buy will perform as well as the overall market. Unfortunately for shareholders, while the AssetMark Financial Holdings, Inc. (NYSE:AMK) share price is up 12% in the last year, that falls short of the market return. AssetMark Financial Holdings hasn't been listed for long, so it's still not clear if it is a long term winner.

View our latest analysis for AssetMark Financial Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year AssetMark Financial Holdings saw its earnings per share (EPS) drop below zero. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. We might get a clue to explain the share price move by looking to other metrics.

We think that the revenue growth of 13% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

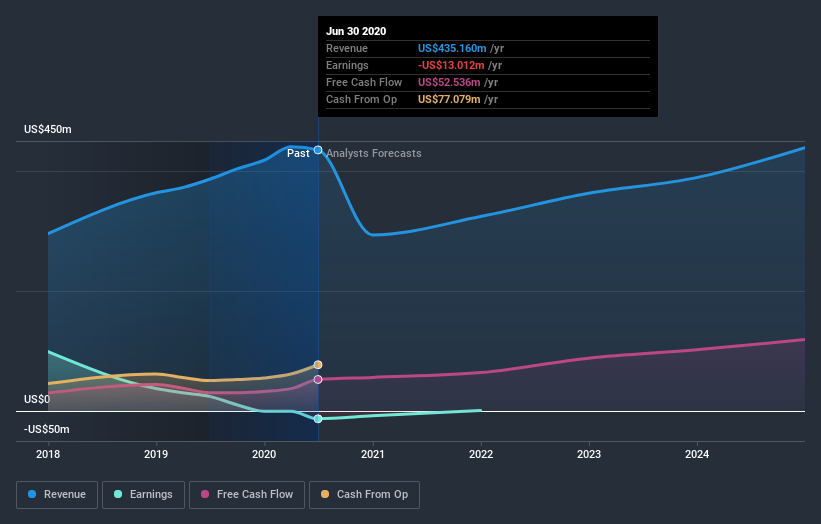

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at AssetMark Financial Holdings' financial health with this free report on its balance sheet.

A Different Perspective

AssetMark Financial Holdings shareholders have gained 12% for the year. Unfortunately this falls short of the market return of around 20%. The last three months haven't been great for shareholder returns, since the share price has trailed the market by 7.9% in the last three months. It might be that investors are more concerned about the business lately due to some fundamental change (or else the share price simply got ahead of itself, previously). You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: AssetMark Financial Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

money

money